A prop firm, short for proprietary trading firm, provides you with the capital to trade stocks, bonds, currencies, and derivatives. You’ll use advanced tools and receive mentorship to navigate the markets. Profits you make are shared with the firm, aligning your success with theirs. These firms emphasize strict risk management to safeguard investments and maintain profitability. You’ll need to adhere to set trading limits and employ strategies like stop-loss orders to minimize losses. In such environments, both beginner and experienced traders can thrive, continually honing their trading skills. Exploring further, you might uncover even richer insights into thriving in this dynamic field.

Table of Contents

ToggleDefinition of a Prop Firm

A prop firm, short for proprietary trading firm, provides traders with capital to trade financial markets, sharing the profits generated from these activities. In the financial industry, this definition encapsulates a key player in the landscape of trading. You’re not just trading on your dime but using the firm’s resources, which shifts some of the risk to the firm itself.

Regulation plays an important role in the operation of prop firms. Due to the substantial risks associated with trading large volumes of capital, regulatory bodies keep a tight leash on their activities to prevent systemic risks and protect the interests of both the traders and the firms. The success of these firms often hinges on the effectiveness of their trading strategies. These strategies range from high-frequency trading to long-term positional plays, each requiring a unique set of skills and market understanding.

For you, as a trader, the success factors include not only your ability to navigate the markets but also the firm’s support with technology, access to information, and market insights. The better equipped you are, the more likely you are to profit, which in turn benefits the firm. It’s a symbiotic relationship where your growth and success directly contribute to the firm’s achievements.

History of Proprietary Trading

The history of proprietary trading stretches back to the early days of stock exchanges, where firms began to risk their own. You’d find traders and brokers maneuvering bustling trading floors, leveraging firm capital to maximize gains. This was the inception of a practice that would evolve greatly over the centuries.

As you explore deeper into this history overview, you’ll notice the trading evolution that transformed how these firms operate. Initially, strategies were straightforward, but as markets expanded and technology advanced, these strategies grew more intricate and sophisticated. Firms developed detailed market strategies to capitalize on minute price discrepancies and fluctuations, increasingly relying on quantitative models and algorithms.

Risk management has always been a cornerstone in prop trading. As the stakes got higher, the methods to mitigate risks became more refined. You’d see firms implementing strict risk control measures to safeguard stability and minimize potential downsides.

Moreover, regulatory changes have continually shaped the landscape. Post the financial crisis of 2008, significant reforms were introduced globally to curb the excessive risk-taking that had led to economic turmoil. These changes forced prop firms to adapt, altering their operations to comply with new, stringent regulations, ensuring a more controlled and transparent trading environment.

Key Characteristics of Prop Firms

Prop firms offer you the unique advantage of accessing substantial trading capital, which can greatly amplify your market operations. One of the key characteristics of these firms is their robust support and resources. They provide you with the latest tools and technology, giving you a competitive edge in fast-paced markets.

Training and mentorship are integral parts of the prop firm environment. You’ll receive guidance from experienced traders who can help refine your strategies and improve your trading decisions. This nurturing atmosphere is designed to accelerate your growth and success in trading.

Here’s a quick overview of what prop firms offer:

| Feature | Description |

|---|---|

| Support | Access to advanced trading tools and dedicated support |

| Training | Mentorship and strategy development |

| Risk Management | Strategies to minimize losses and maximize gains |

Risk management is another critical aspect. Prop firms implement strict risk control measures to protect both their capital and your interests. Profit sharing models are also transparent, aligning your success with the firm’s profitability. Essentially, the more successful you are, the more beneficial it is for the firm. This symbiosis motivates both parties to work towards the highest possible outcomes.

Major Global Prop Firms

Major global prop firms, including those based in financial hubs like London and New York, provide substantial, capital and extensive support to traders worldwide. You’ll find that each has its unique edge, but they all aim at one thing: prop firm success.

Prop firm comparisons often highlight differences in strategies, capital allocation, and technology. As you explore the global prop trends, it’s clear that these firms are not just expanding geographically but also diversifying their trading models and markets. This expansion isn’t just about opening new offices; it’s about integrating into new financial cultures and adapting to local market demands.

Moreover, prop firm innovations are at the forefront of this industry. They are continually developing advanced trading tools and algorithms that redefine how trading decisions are made. These innovations also include educational resources that enhance trader skills and knowledge, directly contributing to the overall success of the firms.

