The USD/JPY currency pair has shown remarkable bullish momentum following recent developments in Japan’s economic and monetary policy environment. Traders and analysts are closely watching as the Bank of Japan (BoJ) signals potential normalization of rates, possibly sooner than many expected.

Recent reports from within Japan have stirred speculation on the currency markets, anticipating an end to the long-standing ultra-loose monetary policy of the BoJ. A spate of local Japanese news and preliminary reports of wage negotiations suggest that the central bank could be shifting gears ahead of its April policy meeting.

Table of Contents

ToggleHistorical Context and BoJ’s Decision Implications

The change in direction comes on the heels of decisive “shunto” spring wage negotiations yielding a weighted average 3.7% increase in base pay. These results mark a significant upward turn, even outstripping last year’s notable spike—the sturdiest in thirty years. This development is particularly salient against the backdrop of the radical BoJ Yield Curve Control (YCC) policy, which has influenced market dynamics for years.

With “core core inflation”—discounting food and energy prices—over the BoJ’s 2% target for an extended period, pressure has mounted for a policy shift. Still, stubborn adherence to accommodative measures has been the norm under the pretext of price pressures being external rather than domestic. Governor Kazuo Ueda has repeatedly stressed the importance of ongoing wage trends as a catalyst for domestically generated inflation; a stance reinforced by emerging data and signs of a strengthening cycle between wages and prices.

Technical Analysis for Traders

The USD/JPY currency pair has been the center of attention as it experiences a notable intraday rise, moving between 90 to 130 pips. This movement comes in the wake of the latest financial analyses and market sentiments. Traders and analysts are leaning towards a bullish outlook for the pair, recommending a BUY strategy with specific trading parameters in place. The entry price is set at 149.30, with target and take profit levels identified at 150.75 and 151.10 respectively.

The advice comes with a caution of maintaining a risk management strategy that does not exceed 2% per trade. This recommendation is based on intraday trading within the spot market and is supported by a technical analysis indicating a mixed to bullish Relative Strength Index (RSI). This movement highlights the dynamic nature of the forex markets and underscores the importance of staying informed on currency trends and technical indicators.

USD/JPY Daily Chart

Market Reaction and Forward-Looking Statements

While anticipation builds around the BoJ’s rate decision, the market has other variables in play as well. The assurance from Governor Ueda about considering previous easing options if necessary, alongside remarkable wage growth, paints an optimistic picture for the yen.

Yet the discourse is tempered with caution. The specter of global economic risks remains, alongside domestic consumption patterns that resist definitive optimism. Observers are pointing towards the April BoJ meeting, where updated economic forecasts will potentially include projections for 2026, as critical for further market movements.

BoJ’s Decision Impact on USDJPY

Looming larger over the currency market is the USDJPY’s reaction to BoJ’s policy actions. Investors are seemingly confident of an end to negative interest rates come April, with a probable raise from negative 0.1% to 0.1%. While nominal rates project a mood of tightening, the real interest rate landscape in Japan still suggests a broadly accommodating monetary environment.

Global traders are weighing these developments against the US Federal Reserve’s impending rate decision. The Fed’s policy trajectory, communicated via Wednesday’s announcement and the accompanying dot plot projections, will undoubtedly influence the USDJPY’s direction further.

Continued monitoring of these critical factors—the shifting stance of the BoJ, wage trends, the upcoming Federal Reserve decision, and overarching market sentiment—will be crucial for traders involved with the USD/JPY pair. As this intricate dance of variables unfolds, currency markets remain on the edge, tuned in to any indication of a new rhythm in global finance.

USD/CAD Sees Bullish Momentum Amid Market Uncertainty

Intraday Outlook: Climbing Higher

The USD/CAD pair has shown a positive trajectory in the latest trading session, marking an increase of 35-55 pips. Currently, it exhibits a bullish bias above the pivot point of 1.3525, with traders encouraged to adopt a BUY strategy. The target and take profit levels are set at 1.3580 and 1.3600, respectively, maintaining a risk management strategy of 2% per trade.

USD/CAD Daily Chart

Key Economic Indicators Ahead

The pair has surged to 1.3550 during Tuesday’s European session, breaking free from the previous two-day consolidation range. This uptick comes amid growing uncertainty as investors await crucial economic indicators and central bank guidance. Notably, the Canadian inflation rate for February, which is a significant marker for the next directional move of the Canadian Dollar, is anticipated to show an acceleration, heightening investor focus.

