You know the old saying, “Knowledge is power”? Well, in the world of technical trading, that couldn’t be more accurate. Today, we’re unwrapping the mystery behind candlestick patterns, those ancient Japanese trading tools that are crucial to technical analysis. But we’re not just scratching the surface; we’re going to dig deeper, focusing on the most powerful candlestick pattern that traders swear by. Curious to find out which pattern holds such predictive prowess? Stick around, as we’re about to reveal the secret that could give you a significant edge in forecasting future price movements and making sound trading decisions.

Table of Contents

ToggleUnderstanding Candlestick Patterns

When you delve into the world of candlestick patterns, you’re essentially analyzing a graphical representation of price movement data, which can forecast potential market trends based on the open, high, low, and closing prices of different time frames. This is where candlestick psychology comes into play. You’re not just looking at lines and shapes; you’re interpreting the collective mindset of market participants.

Pattern recognition is a fundamental skill in this field. You’ll be identifying recurring candlestick formations that signal potential price action, providing crucial market signals. For instance, a ‘bullish engulfing’ pattern might indicate a strong buying pressure, suggesting a potential upward trend.

Understanding these patterns requires a keen eye and an analytical mind. You’re deciphering the storyline of the market, told through the language of candlesticks. Each formation, from the simple ‘doji’ to the complex ‘morning star’, offers a glimpse into the market’s future trajectory.

However, it’s not all about memorization. You need to understand the underlying market dynamics that give rise to these patterns. This involves a deep understanding of supply-demand dynamics, market sentiment, and other fundamental factors.

In essence, candlestick pattern analysis is a blend of art and science, intuition and analysis.

Components of Candlestick Patterns

Building on your understanding of candlestick patterns, it’s crucial to dissect the components of these formations to grasp their predictive power in market trends. The foundation of candlestick analysis lies in the detailed scrutiny of each component: the body, which represents the range between the opening and closing prices, and the wicks, or shadows, which display the highest and lowest prices during the observed timeframe.

Pattern recognition is key to utilizing these components effectively. For instance, a long body coupled with short wicks typically indicates a strong trending market, while a short body with long wicks often reveals market indecision.

In market forecasting, the color of the body also plays a vital role. A filled (or red) body suggests the price closed lower than it opened (bearish movement), while an empty (or green) body implies the price closed higher than it opened (bullish movement).

Moreover, technical analysis relies heavily on these patterns to predict future price movement. By understanding the components of candlestick patterns, you’re better equipped to interpret market sentiments and make informed trading decisions. Remember, every component tells a story about the balance between buyers and sellers in the market.

Candlestick Patterns in Forex Trading

In the dynamic world of Forex trading, understanding and interpreting candlestick patterns can significantly enhance your trading strategy and increase your potential for profit. Candlestick analysis is more than just recognizing patterns; it’s about understanding market psychology and predicting future price movements.

When you delve into Forex patterns, consider these points:

- Candlestick patterns provide technical signals that can indicate potential market trends, enabling accurate price forecasting.

- Patterns like ‘Doji’, ‘Hammer’, and ‘Shooting Star’ provide clues about market reversals and continuations, aiding in decision-making.

- Combining candlestick patterns with other technical analysis tools can increase the reliability of the signals and reduce false alarms.

- Practicing and gaining experience in identifying and interpreting these patterns can significantly improve your trading accuracy over time.

Reliability of Candlestick Patterns

Understanding the reliability of candlestick patterns is crucial to your trading strategy, as not all patterns are created equal in predicting market trends. Pattern reliability varies, so it’s essential to interpret them within the broader market context.

Candlestick effectiveness isn’t just about recognizing a pattern; it’s about understanding what that pattern means in the current market situation. This is where market adaptability comes into play. Depending on market conditions, the same pattern can indicate a buying opportunity in one context and a selling signal in another.

Signal confirmation is another critical aspect of pattern reliability. A single candlestick pattern might suggest a potential trend, but it’s the following patterns that confirm this trend.