In your journey as a trader, understanding these aspects can significantly influence your choice of prop firm. Remember, the right firm should align with your trading style and goals, ensuring that you’re part of a growth-focused environment. Choose wisely, as your success could hinge on this critical decision.

How Prop Firms Operate

Understanding how prop firms function is essential as they utilize their own capital to facilitate trades for their traders, sharing profits while absorbing most of the associated risks. You’ll find that effective risk management is a cornerstone of their operation. Prop firms set specific trading limits and employ strategies to minimize losses, ensuring they can sustain operations even when individual traders face setbacks.

Prop firms heavily invest in technology tools. These include sophisticated trading platforms and analytical software that help you as a trader to make informed decisions quickly. This technology edge is vital for maintaining competitiveness in the fast-paced trading environment.

Profit allocation is another critical aspect. Generally, you’ll receive a percentage of the profits you generate. This model motivates you to perform well since your earnings are directly tied to your trading success.

Moreover, support systems in prop firms are robust. From mentorship programs led by experienced traders to continuous educational resources, you’re well-supported. These firms make sure you have access to the knowledge and strategies necessary to succeed. This extensive backing not only enhances your trading skills but also aligns your goals with the firm’s objectives, creating a mutual drive towards profitability.

Types of Financial Instruments Traded

At prop trading firms, you’ll find a diverse array of financial instruments being traded, including stocks, bonds, currencies, and derivatives. Each type of instrument offers unique opportunities and challenges, and the strategies employed can vary greatly. You’ll see day trading, swing trading, and arbitrage strategies in action, all tailored to exploit short-term market inefficiencies.

Traders at these firms often use sophisticated market analysis tools to predict price movements and inform their trades. This analysis is critical in managing the risks associated with highly leveraged positions. Prop firms prioritize risk management to safeguard their capital while aiming to maximize returns. Techniques like stop-loss orders, position sizing, and diversification are common.

Additionally, profit sharing models at prop firms motivate traders by aligning their interests with the firm’s success. Typically, you’ll retain a portion of the profits from the trades you make. This model not only incentivizes you to perform well but also fosters a culture of shared success. Understanding these dynamics can help you leverage the resources of a prop firm to potentially build a lucrative trading career.

Capital Allocation in Prop Firms

Building on the types of financial instruments traded, let’s explore how prop firms allocate capital to maximize these trading opportunities. You’ll find that prop firms employ sophisticated capital allocation strategies that balance the potential for high returns with the risks involved. Effective risk management techniques are vital here, ensuring that traders don’t expose the firm to undue financial harm.

A key component is the profit sharing agreements that dictate how profits are split between you and the firm. Typically, these agreements are designed to motivate you by offering a higher share of the profits as your trading performance improves. This setup not only boosts your potential earnings but also aligns your goals with those of the firm.

Moreover, prop firms heavily invest in technology utilization. This means you’ll have access to advanced trading software and tools that can greatly enhance your ability to analyze and respond to market conditions effectively. Coupled with robust mentorship programs, you’re provided with guidance and insights from experienced traders, which can be invaluable in sharpening your trading strategies.

Training Programs Offered

Prop firms offer extensive training programs that equip you with the skills needed to succeed in high-stakes trading environments. These programs focus on key areas essential to professional trading, ensuring you’re well-prepared to handle the pressures and opportunities of the market.

You’ll dive deep into trading strategies, learning both fundamental and technical analysis to make informed decisions. Market analysis forms a core part of your training, helping you understand global economic indicators and their impacts on various asset classes. This knowledge is critical in predicting market movements and planning trades accordingly.

Risk management is another vital component. You’ll learn to set stop-loss orders and size your positions appropriately to manage exposure and protect your capital. Understanding trading psychology is also covered, helping you deal with emotional decision-making and maintain discipline in your trading.

Mentorship and Support Structures

After mastering trading strategies and risk management, you’ll find that effective mentorship and support structures greatly enhance your ability to succeed in the dynamic world of prop trading. Engaging with experienced mentors who understand the intricacies of market analysis can provide you with insights that are not readily apparent from charts and data alone. These seasoned traders can guide you through the complexities of trading psychology, helping you manage the emotional aspects of trading that are essential for long-term success.

Your mentors will also play a key role in refining your trading strategies, making sure they align with current market conditions and your personal risk tolerance. This personalized guidance helps maximize your profit potential by adapting strategies to better exploit market opportunities. Additionally, robust support structures within a prop firm ensure that you have access to collective knowledge and experience, enhancing your ability to make informed trading decisions.

