Acuity Trading Limited leverages advanced AI to provide deep insights into financial markets, helping users gain a competitive edge with real-time data and actionable intelligence. Their key partnerships with entities like Dow Jones and the Polytechnic University of Catalonia enrich the platform’s analytical capabilities. The suite of tools, including Research Terminal, AnalysisIQ, and AssetIQ, allows for rapid response to market changes and enhances trading strategies with sophisticated AI algorithms. Users benefit significantly from improved risk management and forecasting, which are pivotal for both retail and institutional traders. Discovering more about Acuity could open up new avenues for optimizing trading strategies.

Acuity Trading Overview

Acuity Trading Limited leverages artificial intelligence to deliver cutting-edge financial market insights. The firm’s AI analytics dive deep into vast data pools, identifying essential market trends and investment opportunities. Their technology doesn’t just skim the surface; it harnesses advanced algorithms to analyze shifts and patterns that are invisible to the naked eye.

This sharp focus on data trends enables both retail and institutional investors to make well-informed decisions, enhancing their trading strategies and risk management. With real-time insights, users gain a significant competitive edge, staying ahead in the fast-paced trading environment. Acuity’s tools are designed to sift through the noise, providing clear, actionable insights that empower investors.

Their commitment to innovation extends into every facet of their service. By continuously refining their AI systems, Acuity guarantees that clients benefit from the most relevant and up-to-date information available. This dedication not only improves trading efficiency but also fortifies the risk management processes, safeguarding investments against unforeseen market volatilities. In an industry where precision and speed are paramount, Acuity Trading stands out by equipping users with superior tools to maximize their investment potential.

Table of Contents

ToggleAcuity Trading Key Collaborations and Partnerships

Strengthening its market position, Acuity Trading Limited has forged strategic partnerships with leading industry players like Dow Jones & Company Inc. and the Polytechnic University of Catalonia. These strategic alliances are pivotal, enhancing Acuity’s access to cutting-edge financial analysis and broadening its research capabilities.

The collaborative ventures with Dow Jones provide Acuity with unparalleled market insights and data analytics, powering its AI-driven platforms. This integration of high-quality journalism and machine learning technology offers clients a significant competitive edge, bolstering their investment decision-making processes. Similarly, the partnership with the Polytechnic University of Catalonia fuels innovative joint initiatives.

Here, academic prowess meets industry needs, leading to the development of advanced analytical tools that push the boundaries of traditional market analysis. Earn Broker Revolutionizes Trading with Enhanced Acuity Research Platform Features, Available at No Extra Cost

These alliances not only amplify the partnership benefits for Acuity but also fortify the overall ecosystem of financial data analytics. By tapping into these diverse resources, Acuity maintains it remains at the forefront of technological advancements in the financial sector. The alliance’s advantages are clear: they provide Acuity with a robust framework for innovation and continuous improvement, ensuring that its clients always have access to the most sophisticated tools and insights available.

