When you’re searching for the best CFD trading platform, it’s important to consider platforms that blend sophisticated features with strict regulatory oversight. Choose a platform that’s regulated by reputable bodies like the FCA, CySEC, or ASIC to guarantee safety and transparency. You should also look for platforms that offer competitive spreads, effective risk management tools, and a variety of account types tailored to different trading styles and experience levels. Automation features and robust market analysis tools can greatly enhance your trading strategies. Reliable platforms with extensive educational resources will better equip you to execute well-informed trades. Exploring these aspects further will guide you to an ideal choice.

Table of Contents

ToggleComparison Table of the Best CFD Trading Platforms

| Platform | Regulation | Key Features | Trading Platforms | Unique Offerings/Bonuses |

| OneRoyal | ASIC, CySEC, VFSC, FSA | High-speed trading, flexible leverage up to 1:1000 | MT4/MT5 | 100% deposit bonus, free premium trading tools |

| ActivTrades | FCA, CSSF, SCB | Low trading fees, wide range of instruments 1:200 | MetaTrader 4/5, ActivTrader | Exclusive trading tools, refer-a-friend bonus |

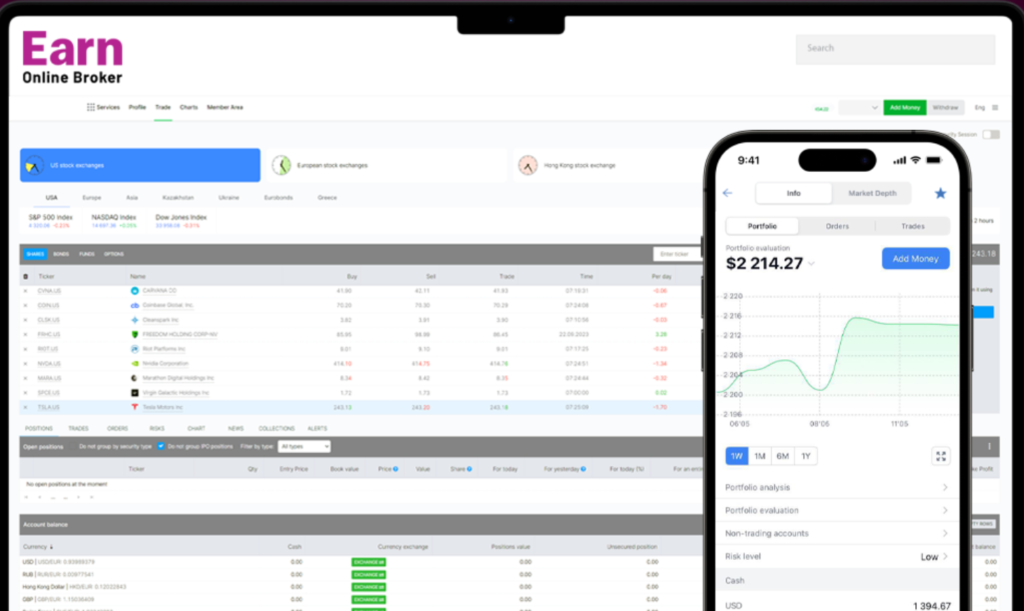

| Earn Broker | CySEC | Advanced trading tools, diverse market access 1:30 | MetaTrader 4/5, Earn.Broker, DAS Trader | IPO investments, margin lending benefits, AI-based trading signals from Acuity |

| TMGM | FCA, ASIC, CySEC, JSC, FSCA | Extensive market access, MetaTrader Supreme Edition 1:5000 | MetaTrader 4/5, TMGM Trader | TMGM CashBack, educational resources |

| IronFX | CySEC, FCA, FSCA, BMA | Zero fees on deposits/withdrawals, multilingual support 1:1000 | MetaTrader 4/5, WebTrader | IronFX Academy, VIP room access |

| FundedNext | Large trading capital up to $4M, profit shares up to 90% | MetaTrader 4/5, cTrader | Various account options, educational support | |

| EightCap | ASIC, VFSC | Over 250 cryptocurrencies, competitive spreads 1:500 | MetaTrader 4/5 | $1 per lot cashback, rapid execution speeds |