Technology and Tools Used

Utilizing advanced technology and tools is vital for enhancing your trading performance at a prop firm. By leveraging top-tier trading technology, you’re not just keeping up; you’re staying ahead. Proprietary tools developed by these firms are tailored to give you a unique market edge that generic platforms can’t provide. They’re designed with precision and depth, focusing on data analysis and real-time market changes, ensuring you make informed decisions quickly.

You’ll find that the trading software available to you is robust and intuitive. It’s crafted to support a myriad of trading strategies, allowing you to pivot between tactics as market conditions change. This software often includes features like automated trading options, advanced charting tools, and algorithmic trading capabilities, which are essential for executing complex trades efficiently.

Risk Management Strategies

While advanced technology equips you with necessary tools, effective risk management strategies guarantee you handle market uncertainties adeptly. Risk mitigation is essential; it involves setting stop-loss orders and diversifying your portfolio to spread risk. It’s not just about limiting potential losses but also about enhancing your ability to sustainably generate profits.

Trade analysis is another critical aspect. You’ve got to consistently review and adjust your strategies based on market performance and your own trading results. This continuous loop of analysis helps you refine your approaches and avoid repetitive mistakes.

Leverage control is vital too. While leverage can magnify your profits, it also increases your risk exposure. You should use leverage cautiously, understanding the full implications of the borrowed capital you’re trading with.

Volatility management can’t be overlooked. Markets can swing wildly, and you need strategies that adapt to both high and low volatility. Tools like volatility indexes can guide you in adjusting your trading tactics in real time.

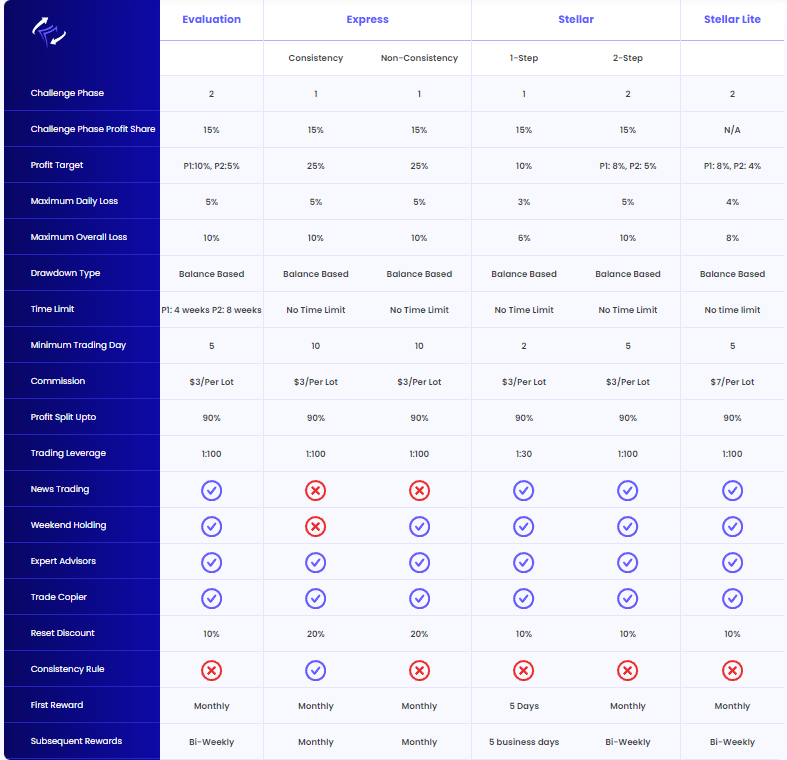

Understanding Profit Sharing Models

Profit sharing models in proprietary trading firms determine how you and the firm split the profits earned from your trades. These financial models are vital as they impact your compensation and the firm’s revenue. You’ll find that most prop firms offer a variety of profit distribution schemes, which are typically tied to your performance metrics.

Here’s a breakdown of common profit sharing structures:

| Type of Model | Features |

|---|---|

| Fixed Percentage | You receive a set percentage of the profits. |

| Sliding Scale | Your percentage increases with higher profit levels. |

| High Water Mark | You must exceed previous profit peaks to earn bonuses. |

| Profit Threshold | You earn profits only after surpassing a predefined earnings threshold. |

| Hybrid Models | Combination of various features tailored to specific trading partnerships. |

These models reflect the prop firm’s compensation structures, designed to motivate you while managing financial risks. Each model has its intricacies, aligning closely with the firm’s strategic goals and the support it provides to traders. As you dive deeper into trading partnerships, you’ll discover which setup syncs best with your trading style and goals. This alignment is pivotal in fostering a successful, mutually beneficial relationship between you and the firm.