Acuity Trading Tools Explained

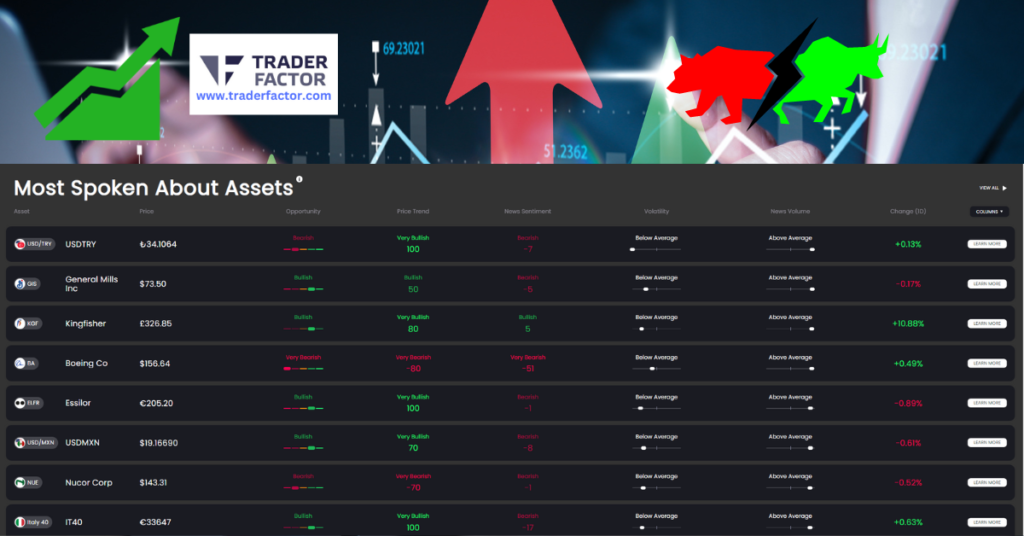

Delving into the suite of tools offered by Acuity Trading, it becomes clear that each is designed to enhance the trading capabilities of its users. These tools leverage AI algorithms to analyze real-time data, providing automated signals and market signals that help investors make more informed decisions. Additionally, event forecasts anticipate market movements triggered by scheduled economic updates or unexpected news.

Each tool in Acuity Trading’s arsenal is tailored to enhance retail and institutional trading by utilizing cutting-edge technology to sift through the vast amounts of data, ensuring traders can react quickly and effectively to market changes.

To draw the audience in and keep them interested, here’s a breakdown of three key tools:

Research Terminal

Offers real-time access to market data, news, and expert analyses, empowering traders with the latest information for swift decision-making.

AnalysisIQ

Provides pre-made market signals crafted by seasoned experts. These signals help traders identify potential buy or sell opportunities based on sophisticated AI analysis.

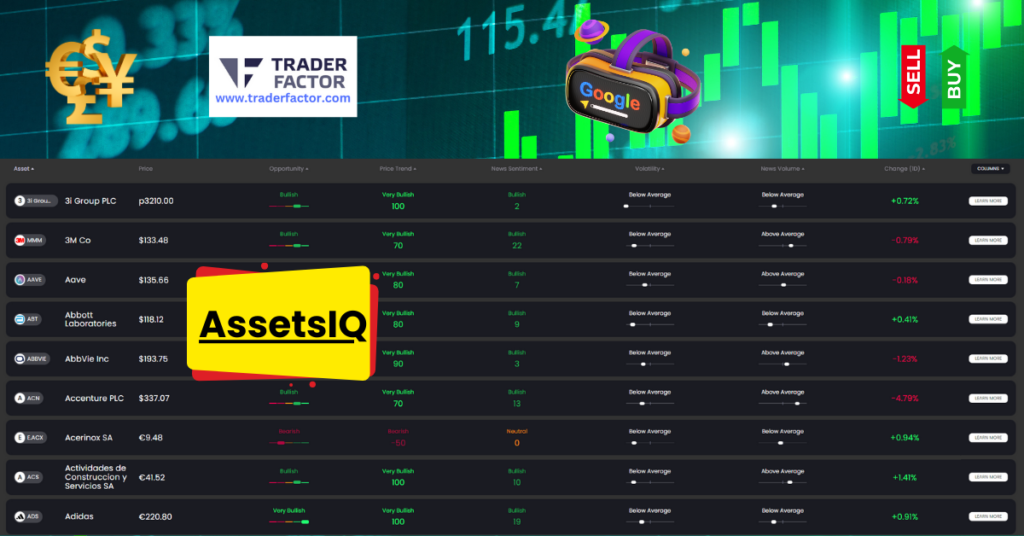

AssetIQ

Utilizes AI to conduct deep asset analysis, offering insights that typically require extensive manual research. This tool is invaluable for understanding asset strengths and vulnerabilities.

Corporate Calendar

Acuity Trading’s corporate calendar tool is a valuable resource for traders, offering real-time and forecasted data alongside advanced filtering features. The tool provides detailed insights into major corporate events and their effects on the market.

Traders can utilize this information to navigate earnings events with high volatility, identifying optimal entry and exit points for trades. This calendar aids in understanding market dynamics and making informed trading decisions.

Economic Calendar

Traders can utilize an economic calendar tool that offers comprehensive access to live and upcoming data on more than 1,000 economic events spanning 55 countries.

