Consider the world of forex trading as a vast ocean teeming with opportunities and risks. As a trader, you’re the captain of your ship and the high-leverage forex brokers are like the powerful sails that can propel you towards your destination. In 2024, these brokers could be your key to navigating the turbulent waters of the Forex ocean and reaching the shores of success. But remember, the right broker can make or break your journey. So, how do you determine which broker to trust? What do the top high-leverage brokers of 2024 have in store for you? MultiBank Group, M4 Markets, TMGM, OneRoyal, FxPro, IronFx, VS Capital, ActivTrades, EightCap, Naga, Exante, RS Prime and Skilling .Hold on to your compass as we embark on this exploration together.

Table of Contents

ToggleTop High Leverage Forex Brokers

If you’re considering trading with high leverage, you must choose a reliable forex broker that offers the necessary support and safety measures. You need a broker that provides versatile platforms, low trading costs, and lightning-fast execution.

Take OneRoyal, for example. They’ve established a reliable reputation with over 20 years in the industry. Their versatile platforms are user-friendly and perfect for day trading and position trading services. Plus, they offer low trading costs, allowing you to maximize your profits. The maximum leverage with OneRoyal Forex Broker is 1:1000.

IronFx is another excellent choice. It offers more than 50 futures contracts, and its platform is feature-rich, designed to support both day trading and position trading services. It also maintains low trading commissions, keeping costs down. The leverage offered here is up to 1:1000.

Last, consider TMGM. They offer leverage up to 1:500, multilayered protection and a low minimum deposit. They also provide comprehensive educational content, helping you stay informed and make smarter trading decisions.

Criteria for Choosing Forex Brokers

Several key criteria should be considered when choosing a forex broker, particularly for high-leverage trading. You should start by comparing brokers and examining their offered leverage and restrictions, fee structures, and the range of trading tools available.

Regulatory compliance is another critical factor. Ensure reputable financial authorities regulate the broker, providing protection and standards for fair trading practices. Not all jurisdictions offer the same level of regulatory oversight, so it’s important to research this aspect thoroughly.

Next, consider the trading tools the broker provides. These can range from advanced charting software to risk management tools and should ideally be customizable to suit your trading style.

Finally, don’t overlook educational resources. Especially if you’re new to forex trading, educational materials like webinars, e-books, and tutorials can be immensely valuable. A broker that invests in educational resources demonstrates a commitment to their client’s success.

In short, choosing a high-leverage forex broker involves careful comparison, understanding leverage restrictions, ensuring regulatory compliance, assessing trading tools, and evaluating educational resources.

Risk Management and Broker Selection

Choosing the right forex broker and effectively managing risk are pivotal steps in your journey towards successful high-leverage trading. Safety measures are crucial in mitigating potential losses. These include:

- Setting stop-loss orders to limit potential losses.

- Regularly monitoring your open positions.

- Only investing money that you can afford to lose.

- Diversifying your portfolio to spread the risk.

Regulatory verification is a must when selecting a broker. Ensure that your broker is registered and regulated by a reputable authority. A thorough trading platform evaluation is also essential. Look for a user-friendly interface, reliable customer support, and a platform that supports your preferred trading strategies.

Understanding leverage risks is critical. Higher leverage can lead to significant profits, but it can also result in substantial losses. Implementing risk management techniques can help mitigate these risks. These include understanding the market, using leverage judiciously, and regularly reviewing your trading strategies. With careful broker selection and effective risk management, you can navigate the high-leverage forex market successfully.

