USD/JPY struggles to gain traction as mixed job reports confirm a likely Fed rate hike pause, capping the USD. Despite this, the risk-on impulse is supporting the pair as it remains resistant to bearish traders.

Meanwhile, the BoJ’s more dovish stance and positive market tone is undermining the safe-haven Japanese Yen, albeit only partially as prices remain on track for losses for the first time in four weeks.

Technical levels to watch include the daily Fibonacci 38.2% and 61.8%, as well as the daily pivot point S1 and R1.

Table of Contents

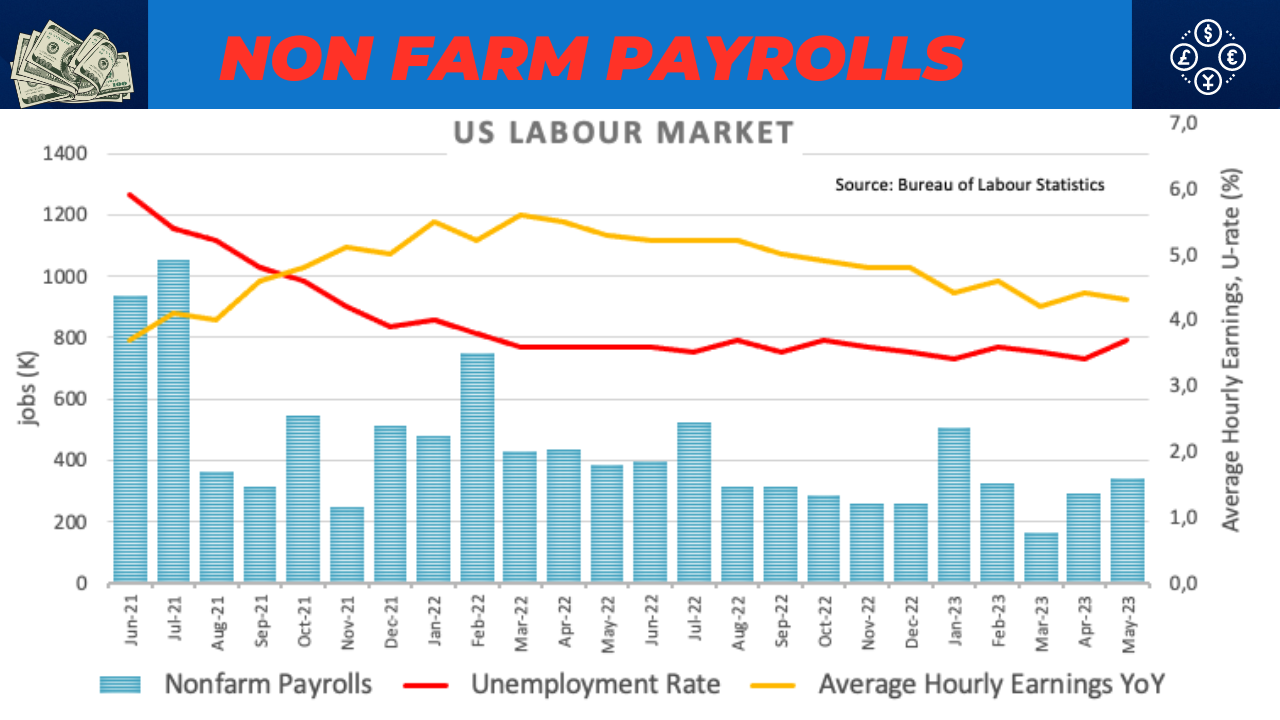

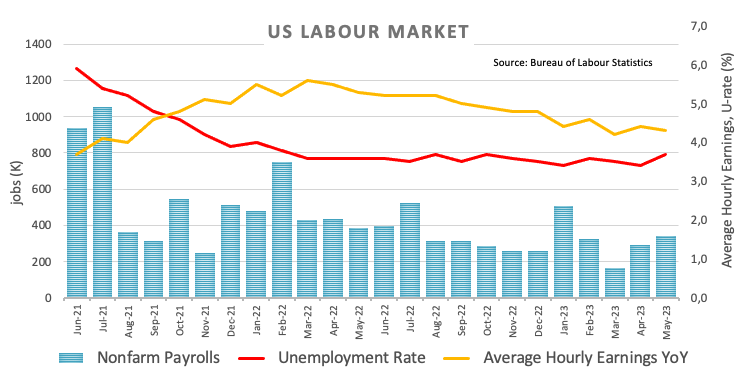

Toggle“May Nonfarm Payrolls Beat Expectations with 339K Jobs Created, Unemployment Rises to 3.7%, Gold Prices Fall as Analysts Question Fed Rate Hike Impact.”

US Nonfarm Payrolls beat expectations in May, with 339K jobs created – the highest figure in four months. Although unemployment rose from 3.4% to 3.7%, the Labor Force Participation rate held steady at 62.6%.

The US Dollar gained briefly, but the momentum faded, and Gold prices fell following the release of the employment report. Market analysts are questioning whether the figures are strong enough to pressure the Federal Reserve for another rate hike.

US yields spiked but fell back and Gold tumbled to $1,971. The yellow metal trades at $1,975 post-NFP, with the next support standing at $1,960.

On the upside, a break of the $1,980/85 area could drive prices to $2,000. Technical levels show daily SMA20 at 1984.35, daily SMA50 at 1992.3, and daily SMA100 at 1938.6.

EUR/USD Falls As US Economy Outperforms Job Market Expectations

EUR/USD falls as greenback strengthens after higher than expected job growth in May. Nonfarm Payrolls added 339K jobs, surpassing the expected gain of 190K, and the April reading was revised up to 294K.

Unemployment rate increased to 3.7% and Average Hourly Earnings rose 0.3% MoM and 4.3% YoY. EUR/USD tries to consolidate after breaking 1.0700 barrier and will be impacted by differences in approach between the Fed and ECB on interest rates.

Watch for continuation of ECB hiking cycle and impact of Russia-Ukraine war. Pair currently losing 0.03% at 1.0758 with initial support at 1.0635 and resistance at 1.0779.

US Job Market Surges as Nonfarm Payrolls Exceed Expectations by Wide Margin

In May, the US Bureau of Labor Statistics reported a significant rise in the country’s nonfarm payrolls, totaling 339,000 jobs – far surpassing market expectations of 190,000. What’s more, April’s reading was also revised up to 294,000 from 253,000.

While the unemployment rate rose to 3.7% from 3.4%, the labor force participation rate remained stable at 62.6%. Average hourly earnings saw a slight dip to 4.3% from 4.4%.

The BLS also noted that part-time employment remained unchanged at 3.7 million individuals, usually preferring full-time work but working part-time due to reduced hours or the inability to find full-time employment.

This impressive news bolstered the US Dollar Index, which immediately erased its daily losses and exceeded 103.50 for the day. The benchmark 10-year US Treasury bond yield also rose to 3.65%.

Disclaimer:

All information has been prepared by TraderFactor or partners. The information does not contain a record of TraderFactor or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.