This resource provides valuable insights into how various assets are affected, allowing traders to gauge the impact on their trading strategies effectively.

With its advanced filtering options, users can customize their views based on specific impact levels and access market-moving news and commentary from Dow Jones, aiding in more informed decision-making.

Integration of Acuity Analysis Tools

Integrating Acuity’s analysis tools into trading strategies offers significant advantages to investors. These tools provide enhanced insights by tapping into AI-driven analytics that process vast amounts of market data. This capability allows traders to harness the latest trends and apply them effectively within their trading strategies, fostering a more data-driven approach.

For instance, Acuity’s Research Terminal delivers real-time data and analysis, equipping users with the necessary information to make informed decisions. This integration is pivotal in today’s fast-paced markets where timely information can be the difference between profit and loss. Similarly, AnalysisIQ and AssetIQ offer pre-made market signals and AI-based asset analysis, respectively, which streamline decision-making processes and augment the accuracy of market forecasts.

Moreover, the integration of these tools into daily trading routines enhances risk management by providing forecasts that predict market volatility and potential economic impacts. These forecasts enable traders to adjust their strategies proactively, minimizing potential losses and capitalizing on market opportunities.

Benefits of Using Acuity Tools

Acuity’s tools offer investors significant benefits, streamlining the trading process with robust, AI-enhanced analytics.

These tools not only improve the accuracy and speed of market analysis but also empower both retail and institutional investors with deeper insights. Here’s how they transform the trading experience:

Enhanced Decision Making

Acuity’s platforms integrate real-time data and historical analysis, providing users with actionable intelligence. This leads to more informed decisions, minimizing risks and identifying opportunities quicker than traditional methods.

Competitive Edge:

Investors gain a competitive edge through access to exclusive market insights and trend predictions. Acuity’s advanced tools analyze vast amounts of data to forecast market movements, giving users a head start in their trading strategies.

Retail and Institutional Support

The tools are designed to support both retail and institutional needs. Retail traders benefit from user-friendly interfaces and simplified data presentations, enhancing their trading experience.

Meanwhile, institutions utilize sophisticated analytics to support complex trading strategies and improve risk management.

Pros and Cons of Acuity Trading

While Acuity Trading provides a variety of advanced tools strengthened by AI and strategic collaborations, it’s crucial to evaluate both the benefits and drawbacks of utilizing their platform. The pros encompass state-of-the-art AI-driven analytics, which improve trading decisions and asset analysis. Users gain from automated signals that streamline and potentially enhance the effectiveness of trading strategies. Additionally, Acuity’s partnership with top-tier institutions like Dow Jones guarantees access to dependable and current market data.

However, there are cons to take into account. The algorithm transparency is somewhat limited, which may raise concerns for traders who prefer to comprehend the intricate workings behind the automated signals they rely on. This lack of clarity could result in dependence on the automated systems without fully understanding the underlying risk factors. Furthermore, while the automated signals are beneficial, they do not promise success, and users must exercise caution, making sure not to replace these tools with their own critical analysis and risk evaluation.

In essence, while Acuity Trading’s platform provides significant advantages through its advanced technology and collaborations, users need to stay alert to the potential downsides, especially regarding transparency and excessive reliance on automation.

Acuity’s Impact on Retail Investors

Given its advanced toolset, Acuity Trading greatly enhances the trading experience for retail investors. It leverages cutting-edge technology to provide sharper investment data and user-friendly tools that are essential for making informed decisions. This accessibility not only improves efficiency but also significantly enriches the investor experience. By demystifying complex market data, Acuity empowers individuals to manage their investments with confidence.

Here are three major impacts of Acuity Trading on retail investors:

Retail Empowerment

Acuity’s platform offers tools that level the playing field between retail investors and larger institutional participants. Users gain independent control over their investment strategies, fostering a sense of empowerment.

Data Driven Decisions

The focus on data-driven approaches ensures that all investment decisions are backed by robust analytics and real-time market data, enhancing the accuracy and timeliness of trades.

Enhanced Trading

The integration of advanced analytics tools within Acuity’s platform facilitates an improved trading environment where retail investors can execute strategies that were previously only accessible to professionals with sophisticated setups.