Let’s dive into the details with an informative table:

| Pattern Reliability | Crucial for strategy, varies among patterns |

|---|---|

| Candlestick Effectiveness | Depends on market context |

| Market Adaptability | Same pattern may have different interpretations |

| Signal Confirmation | Following patterns confirm a trend |

Applying Candlestick Pattern Analysis

To effectively apply candlestick pattern analysis in your trading, you need to learn how to read and interpret these patterns in real-time market conditions. Understanding the psychology behind each candlestick can provide valuable insights into market sentiment, helping you make informed trading decisions.

Here are four steps to get you started:

- Master the basic and advanced strategies of candlestick pattern analysis. This includes familiarizing yourself with common patterns and understanding their implications.

- Dive into the psychology of candlesticks. Recognize the emotional dynamics represented by each pattern and how they reflect the balance between buyers and sellers.

- Sharpen your pattern recognition skills. Practice identifying patterns in various market conditions and validate them with other technical indicators.

- Conduct trend analysis. Use candlestick patterns to identify the start, continuation, or end of trends.

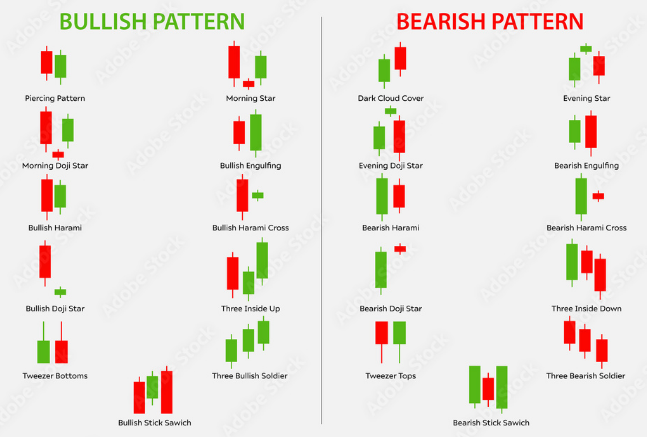

Overview of Bullish Patterns

Diving into the realm of bullish patterns, you’ll notice they signify potential upward movement in price, offering valuable insights for those looking to take long positions in the market. These patterns, revealed through candlestick analysis, can be a game-changer for traders, enabling them to predict price movements and make informed investment decisions.

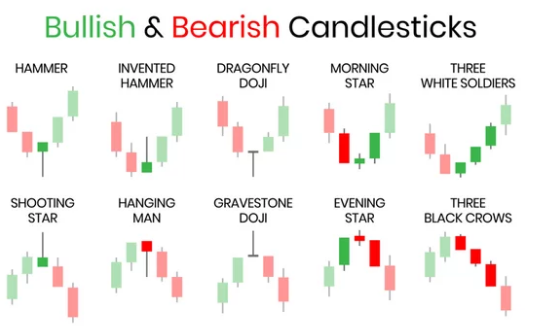

Bullish reversal patterns, like the hammer or inverted hammer, are particularly noteworthy. They typically appear during downtrends and indicate a potential change in market direction. The hammer, for example, is characterized by a small body and a long lower shadow, signaling that the market has rejected lower prices.

Another critical bullish pattern is the ‘bullish engulfing’, where a small bearish candle is completely overshadowed by a subsequent large bullish candle. This pattern often signifies the end of a downtrend and the start of an uptrend.

In the world of trading, these bullish patterns provide significant market signals. By interpreting these signals and the trends they suggest, you can make calculated investment decisions. Remember, though, while these patterns can be extremely useful, they’re not foolproof. Always complement your analysis with other trading tools for the best results.

Insight on Bearish Patterns

Just as bullish patterns shed light on potential uptrends, bearish patterns offer crucial clues about possible downtrends in the market. These bearish signals help you in your market analysis and trend identification, enhancing your ability to anticipate price reversals.

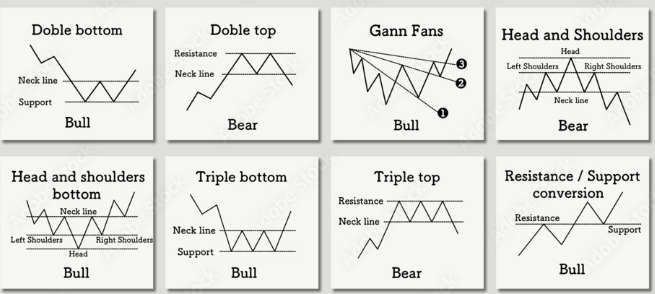

Bearish patterns aren’t just random formations; they’re the result of meticulous data collection and analysis. Here are some of the most common bearish patterns to keep an eye out for:

- The Bearish Engulfing: A two-candle pattern that signals a potential bearish reversal.