Regulation Standards Overview

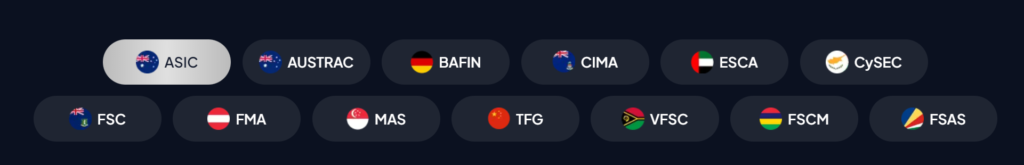

Understanding the regulation standards, such as those set by the FCA, CySEC, and AFSL-ASIC, is essential for guaranteeing your broker operates with transparency and accountability. These regulatory bodies impose stringent compliance standards and licensing requirements that your broker must adhere to, which greatly impacts the safety measures and reliability factors of their operations.

Regulatory oversight serves as the cornerstone of investor protection, mandating brokers to maintain high levels of operational integrity and financial transparency. This oversight guarantees that brokers implement robust safety measures to safeguard your investments. For instance, they’re required to segregate client funds from corporate funds, providing an additional layer of security.

Compliance standards are rigorously enforced. Brokers undergo regular audits and must submit detailed reports to regulatory authorities, guaranteeing continuous adherence to legal and ethical standards. This not only enhances the reliability of the trading platform but also minimizes the risk of fraudulent activities.

Each regulatory body has its specific set of rules and standards, and understanding these can provide you with a clear insight into the broker’s operational ethos and commitment to safeguarding your interests. Always verify that your broker not only meets but exceeds these regulatory benchmarks to guarantee a secure and reliable trading environment.

Broker Licensing Insights

To verify your broker’s credibility, it’s important to examine their licensing status with reputable regulatory authorities. This assessment is essential as it guarantees that your chosen broker adheres to strict licensing requirements set by these bodies. Regulatory authorities like the FCA, CySEC, and ASIC mandate rigorous compliance standards that brokers must meet to operate legally. These standards are designed not only to protect the broker but also to provide significant investor safeguards.

When evaluating a broker, consider these vital elements:

- Regulatory Compliance: Confirm that the broker consistently meets high regulatory standards, which aids in safeguarding your investments.

- Licensing Validity: Verify that the broker’s license is current and issued by a reputable authority, confirming their legitimacy in the financial markets.

- Investor Protection Measures: Seek features such as segregated accounts, which keep client funds separate from the broker’s operating funds.

Optimal Trading Conditions

Ideal trading conditions greatly enhance your trading success by offering competitive spreads, leverage options, and minimal deposit requirements. When you’re evaluating platforms, it’s crucial to focus on how these factors can serve your trading strategy and risk tolerance.

Leverage benefits are particularly significant; they allow you to open larger positions than your current capital would otherwise permit. It’s a powerful tool, boosting potential profits with a relatively small investment. However, it’s essential to understand that while leverage can magnify returns, it also increases potential losses. Effective risk management is thus necessary to protect your capital. This includes setting stop-loss orders to limit potential losses and monitoring positions closely.

Competitive spreads are another key aspect. Lower spreads mean less cost to you on each trade, enhancing profitability, especially for frequent traders. Look for platforms that offer tight spreads across a wide range of assets to maximize your trading flexibility.

Additionally, robust market analysis tools empower you to make informed decisions. These tools should offer both technical and fundamental analysis capabilities, enabling you to adapt your strategies to market conditions and news events. This analytical capacity, combined with real-time data, helps you to better navigate the volatility and complexities of the markets.