Technical Analysis: Ascending Triangle Pattern

Technically, the USD/CAD is approaching a critical resistance level within an Ascending Triangle pattern on the daily timeframe. This pattern, characterized by its horizontal resistance and upward-sloping support, suggests a potential breakout. The 20-day Exponential Moving Average (EMA) near 1.3520 bolsters the bullish sentiment, while the Relative Strength Index (RSI) indicates a balanced momentum among investors.

Potential Movements

A decisive break above the December 7 high at 1.3620 could pave the way for further gains towards the 1.3655 mark and potentially the 1.3700 resistance level. Conversely, a shift below the February 22 low at 1.3441 might signal a bearish turn, exposing lower supports.

Market Watch

Investors are advised to keep a close eye on upcoming CPI data and Federal Reserve interest rate guidance, as these events could significantly impact the USD/CAD pair’s movement in the short term. With an intraday perspective and spot market focus, the current sentiment leans towards a bullish outlook, underscored by the supportive RSI momentum.

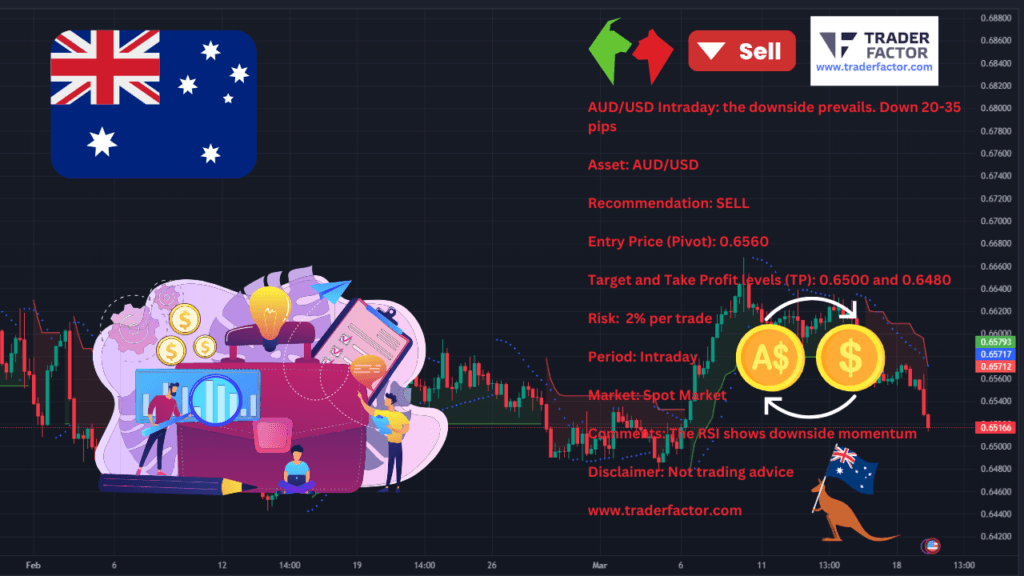

AUD/USD Faces Downward Pressure as RBA Maintains Status Quo

Extended Losses in Early European Trading

The Australian Dollar (AUD/USD) is witnessing a notable downtrend, with prices edging closer to the 0.6500 mark in the early hours of European trading on Tuesday. This decline follows closely on the heels of the Reserve Bank of Australia’s (RBA) recent policy announcement, where it opted to maintain its current interest rate, casting a shadow over the Aussie dollar’s near-term prospects.

AUD/USD Daily Chart

Market Reaction to RBA’s Policy Stance

The market’s response to the RBA’s decision has been largely influenced by Governor Bullock’s less hawkish policy statement, which has contributed to the currency’s downward momentum. Despite positive economic indicators from China, including better-than-expected results in Fixed Asset Investment, Retail Sales, and Industrial Production, the AUD has struggled to capitalize on these developments. Conversely, a slight uptick in China’s Unemployment Rate to 5.3% has added to the bearish sentiment surrounding the Aussie.

RBA’s Cautious Outlook Weighs on AUD

As the RBA gears up for its upcoming meeting, the anticipated cautious stance by the central bank is expected to remain a key focal point for investors. The bank’s forward guidance is predicted to stay unchanged, emphasizing that further rate hikes are still on the table. This conservative approach stands in stark contrast to the aggressive policy adjustments seen among other G10 central banks, placing additional pressure on the AUD.

Future Prospects for AUD/USD

Despite the immediate challenges, there remains a potential for the Aussie dollar to regain momentum later in the year, particularly as discrepancies in monetary policy adjustments between the RBA and the Federal Reserve (Fed) begin to narrow. Should the AUD/USD manage to breach the December 2023 peak of An error occurred during generation. Please try again or contact support if it continues.

Disclaimer

All information has been prepared by TraderFactor or partners. The information does not contain a record of TraderFactor or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.