- The Shooting Star: An indicator of an upcoming downturn after a price rise.

- The Dark Cloud Cover: A pattern that hints at a bearish reversal after an uptrend.

- The Evening Star: A three-candle pattern that predicts a bearish reversal.

The candlestick accuracy of these patterns, backed by historical data, makes them reliable for predicting market trends. Remember, understanding these patterns isn’t an assurance of success, but it does increase your chances of making informed trading decisions. So, take time to study, practice, and familiarize yourself with these bearish patterns. They could be key to your future trading success.

Neutral Candlestick Patterns

While we’ve covered both bullish and bearish patterns, it’s essential not to overlook the neutral candlestick patterns that often signify market indecision and can provide valuable input for your trading decisions. Neutral candlestick patterns, such as Dojis and Spinning Tops, typically characterize market indecision. They illustrate a tug-of-war scenario between buyers and sellers, where neither side has won the battle, causing limited price movements.

Candlestick analysis of these neutral patterns can offer timely insights on potential trend pauses and reversals. Interpreting these patterns involves understanding their structure and occurrence within a broader market context. For instance, a Doji pattern following a lengthy uptrend may signify a potential trend reversal, providing an opportune moment to reassess your market direction assumptions.

Identifying Reversal Patterns

In your journey as a trader, mastering the art of identifying reversal patterns in candlestick charts can provide critical insights into potential shifts in market trends, helping you make informed decisions based on accurate, real-time data. These patterns, known as reversal signals, are the backbone of trend analysis and serve as a key tool in your trading strategy.

Recognizing these reversal signals involves a complex process of pattern identification. You’ll need to keep an eye out for specific configurations of candlesticks that suggest a change in market sentiment. Here are a few key reversal patterns to watch for:

- The ‘Doji’, signaling indecision in the market.

- ‘Hammer’ and ‘Hanging Man’, indicating potential bullish and bearish reversals respectively.

- ‘Engulfing’ patterns, showcasing a strong shift in buying or selling pressure.

- ‘Morning Star’ and ‘Evening Star’, two three-candle patterns predicting future bullish or bearish trends.

Single Candlestick Patterns

Diving into single candlestick patterns, you’ll find that they offer valuable information about a market’s potential price movements based solely on the formation of one candle. These patterns, the heart of candlestick essentials, provide a snapshot of price action and can be pivotal in your trading strategies.

Single patterns like the Hammer or Doji, for example, have significant pattern significance. A Hammer, resembling its namesake with a small body and a long lower wick, often indicates that the market is attempting to hammer out a bottom. The Doji, characterized by an almost invisible body, represents indecision in the market.

In terms of market interpretation, these patterns can alert you to potential reversals or continuations. Hammer at the end of a downtrend may suggest a bullish reversal, while a Doji in a clear trend could indicate a possible continuation or reversal, depending on the subsequent candle.

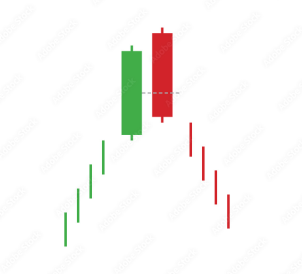

Double Candlestick Patterns Unveiled

Moving beyond single candlestick patterns, you’ll find that double candlestick patterns offer a deeper understanding of potential market movements, as they rely on the relationship between two consecutive candles. These patterns provide valuable trading insights and give you a chance to uncover candlestick secrets, enhancing your pattern mastery in the process.

To further delve into the world of double candlestick patterns, let’s examine some key types:

- The Bullish Engulfing: This indicates that buyers have taken control of the market after a period of seller dominance.

- The Bearish Engulfing: A signal of the sellers overtaking the buyers, hinting at a potential market downturn.

- The Tweezer Bottoms and Tops: These patterns suggest a potential price reversal.

- The Dark Cloud Cover: Often seen as a bearish reversal pattern, it suggests that sellers are starting to push the price down.