Account Types Comparison

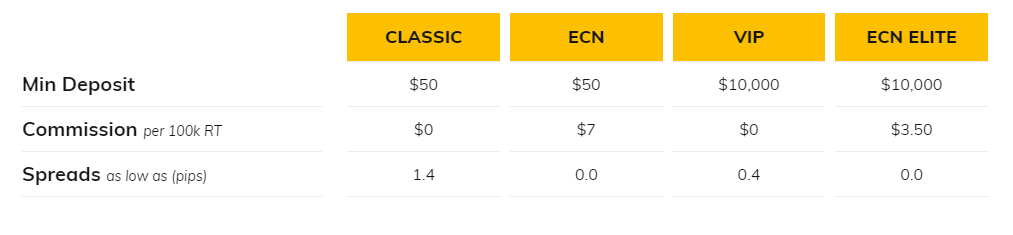

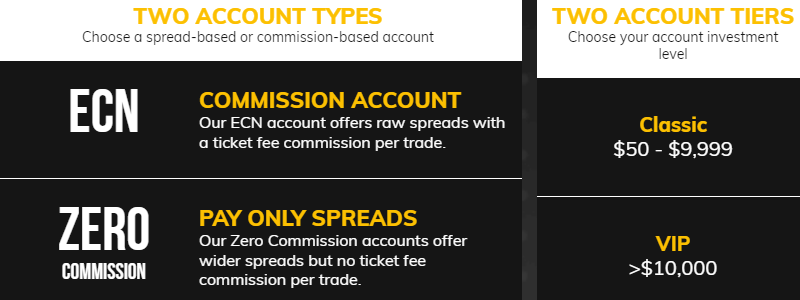

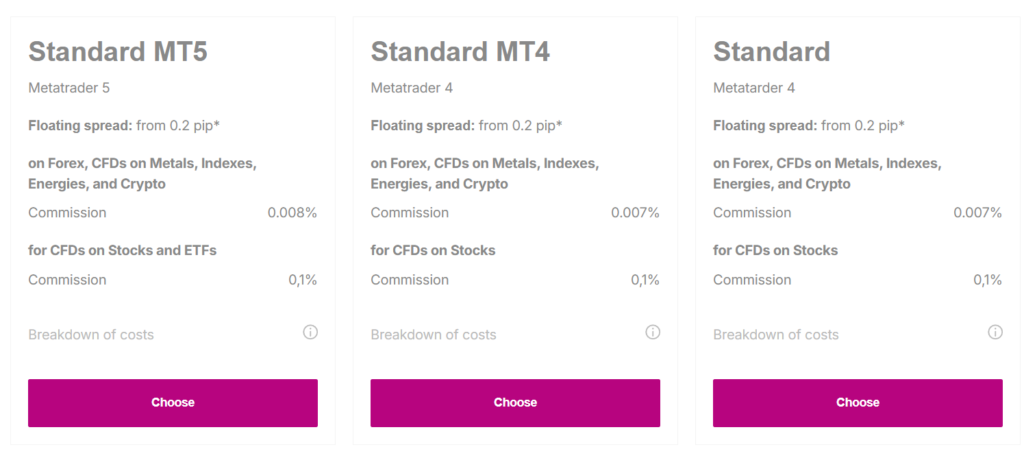

After examining optimal trading conditions, let’s compare the account types offered by various brokers to align with your investment needs and trading style.

Choosing the right account can greatly impact your trading efficiency and financial outcomes. The account features vary widely, including minimum deposit requirements, leverage options, and access to different markets. Here’s what you need to take into account:

- Account Features: Brokers offer accounts that cater to different levels of traders, from beginners to professionals. For example, some might provide lower leverage to protect new traders while offering advanced tools for seasoned traders.

- Fee Comparison: Understanding the fee structure is essential. Look for transparency in spreads, commission rates, and any other transaction fees. This will help you manage costs effectively and maximize your returns.

- Support Options: Effective customer support can be a deciding factor. Make sure the broker offers thorough support via various channels like live chat, email, and phone. Also, check for the availability of educational resources and trading advice.

Beyond these points, evaluate the trading benefits associated with each account type, which might include bonuses, risk management tools, or exclusive updates. Platform usability also plays an important role; a user-friendly interface can enhance your trading experience and performance. Make sure to carefully assess these factors to find the best fit for your trading goals.