Institutional Advantages With Acuity

As institutions seek to optimize their trading strategies, Acuity Trading emerges as a pivotal resource. With its robust suite of specialized tools and access to cutting-edge data, Acuity enables institutions to enhance their trading capabilities substantially. The platform’s strength lies in its integration of advanced analytics, which plays an essential role in improving risk management. By providing deeper insights into market trends and potential risks, institutions can make more informed decisions, steering clear of costly pitfalls.

Acuity’s support for alternative strategies further empowers institutions, allowing them to diversify their investment approaches and explore new market opportunities. This adaptability is vital in today’s volatile financial landscape, where traditional models often fall short. Acuity’s institutional capabilities are designed to handle the complexities of large-scale trading operations, offering both resilience and agility.

Additionally, Acuity’s deployment of specialized tools tailored for institutional needs means that these organizations aren’t just reacting to market changes—they’re anticipating them. Leveraging such tools results in more strategic, data-driven decision-making, placing these institutions at a competitive advantage. This strategic edge is what sets Acuity apart as a leader in the trading sector, transforming institutional trading frameworks with precision and efficiency.

Staying Updated With Acuity

Staying in the loop with Acuity guarantees investors always have access to the most advanced trading tools and analytics. Acuity’s cutting-edge platform leverages AI-driven insights to refine investment decisions, offering a robust foundation for both novice and seasoned traders. The integration of real-time market analysis with historical data trends allows users to anticipate market movements more accurately.

Investors can tailor their trading strategies using Acuity’s inclusive toolset, which includes AnalysisIQ and AssetIQ. These tools provide pre-made market signals and in-depth asset analysis, respectively, empowering users to navigate the complexities of various financial markets with confidence. Retail investors particularly benefit from the user-friendly interface, which simplifies complex data, enhancing their trading efficiency.

Institutional clients find value in Acuity’s support for alternative trading strategies and specialized tools that improve risk management and institutional trading capabilities. By staying engaged with Acuity, all investors make certain they’re at the forefront of market trends and technology advancements. They’re not just keeping pace; they’re setting the pace in a highly competitive field, driven by data and powered by technology.

Frequently Asked Questions

How Does Acuity Trading Handle User Data Privacy and Security?

Acuity Trading prioritizes user data privacy and security through robust privacy policies, stringent security protocols, and advanced data encryption. They enforce user access controls and adhere to compliance standards to protect client information.

Are There Custom Pricing Options for Small Businesses Using Acuity Trading?

Yes, they offer custom pricing options for small businesses seeking cost-effective solutions. Their tailored packages provide competitive pricing and custom options to meet the unique needs of smaller enterprises efficiently.

What Training Resources Are Available for New Acuity Trading Users?

New users find Acuity Trading’s onboarding smooth, with thorough training materials to ease the learning curve. They offer varied support resources and tools for skill development, ensuring everyone’s up to speed quickly.

Can Acuity Trading Tools Integrate With Third-Party Trading Platforms?

Acuity Trading tools can indeed integrate with third-party platforms, offering API integration possibilities and platform partnerships that enhance cross-platform functionality and external software integration, ensuring users benefit from a seamless trading experience.

What Customer Support Options Does Acuity Trading Offer?

They offer live chat, phone support, and 24/7 availability. Email responses are swift, and users can access an online knowledge base or community forums for additional help and peer advice.

Conclusion

Acuity Trading’s advanced AI tools are revolutionizing market analysis by offering profound insights and enhancing trading strategies for both retail and institutional investors. These tools enable users to leverage real-time data and automated intelligence, significantly improving their risk management capabilities. The strategic partnerships with industry leaders like Dow Jones and academic institutions further enrich Acuity’s platform, providing unparalleled access to cutting-edge analytics. As the financial landscape evolves, Acuity Trading stands at the forefront, poised to continue transforming trading methodologies with its innovative approach to AI-driven market analysis, setting a new standard for data-driven investment strategies.

Disclaimer:

All information has been prepared by TraderFactor or partners. The information does not contain a record of TraderFactor or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.