Triple Candlestick Patterns Explained

Now that you’ve mastered double candlestick patterns, let’s delve into the world of triple candlestick patterns, which provide a more nuanced understanding of market trends by examining the relationship between three consecutive candles.

Triple candlestick formations are instrumental in candlestick psychology. They offer a deeper insight into the market’s emotional state, capturing the ongoing tug-of-war between buyers and sellers. These patterns are quite significant as they often signal turning points in the market, hinting at possible trend reversals or continuations.

One of the most common triple candlestick patterns you’ll encounter is the ‘Morning Star’. This occurs after a sustained downtrend and signifies a potential bullish reversal. Similarly, the ‘Evening Star’ pattern emerges at the end of an uptrend, indicating a possible bearish reversal. Understanding these variations aids in predicting future price movements.

In terms of candlestick pattern analysis techniques, you need to consider the preceding trend, the formation of each candle in the pattern, and the market’s response after the pattern’s completion. By doing so, you enhance your ability to make informed trading decisions. Remember, while no pattern guarantees a certain outcome, they provide valuable clues about potential market movements.

Continuation Candlestick Patterns

In your journey of mastering candlestick patterns, understanding continuation patterns is a crucial next step, as these particular formations can provide valuable insights into the persistence of existing trends. Candlestick continuation patterns are significant contributors to market trend identification and play a vital role in trend following strategies.

These patterns are primarily used in price momentum analysis, helping you gauge the strength of an ongoing trend. Recognizing these patterns on a chart can provide insightful price action signals, assisting you in making informed trading decisions.

Here are some common continuation patterns:

- The Rising Three Methods: This bullish pattern signifies a pause in an uptrend, followed by a resumption of the upward move.

- The Falling Three Methods: The bearish equivalent of the Rising Three Methods, indicative of a brief pause in a downtrend before it continues.

- The Flag Pattern: These appear as small rectangles during a rapid trend and suggest a continuation of the trend.

- The Pennant Pattern: Similar to flags, but they appear as small triangles during a trend, signaling trend continuation.

Properly understanding and utilizing these continuation patterns can enhance your proficiency in market trend analysis.

Bullish Reversal Patterns

As you delve deeper into your technical analysis toolkit, it’s essential to comprehend bullish reversal patterns. They are powerful indicators that can signal a potential shift from a downtrend to an uptrend in the market. Understanding the candlestick psychology behind these patterns helps you anticipate changes in bullish momentum.

Candlestick recognition is vital to identify these patterns. Look for the hammer and inverted hammer patterns; these indicate a market bottom and hint at a potential reversal. Another crucial pattern is the bullish engulfing. This pattern showcases a small red candlestick swallowed by a larger green one, reflecting a sudden shift in trading sentiment.

Your trading strategies should incorporate these patterns. The bullish harami, for instance, emerges when a small green candlestick forms within the body of a larger red one, signaling a potential end to a bearish trend.

Bearish Reversal Patterns

Shifting gears to bearish reversal patterns, it’s crucial to understand that these patterns provide a significant indicator of a potential change from an uptrend to a downtrend in market conditions. Armed with solid bearish reversal strategies, you’ll be better equipped to anticipate and react to these shifts.

Candlestick pattern analysis is a fundamental part of this process. By studying the shapes and arrangements of your candlesticks, you can recognize certain bearish patterns. These might include the ‘Hanging Man’, ‘Shooting Star’, or ‘Bearish Engulfing’ formations.

Trend identification techniques play a vital role as well. You need to know when an uptrend is losing steam, an insight that bearish reversal patterns can provide. Price movement interpretation is also key, as the size and direction of price moves can offer additional clues about upcoming trend reversals.

Here’s a basic list of steps for reversal pattern recognition:

- Identify the current trend.

- Watch for a bearish candlestick formation.

- Confirm the pattern with the next candlestick or price action.

- Make your trading decision based on this information.

With these strategies, you’ll be better prepared for when the market tide turns.

Reversals at Bottom of Chart

Analyzing reversals at the bottom of a chart can reveal powerful bullish signals, indicating a potential shift from a downtrend to an uptrend. This reversal patterns analysis plays a crucial role in trend reversal strategies. Being able to identify these bottom reversals increases your candlestick pattern strength, giving you an edge in the market.