Evaluating Trading Platforms

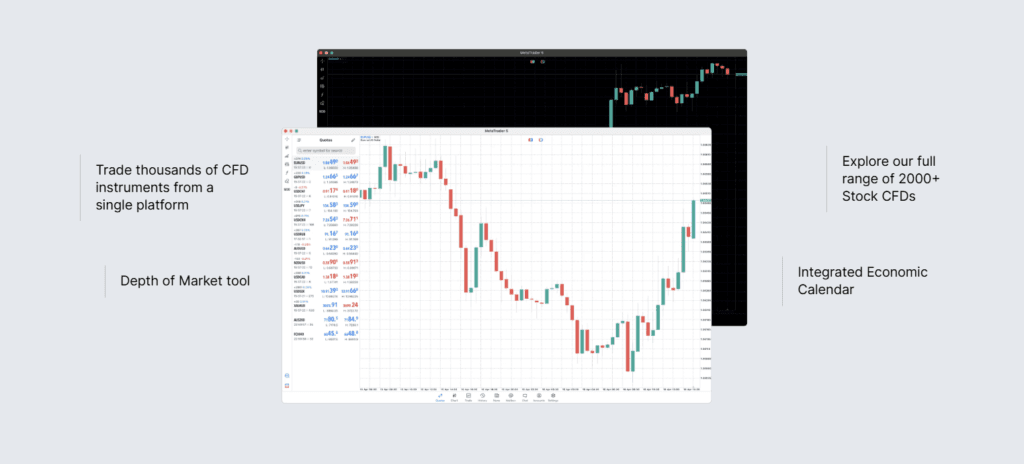

Navigating the landscape of trading platforms is a crucial step in your journey towards successful forex trading. It’s not just about choosing a high-leverage forex broker; it’s also about finding a platform that suits your trading style and needs.

Look out for efficient trading tools. The best platforms provide many tools that aid in analysis and decision-making. These can range from real-time price feeds to advanced charting options, which let you visualize market trends and devise strategies accordingly.

Platform versatility is another crucial factor. A good platform should be compatible with multiple devices and operating systems, allowing you to trade on the go. This flexibility can give you an edge in the fast-paced forex market.

Risk assessment tools are also essential. These can help you gauge your exposure and manage potential losses. Some platforms even offer account customization, allowing you to tailor your trading environment to your preferences.

Risks and Pitfalls of High Leverage

While high leverage can amplify your profits, it can also significantly escalate your losses, exposing you to considerable risks if not managed correctly. If the market moves against you, high leverage can cause steep losses, resulting in a margin call or the liquidation of your position.

To mitigate these risks, you need to understand and apply the following concepts:

- Impact assessment: Evaluate the potential consequences of using high leverage before initiating a trade. This includes understanding the potential losses you could incur.

- Risk mitigation: Implement strategies such as stop-loss orders to limit potential losses. This also involves managing your leverage use and not overextending yourself.

- Account protection: Use features such as negative balance protection, offered by some brokers, to limit the losses you can incur in your trading account.

- Leverage management: Maintain a balance between the potential profits and the risks associated with high leverage.

- Trading psychology: Stay disciplined, control your emotions, and adhere to your trading plan.

Frequently Asked Questions

Explore these trusted and multiregulated forex brokers, each tailored to different trading styles:

OneRoyal stands out with its social trading platform, offering a wealth of educational materials and a demo account for practice. Enjoy up to 1:1000 leverage and a 100% deposit bonus. OneRoyal’s trading toolkit includes CopyTrading with Hoko Cloud, Trading Central, MT4 Accelerator, VPS Hosting, and Trading Calculators. OneRoyal regulated by AFSL-ASIC, CySEC, VFSC, and FSA.

IronFx offers a streamlined platform with effective risk management tools to help control your trading risks. Leverage options go up to 1:1000, complemented by a 100% deposit booster. Tools available for live account holders include TradeCopier, Trading Central, AutoTrade, and VPS Hosting. IronFx is regulated by FCA, CySEC, FSCA, and BMA.

M4 Markets distinguishes itself with excellent customer support and an extensive selection of educational resources. Leverage reaches up to 1:500, with VIP account conditions and cashback on trades. Trading tools include MetaTrader Supreme Edition, StereoTrader, Trading Central, Premium Analytics, and VPS Hosting. Admirals is regulated by FCA, CySEC, AFSL-ASIC, JSC, CIPC, and CMA.