Platform Automation Features

As you explore the capabilities of various trading platforms, consider the automation features that can greatly enhance your trading efficiency. Automated trading strategies allow you to execute trades based on predefined criteria without manual intervention. This not only speeds up the trading process but also eliminates emotional decision-making, leading to more disciplined and consistent trading.

Platform integration capabilities are essential for developing and deploying sophisticated trading algorithms. These features enable seamless interaction with historical data and real-time market feeds, essential for back-testing and refining algorithms before live deployment. Algo trading advantages are significant, as they leverage computational power to analyze large datasets and execute trades at best times, often faster than a human could.

Trading algorithm development involves creating algorithms that can adapt to market conditions and learn from past performance to optimize future strategies. This is where advanced programming interfaces (APIs) and high-level customization features of a platform come into play.

Innovative Trading Tools

To stay competitive in today’s fast-paced market, you’ll need access to innovative trading tools that enhance analytical precision and decision-making speed. The best CFD trading platforms incorporate features that streamline your trading process and elevate your ability to respond quickly to market changes.

- Trading Algorithms: Automated systems that execute trades based on predefined criteria, minimizing the emotional impact on your trading decisions and enhancing your strategy’s consistency.

- Risk Assessment Tools: Advanced functionalities that help you evaluate potential losses and manage your exposure effectively. These tools are essential for maintaining control over your financial risks.

- Market Analytics: Sophisticated analytical tools that provide deep insights into market trends, helping you make informed decisions backed by data.

These tools are supported by real-time trading signals and robust portfolio management features, allowing you to monitor and adjust your investments efficiently. Trading signals alert you to potential trading opportunities, ensuring you’re always in the loop, while portfolio management helps in tracking the performance of your investments, making it easier to assess how well your choices align with your financial goals. Leveraging these tools can greatly enhance your trading effectiveness, making it vital to choose a platform that offers these capabilities.

Tradable Instruments Range

The range of tradable instruments a platform offers directly impacts your trading strategy’s versatility and potential profitability. When you’re selecting a CFD trading platform, consider not just the asset variety but also how these assets cater to your needs for trading flexibility and market responsiveness. A platform with a broad spectrum of instruments, including commodities, indices, and stocks alongside traditional forex pairs, allows you to diversify your portfolio effectively. This diversity helps mitigate risks associated with market volatility by spreading your investment across different asset classes.

Moreover, regulatory compliance is essential. Confirm the platform adheres to stringent standards set by bodies like FCA or CySEC, which guarantees that the trading operations are transparent and fair. This compliance not only protects your investments but also ensures the reliability of the trading environment.

Cryptocurrency Trading Options

Exploring cryptocurrency trading options expands your portfolio beyond traditional assets, offering unique opportunities for profit in volatile markets. As you immerse yourself in the crypto space, understanding the intricacies of cryptocurrency volatility and its impact on trading pairs is essential. Market trends in the cryptocurrency domain can be suddenly dynamic, which necessitates robust risk management strategies to safeguard your investments.

Here are key points you’ll need to ponder:

- Cryptocurrency Volatility: Rapid price fluctuations can present significant opportunities but require careful analysis and quick decision-making.

- Trading Pairs: Familiarize yourself with major and exotic crypto pairs. Analyzing how pairs like BTC/USD or ETH/BTC respond to market news helps in strategizing trades.

- Technical Analysis: Utilize tools such as moving averages, RSI, and Fibonacci retracements to predict future movements and identify trading opportunities.

Effective risk management in cryptocurrency trading involves setting stop-loss orders, monitoring leverage carefully, and keeping abreast of global regulatory changes that could impact market conditions. By applying technical analysis, you can decipher patterns that guide your trading decisions, ensuring you’re not merely reacting to market trends but anticipating them. This analytical approach will enhance your trading acumen, leading to potentially higher returns in the fast-paced world of cryptocurrencies.

Margin Lending Opportunities

Margin lending magnifies your trading capacity by enabling you to borrow funds from a broker to boost your investment exposure. This strategy incorporates risk assessment tools to evaluate potential financial opportunities against market trends, enhancing your ability to capitalize on price movements with greater volume.