The bottom reversals significance lies in their predictive power. They often precede a strong upward price movement. To ensure you’re not misinterpreting the signals, it’s necessary to apply candlestick pattern validation.

Consider the table below:

| Candlestick Pattern | Significance |

|---|---|

| Hammer | Indicates a bullish reversal when it appears at the bottom of a downtrend |

| Inverted Hammer | A bullish signal that needs confirmation from the next candle |

| Piercing Line | A two-candle pattern that signifies a strong reversal |

| Morning Star | A three-candle pattern that’s a strong signal for a bottom reversal |

| Bullish Doji Star | It suggests a potential bullish reversal but requires confirmation |

Reversals at Top of Chart

Identifying reversals at the top of a chart can provide potent bearish signals, hinting at a possible transition from an uptrend to a downtrend. Your trend analysis skills become critical here. Recognizing these pivotal moments relies heavily on your understanding of candlestick accuracy and chart interpretation.

A key element to look for is price rejection at the top of the chart. This signifies that the market is batting away attempts to push prices higher, indicating a potential reversal.

Consider these market signals:

- A sudden increase in volume, possibly signaling a climax of buying activity.

- The appearance of Doji or Spinning Top candlesticks, suggesting indecision in the market.

- The emergence of bearish candlestick patterns such as Hanging Man or Shooting Star.

- A significant price gap down following a long bullish candle, hinting at a shift in market sentiment.

These signals, when combined, can provide a reliable indication of an impending downtrend. Remember, the more you practice chart interpretation, the better you’ll get at spotting these crucial turning points in the market.

Doji in Bullish Reversals

In the realm of bullish reversals, the Doji pattern plays a significant role, acting as a powerful indicator of potential shifts in market sentiment from bearish to bullish. The Doji characteristics, marked by an almost equal open and close price, signify a tug of war between buyers and sellers, resulting in a stalemate.

This pattern, often seen at the bottom of a downtrend, suggests that bears may be losing their grip on the market. However, it’s crucial to wait for pattern confirmation before acting on these bullish signals. Confirmation typically comes in the form of a green candlestick closing higher than the midpoint of the previous candlestick.

For your understanding, here’s a table summarizing the Doji:

| Doji Characteristics | Bullish Signals | Pattern Confirmation |

|---|---|---|

| Equal open and close price | Occurs at the bottom of a downtrend | Green candlestick closing higher than previous midpoint |

| Signifies market indecision | Bears losing control | Further bullish movement |

| Tug of war between buyers and sellers | Potential shift from bearish to bullish | Increased trading volume |

Doji in Bearish Reversals

While the Doji pattern can act as a strong signal for bullish reversals, it’s equally powerful in predicting bearish turns in the market. For a bearish reversal, a Doji often forms at the peak of an uptrend, indicating that buyers are losing control. This Doji interpretation signifies a potential trend reversal, where the market may start to decline.

Consider these key aspects of the Doji in a bearish reversal scenario:

- Market indecision: The Doji’s thin line represents a tug of war between buyers and sellers, revealing market indecision.

- Candlestick reliability: Although Doji patterns are not always reliable in isolation, their strength increases with confirming signals.

- Price rejection: The long wicks of a Doji suggest price rejection, where attempts to drive the price up or down were unsuccessful.

- Trend reversal: A Doji following a long bullish candlestick could indicate a potential bearish reversal.

To enhance your trading strategy, remember to combine the Doji pattern with other technical analysis tools. This way, you can confirm the trend reversal and increase your chances of a successful trade.

Rare Candlestick Patterns

Diving into the world of candlestick patterns, you’ll notice that some patterns are relatively rare yet offer significant predictive power when they do occur. Rare patterns analysis reveals that these uncommon formations exploration can provide exceptional pattern insights.

For instance, the “Three Black Crows” pattern, though infrequent, often signals a strong bearish reversal. When you spot this pattern, it’s formed by three consecutive long-bodied candlesticks that have closed lower than the previous day, with each session’s open occurring within the body of the previous candle.

Another unusual candlestick discovery is the “Abandoned Baby” pattern. This formation is considered a reliable reversal signal, but it’s rare due to its strict formation criteria. The setup involves a Doji star gapping away from the preceding candlestick, followed by another gap before the next candlestick begins.