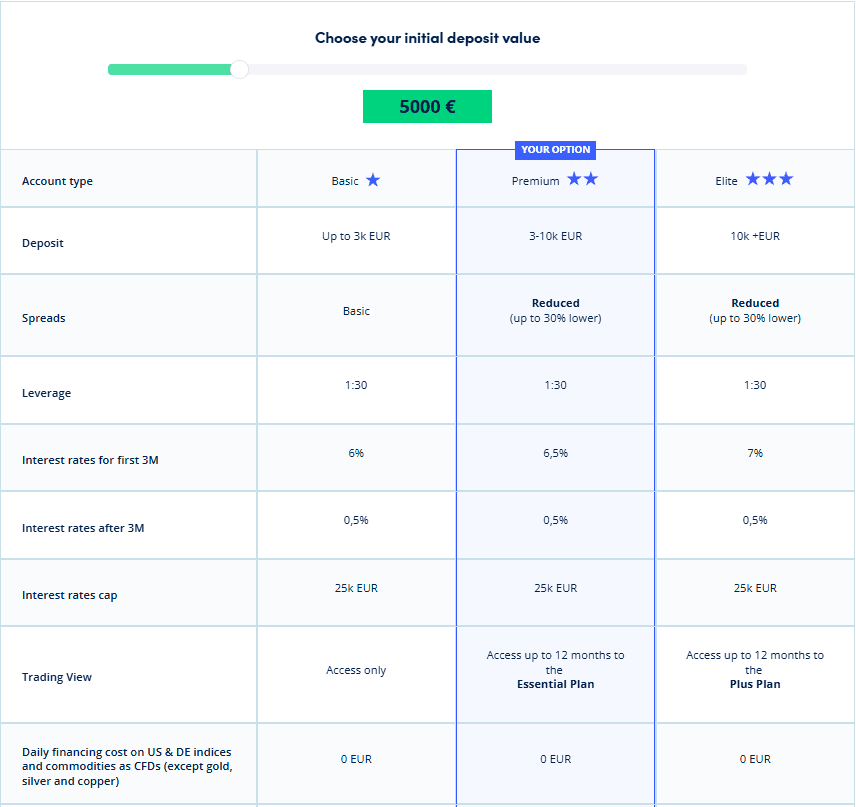

ActivTrades features a user-friendly platform, comprehensive educational resources, and versatile demo accounts for beginners and experienced traders alike. Professional traders can access leverage up to 1:400, while retail traders have a maximum of 1:200. Benefits include cashback and interest on free margin funds. ActivTrades’ platform, ActivTrader, integrates TradingView. ActivTrades regulated by FCA, CSSF, CMVM, SCB, and BACEN.

EightCap rounds off the list with an intuitive trading platform, superior educational content, and dedicated customer support. Leverage can reach 1:500, and traders are eligible for a 10% deposit bonus. Trading tools available include TradingView, Crypto Crusher, Capitalise AI, FlashTrader, Acuity, and VPS Hosting. EightCap is regulated by AFSL-ASIC and SCB.

Each of these forex brokers offers unique features suited to various trading preferences, all underpinned by robust regulatory oversight to ensure a secure trading environment.

What Is the Process for Opening an Account With a High Leverage Forex Broker?

You’d start by selecting a broker and verifying your account by providing the required documents. Next, you’d make your initial deposit, choose your trading instruments, and develop a solid risk management strategy.

Can I Change My Leverage Level After Opening an Account With a Forex Broker?

Yes, you can adjust your leverage level after opening a forex trading account. However, this depends on your broker’s policies, leverage limitations, and risk management strategies for trading flexibility.

What Are Some Strategies for Managing High Leverage Trading in Volatile Market Conditions?

Strong risk management is essential to managing high-leverage trading in volatile markets. Regularly calibrate your leverage, conduct thorough market analysis, employ hedging techniques, and maintain strict trading discipline. It’s challenging, but you’ve got this.

Are There Any Specific Trading Platforms That Are Better Suited for High Leverage Trading?

You’ll want platforms that manage leverage risks and prevent margin calls. Compare brokers’ regulatory constraints. While high leverage has benefits, it’s crucial to choose platforms adept at it.

How Do Interest Rates Impact High-Leverage Forex Trading?

Interest rate fluctuations impact your high-leverage forex trading by affecting currency value shifts. Higher rates can strengthen a currency, while lower rates can weaken it, significantly influencing your trading decisions and potential returns.

Conclusion

So, you’re ready to dive into the thrilling world of high-leverage forex trading. You can make informed decisions with knowledge about top-notch brokers like MultiBank Group, M4 Markets, TMGM, OneRoyal, FxPro, IronFx, VS Capital, ActivTrades, EightCap, Naga, Exante, RS Prime and Skilling and a clear understanding of risk management. Remember, always verify a broker’s regulatory status and carefully evaluate their trading platform. Yes, high-leverage trading is risky, but you can use diligent planning and preparation to turn those risks into rewards. Good luck!

Disclaimer:

All information has been prepared by TraderFactor or partners. The information does not contain a record of TraderFactor or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.