When you engage in margin lending, you’re basically using leverage to expand your market position beyond what your current capital would allow. This can greatly enhance potential returns from market movements. However, it’s vital to apply rigorous risk assessment to safeguard against the inherent risks of increased exposure. Effective risk management involves setting stop-loss orders and having a clear exit strategy to mitigate potential losses.

Furthermore, margin lending facilitates asset diversification. By borrowing funds, you can spread your investments across a variety of asset classes, rather than concentrating on a single area. Diversification is a fundamental investment strategy that helps to reduce risk and stabilize returns, even when specific market segments face volatility.

As you align your trading strategies with ongoing market trends, margin lending can be a valuable tool. It allows you to make the most of financial opportunities that arise, provided you maintain a disciplined approach to monitoring and adjusting your positions in response to market changes.

Broker Background Information

Many brokers, such as Earn Broker established in 2011 and Admirals in 2001, have decades of experience in the trading industry, providing them a solid foundation to serve their global clientele effectively. The longevity and stability of these institutions are underpinned by their adherence to stringent regulatory frameworks, which not only enhance their reputation but also guarantee a secure trading environment for you.

When selecting a broker, consider these critical aspects:

- Company Growth: Look for brokers that have shown consistent growth, expanding their services and market presence over time. This indicates a robust business model and the ability to adapt to market changes.

- Broker Reputation: A broker’s reputation is often reflected in their customer service, transparency, and the quality of their trade executions. Long-standing brokers typically have well-established practices that promote client trust and satisfaction.

- Regulatory Adherence: The best brokers prioritize compliance with international finance regulations. This adherence safeguards your investments and provides a level of security in your trading ventures.

As you explore the trading experience, these factors are instrumental in ensuring that your chosen platform can offer not just a wide range of tools and assets, but also a stable and reliable environment for managing your investments.

Influence of Market Participants

You’ll find that central banks, hedge funds, and retail traders greatly shape the forex market’s dynamics through their varied trading activities and strategies. Central banks, in particular, influence market sentiment significantly by setting interest rates and managing national currency reserves, impacting forex volatility directly through interventions or indirectly via economic data releases. Their actions often aim to stabilize or devalue their currency to favor national economic conditions, which can lead to substantial market movements.

Hedge funds, wielding massive capital, engage in high-frequency trading and employ complex strategies that leverage economic data to predict market movements. Their trades can swiftly change the market sentiment, creating opportunities or risks for other participants.

Retail traders, though individually less impactful, collectively contribute to market liquidity and sentiment. Their reactions to economic data and their trend-following or contrarian strategies can amplify market movements initiated by bigger players.

Understanding these interactions is essential for selecting a CFD trading platform that offers robust tools for analyzing market sentiment, real-time economic data feeds, and advanced charting packages. This setup helps you anticipate and react to shifts initiated by these influential market participants, potentially enhancing your trading performance.

Utilizing Fundamental Analysis

To effectively utilize the potential of fundamental analysis, understanding how economic indicators, earnings reports, and political events impact market prices is crucial. These components act as decision-making tools, aiding in foreseeing price fluctuations and assessing market sentiment. When combined with technical analysis, you have a complete set of tools for navigating the intricate realm of CFD trading.

Here’s how you can implement fundamental analysis:

- Economic Indicators: Monitor GDP reports, employment data, and inflation rates. These indicators mirror the economic well-being of a country and strongly influence market movements.

- Earnings Reports: Evaluate quarterly financial statements from major companies. Positive earnings often enhance investor confidence and push market prices higher.

- Political Events: Stay updated on elections, policy adjustments, and international relations. These events can trigger significant volatility in the markets.

Order Execution Speed

Order execution speed is vital in CFD trading, as it directly impacts the price at which your trades are executed. You’ll find that latency issues can significantly affect execution quality, leading to price slippage and potentially less favorable outcomes. To minimize this, selecting platforms that excel in speed optimization is crucial.

Platforms that prioritize real-time monitoring ensure that you’re receiving the most accurate pricing information available. This monitoring is essential during fast-moving markets where prices can change in milliseconds. By having access to real-time data, you can make more informed decisions swiftly.