Unique signals interpretation is crucial in these scenarios. While these patterns are infrequent, their occurrence can dramatically shift the market’s direction. However, remember that no pattern offers a sure-fire guarantee. Always use these patterns in conjunction with other indicators to validate potential trades and manage risk effectively.

Complex Candlestick Patterns

Building on the concept of rare patterns, it’s equally important to understand complex candlestick formations that can offer deeper insights into potential market shifts. Your candlestick complexity exploration involves recognizing intricate designs that could signal significant changes in market trends.

To master these patterns, focus on pattern intricacies analysis and the advanced formation examination. This involves identifying patterns within patterns and understanding their implications. The following are some complex patterns:

- The three-line strike, a four-candle pattern that signals a strong reversal.

- The two black gapping, a bearish continuation pattern.

- The mat hold pattern, a bullish continuation formation.

- The separating lines, a reversal pattern that can be either bullish or bearish.

Complex trend identification is integral to your trading strategy, enhancing your ability to interpret market movements. Moreover, pattern strength evaluation is crucial. Not all patterns hold the same weight; the strength of a pattern could vary depending on its location within the overall trend, the trend’s strength, and market volatility. By delving into complex candlestick patterns, you gain a more profound understanding of market mechanics, equipping you with the tools to make more informed trading decisions.

Bullish Engulfing Pattern

Marked by its distinct two-candle formation, the Bullish Engulfing Pattern is a key signal for traders, indicating a potential reversal in market trends from bearish towards bullish. This candlestick formation is critical in understanding candlestick psychology and provides valuable price action insights.

In the first day of this pattern, you’ll observe a small red (or black) candlestick followed by a larger green (or white) one. The second candle ‘engulfs’ the first one – hence the name. This symbolizes the shift of power from sellers to buyers, a key aspect of candlestick psychology.

The pattern offers valuable price action insights that can aid in refining your trading strategies. You might notice the formation when prices are falling, indicating that it might be time to buy. However, don’t make hasty decisions based on this pattern alone. A thorough market analysis technique should involve corroborating the pattern with other indicators or patterns for confirmation.

Dark Cloud Cover Pattern

While the Bullish Engulfing Pattern signals a potential trend reversal from bearish to bullish, its counterpart, the Dark Cloud Cover Pattern, serves as a bearish reversal indicator, hinting at a shift from a prevailing uptrend to a possible downtrend.

This pattern is significant in the world of trading, and understanding it can give you an edge in predicting market movements. The Dark Cloud Cover Pattern is formed when a bullish candle is followed by a bearish candle that opens higher but closes below the midpoint of the previous candle.

- The first day sees a strong bullish move

- On the second day, the market gaps up yet closes below the midpoint of the prior day’s body

- This bearish confirmation creates a sense of pessimism

- The psychology behind this is that the bears have overpowered the bulls, indicating a potential reversal

Pattern validation is key for confirming the Dark Cloud Cover. The third day should see a lower closing, further validating the pattern. The bearish confirmation, coupled with trend analysis and market psychology, increases the candlestick accuracy in predicting a bearish reversal. Remember, no pattern provides a 100% guarantee; always use in conjunction with other indicators.

The Powerful Harami Pattern

Diving into another significant candlestick pattern, you’ll find the Harami Pattern, a powerful tool used by traders to spot potential reversals in market trends. This pattern is a two-candlestick formation and plays a crucial role in price action.

The Harami pattern is all about candlestick psychology. It signals that the current trend is losing momentum and a reversal might be imminent. The first candlestick is a long one, continuing the current trend. The second is shorter, nestled within the range of the first, like a child in a mother’s womb – that’s where the name ‘Harami’ comes from, a Japanese word for ‘pregnant’.

Pattern recognition is key in technical analysis, and the Harami pattern stands out. Its market implications are significant; when you spot a Harami, it’s time to pay attention.

Bearish Harami

The bearish Harami occurs at the end of an uptrend, suggesting sellers are gaining control.

Bullish Harami

A bullish Harami, on the other hand, indicates that buyers are stepping in at the end of a downtrend.

The Harami pattern might not guarantee a reversal, but it’s a strong sign to watch the market closely. By understanding this pattern, you can make informed decisions and potentially reap substantial rewards.