Slippage prevention is another key feature to take into account. Some platforms have built-in mechanisms that reduce slippage by executing orders at the best available price rather than the initially requested one. This can make a significant difference in the execution quality of your trades.

To improve your trading efficiency, look for platforms that address latency issues through robust technical infrastructure. Such platforms often use state-of-the-art servers and place them strategically near major financial hubs to reduce delay times.

Risk Management Strategies

Effective risk management strategies are essential to safeguard your investments and limit potential losses in CFD trading. To effectively manage the inherent risks, you need to adopt several key practices:

- Position Sizing: Careful calculation of the size of each trade relative to your total capital is vital. It prevents any single trade from causing significant damage to your portfolio.

- Stop Loss Placement: Setting stop loss orders strategically helps to cap potential losses. It’s a form of risk mitigation that locks in profit levels or prevents excessive losses by automatically closing out positions once they reach a certain price.

- Portfolio Diversification: Spreading your investments across various asset classes can shield you from unexpected market shifts. This diversification is a cornerstone of reducing risk exposure.

Incorporating these elements into your trading strategy can dramatically improve your ability to manage adverse conditions without compromising potential gains. It’s not just about predicting market movements but also preparing for scenarios where things don’t go as planned. By emphasizing risk mitigation, volatility management through these methods, you’re not just trading; you’re strategically positioning yourself to maintain sustainability and growth in the volatile domain of CFD trading.

Adapting to Market Volatility

Adapting to market volatility requires you to closely monitor and swiftly respond to rapid price changes that can greatly impact your trading outcomes. Effective risk assessment is vital; you’ll need to analyze historical data and current market trends to gauge potential risks accurately. This involves understanding the catalysts for volatility, such as economic announcements or geopolitical events, and adjusting your strategies accordingly.

Developing volatility strategies is essential. These might include employing stop-loss orders to mitigate losses or using options strategies to hedge against unforeseen movements. You’ve got to be adaptive, tweaking your approaches as market conditions evolve, ensuring you’re not caught off-guard.

Market adaptability also hinges on your trading psychology. Emotional decision-making can lead to rash trades which often exacerbate losses during volatile times. Cultivating a disciplined mindset, one that adheres strictly to a well-thought-out trading plan, is crucial to success.

Lastly, constant risk mitigation measures such as diversification of your investment portfolio and regular review of your risk tolerance align with the dynamic nature of markets. By integrating these practices, you’re not just reacting to the markets, but actively managing your exposure to fluctuations, thereby enhancing your ability to operate successfully within a volatile trading environment.

Investor Protection Measures

Investor protection measures guarantee you’re trading on platforms that adhere strictly to legal and ethical standards, thereby safeguarding your investments. These measures are essential for maintaining trust and making sure you can invest with confidence. Let’s explore the key components:

- Investor Education: Understanding the intricacies of CFD trading is crucial. Platforms that prioritize investor education provide resources to enhance your trading knowledge, equipping you with the tools to make informed decisions.

- Account Segregation: This ensures your funds are kept separate from the broker’s operating funds. In the event of a broker’s financial failure, your capital remains protected.

- Transparency Measures: Platforms must disclose all relevant trading conditions and fees upfront. This openness helps you understand exactly what you’re getting into, avoiding any hidden charges or misleading terms.

Incorporating these protections, you’ll find platforms focusing heavily on risk mitigation strategies to minimize losses during volatile market conditions. Regulatory requirements enforce these standards, ensuring each platform maintains a high level of operational integrity. When selecting a CFD trading platform, assess how these investor protection measures are implemented. This approach not only secures your investments but also enhances your trading experience by fostering a safer, more transparent trading environment.

Advanced Charting Tools

Advanced charting tools equip you with the capability to analyze market trends and make informed trading decisions efficiently. These tools are essential in the world of CFD trading, where understanding slight shifts in market dynamics can greatly impact your trading outcomes. By utilizing advanced charting software, you’re not just looking at price movements; you’re dissecting them with precision.

When selecting a trading platform, consider these crucial aspects:

- Charting software comparison: Evaluate platforms based on the variety of technical analysis tools they offer. This includes the ability to customize and save chart templates, which saves time and enhances your analytical capabilities.

- Trading indicator usage: Indicators such as moving averages, RSI, and MACD help you identify trends and signals within the market. A platform that allows for extensive indicator customization and combination gives you an edge in strategy development.

- Chart pattern recognition: Effective platforms incorporate technology that automatically detects and alerts you to common chart patterns, supporting quicker and more accurate decision-making.

These features enable you to apply complex technical analysis techniques, empowering you to understand and predict price movement analysis more adeptly. Choosing the right platform involves more than just comparing features; it’s about finding a tool that complements your trading style and enhances your market analysis.

Trading Platform Reliability

While advanced charting tools enhance your analytical capabilities, the reliability of a trading platform guarantees that these tools operate seamlessly during market fluctuations. You need a platform that won’t let you down when you’re making split-second decisions based on complex, real-time data. Platform stability is essential; it ensures the interface and functionalities remain responsive, even under the stress of high trading volumes or unexpected news events that can cause significant market volatility.

Reliable performance is another key aspect. It’s about consistent execution of trades without delays or glitches. Dependable technology underpins this, incorporating robust infrastructure and state-of-the-art software that can handle the demands of active traders. A trustworthy service means that the platform not only performs well during optimal conditions but also maintains its integrity during peak times.

Consistent execution is crucial. It ensures that your trades are carried out at expected prices, without substantial slippage, even in fast-moving markets. This reliability can significantly impact your trading outcomes, particularly if you’re engaged in strategies that require high precision and timing. Choosing a platform that integrates these elements of stability, performance, and dependable technology will enhance your trading efficacy and can drastically reduce potential risks associated with platform-induced failures.

Educational Resources for Traders

As you start your trading journey, access to extensive educational resources can greatly improve your understanding and performance in the market. A well-rounded educational suite covers a variety of essential topics:

- Trader Psychology: Understanding your own psychological triggers can significantly influence your trading decisions. It’s crucial to manage emotions like fear and greed.

- Risk Management: Learning to apply strategies to minimize losses while maximizing potential profits is necessary. This includes setting stop-loss orders and managing leverage effectively.

- Trading Strategies and Technical Indicators: Familiarize yourself with different trading strategies and the technical indicators that support them, such as moving averages and MACD. This knowledge is key in developing tactics that align with market conditions.

These resources are crucial in building your proficiency in market analysis, enabling you to interpret and react to market dynamics adeptly. Educational materials often include webinars, e-books, and interactive courses that explore topics like chart patterns and economic indicators, all designed to refine your trading skills and enhance your market foresight.

Frequently Asked Questions

How Do I Calculate Swap Fees for Overnight CFD Positions?

To calculate swap fees for overnight CFD positions, you’ll need to take into account interest rate differentials, adjust leverage, and assess position costs. Use the formula involving these factors and implement risk management strategies effectively.

What Are the Tax Implications of Trading CFDs?

You’ll face capital gains tax on profits and can claim tax deductions on trading losses. Tax reporting is essential; consult a tax professional to manage your CFD trading’s tax implications effectively.

Can I Use Social Trading Features on CFD Platforms?

Yes, you can use social trading features like copy trading, mirror trading, and social investing on CFD platforms, enabling community and crowd trading to leverage insights from experienced traders.

What Are the Typical Withdrawal Times for CFD Trading Accounts?

Withdrawal times for CFD trading accounts vary, depending on account verification, payment methods, and withdrawal limits. Efficient customer support can expedite withdrawal processing, ensuring you access your funds promptly.

How Do Environmental Factors Influence Commodity-Based Cfds?

Environmental factors like weather impact and sustainability concerns affect commodity-based CFDs by causing market volatility, influencing geopolitical events, and disrupting supply chains, which in turn affects prices and trading strategies.

Disclaimer:

All information has been prepared by TraderFactor or partners. The information does not contain a record of TraderFactor or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.