Trading Tips With Candlestick Patterns

Harnessing the power of candlestick patterns can significantly enhance your trading skills, but it’s crucial to apply them strategically and understand their limitations. These patterns can provide valuable insights into market trends and price movements.

Here are a few tips to help you effectively use candlestick patterns in your trading strategies:

- Always backtest your strategy: Don’t blindly trust a pattern. Use historical data to see how it has performed in the past.

- Incorporate other technical indicators: Candlestick patterns can give false signals. Using other technical analysis tools can help confirm signals and manage risk.

- Understand the market context: Candlestick patterns should be used in conjunction with an understanding of broader market trends.

- Be patient: Not every pattern will lead to immediate results. Wait for the pattern to fully develop before placing a trade.

How to read candlestick patterns for day trading?

Reading candlestick patterns involves analyzing the open, high, low, and close prices to identify trends and make trading decisions effectively.

What is the most reliable candlestick pattern?

The “hammer” and “shooting star” patterns are considered reliable due to their strong indications of potential trend reversals.

Are candlestick patterns reliable?

Candlestick patterns can be reliable indicators of market sentiment and potential price movements when used in conjunction with other technical analysis tools.

Do candlestick patterns work?

Candlestick patterns can be effective signals for traders, but they should be confirmed by other indicators to increase the likelihood of successful trades.

Do candlestick patterns work for crypto?

Yes, candlestick patterns can be applied to cryptocurrency trading just like in traditional markets, providing insights into price movements and trends.

Don’t trade before learning these 14 candlestick patterns.

It’s essential to familiarize yourself with common candlestick patterns like doji, engulfing, and evening star patterns before engaging in trading to make informed decisions.

Don’t trade before learning these 14 candlestick patterns PDF.

Educational resources such as PDF guides on candlestick patterns can help traders understand and recognize various patterns for more effective trading strategies.

How accurate are candlestick patterns?

Candlestick patterns’ accuracy varies, but when combined with other technical analysis tools and used in the right context, they can enhance trading decisions significantly.

How many candlestick patterns are there?

There are numerous candlestick patterns, but traders commonly focus on around 40 key patterns that provide actionable insights into market trends and sentiment.

How many candlestick patterns are there in the stock market?

In the stock market, traders often work with a core set of about 12 to 16 key candlestick patterns that are widely recognized and utilized for making trading decisions.

What is the hammer candlestick pattern?

The hammer candlestick pattern is a bullish reversal pattern characterized by a small body at the top with a long lower wick, indicating potential trend reversal from bearish to bullish.

What is the 3 candle rule?

The 3 candle rule refers to a trading strategy where traders analyze patterns formed by three consecutive candles to identify potential trend reversals or continuations.

What is the 5 candle rule?

The 5 candle rule, also known as the Five Candles Pattern Rule, is a trading concept involving the analysis of at least five consecutive candles with small bodies moving in a sideways or flat trend without a clear directional bias. This pattern may suggest indecision in the market and potential for a breakout or reversal.

What is Rising Three Methods?

The Rising Three Methods is a bullish continuation pattern that occurs during an uptrend and consists of a large bullish candlestick (flag pole) followed by three smaller consolidation candles before continuing the upward trend. This pattern often signifies the potential continuation of the existing uptrend.

How do you predict the next candlestick?

Predicting the next candlestick involves analyzing current market conditions, historical price data, volume trends, and various technical indicators to make an educated forecast based on probabilities rather than certainties. Traders often use a combination of technical analysis, chart patterns, reverse candlestick patterns and market sentiment to anticipate potential price movements.

How do you master a candlestick pattern?

To master a candlestick pattern, it’s essential to study and understand the characteristics of each pattern, practice identifying them in historical charts, backtest strategies using these patterns, and gain real-time trading experience to recognize their significance in different market conditions. Continuous learning, analysis, and application are key to mastering candlestick patterns effectively.

What is candlestick patterns cheat sheet?

A candlestick patterns cheat sheet is a handy reference guide that helps traders identify various candlestick patterns on a chart. These patterns provide valuable insights into market sentiment and potential price movements. By recognizing these patterns, traders can make informed decisions regarding their trading strategies.

Disclaimer:

All information has been prepared by TraderFactor or partners. The information does not contain a record of TraderFactor or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.