Benefits of Trading With a Prop Firm

Understanding how profit sharing models work in proprietary trading firms sets the will stage for appreciating the broader benefits of trading with a prop firm. When you’re with a prop firm, you’re not just gaining a position; you’re accessing a suite of resources tailored to foster trader success.

Firstly, the risk management systems in place at these firms are exceptional. They’re designed to protect both you and the firm by minimizing losses and optimizing trading strategies. Speaking of strategies, the opportunity to learn and apply advanced trading strategies is a significant edge. You’re not only executing trades but also mastering techniques that can amplify your trading efficiency and effectiveness.

Moreover, capital access is a game-changer. Prop firms provide you with the capital necessary to make substantial trades without requiring you to tie up your personal funds. This can dramatically increase your potential for high returns.

Additionally, you gain a market edge through the latest technology and analytics tools provided by the firm, which can be cost-prohibitive to acquire on your own. All these factors contribute to a structured environment where you can thrive, making trading with a prop firm a compelling choice for serious traders looking to elevate their trading career.

Common Risks and Challenges

Trading with a prop firm presents several risks and challenges that you should be aware of before committing. The first step in maneuvering these waters is a thorough risk assessment. You’ll need to understand the specific conditions of engagement, including the high stakes of profit sharing and potential for significant financial loss. Unlike traditional trading, where your losses might be limited to your own capital, trading with a prop firm can expose you to larger liabilities.

A critical part of your preparation should involve challenge analysis. This means carefully examining what could go wrong and planning how to handle such scenarios. For instance, consider what happens if your trading strategy fails consistently. Are there safety precautions or stop-loss measures in place to protect you from devastating losses?

Additionally, you must be aware of common prop firm pitfalls. These can include lack of trader protection regarding legal rights and financial security. Many traders overlook the importance of these protections, assuming the firm’s infrastructure will cover all bases.

Ultimately, while prop firms offer significant opportunities, they also require you to be vigilant and proactive about your safety and security. Always make sure you’re well-informed and prepared for any challenges that might arise.

Criteria for Choosing the Right Prop Firm

Now that you’re aware of the potential risks, let’s focus on how to select the best prop firm that aligns with your trading goals and needs. Choosing the right prop firm is important, not only to maximize your trading benefits but also to guarantee effective risk management. Here’s what you should consider in your selection process:

- Risk Management Protocols: Look for firms with strong risk management frameworks. Effective risk controls protect both the trader and the firm’s capital.

- Capital Allocation: Evaluate how the prop firm allocates capital to its traders. More capital might mean more trading opportunities and profits.

- Training and Support: Check if the prop firm offers thorough training and ongoing support to help you develop as a trader.

- Profit Sharing Terms: Understand the profit sharing structure. Make sure it’s fair and provides you with a significant share of the trading profits.

Application and Acceptance Process

To apply to a prop firm, you’ll typically need to submit a detailed trading resume and pass a rigorous assessment of your trading skills and strategy. This step is important as it forms the backbone of the prop firm evaluation process. They’re not just looking at your past profits; they scrutinize your approach to risk management, your adaptability to market changes, and your potential for future growth.

Once your application is in, the trader selection phase kicks in. Here, the firm assesses whether your trading style aligns with its strategies and goals. They look for traders who can balance risk with the potential for high returns, a key element in the overall risk assessment. If you make the cut, you’ll enter into a profit sharing arrangement. This means you’ll earn a percentage of the profits, but remember, the firm also shares in any losses.

Lastly, technology integration is essential in today’s trading environment. The prop firm will expect you to seamlessly adapt to their platforms and tools. This integration aids in efficient trading and is crucial for maintaining the edge in a highly competitive market.

Typical Trader Profile and Expectations

Typically, prop firms look for traders who demonstrate a consistent ability to manage risk and generate profits. As you consider joining a prop firm, understanding what’s expected of you is essential. You’re not just trading with your skills but also with the firm’s capital, so the stakes are high.

Here’s what you need to know:

- Trader Expectations: You’re expected to consistently apply proven trading strategies and achieve profitability while adhering to the firm’s trading guidelines.

- Success Factors: Your ability to analyze market trends, adapt to volatile conditions, and maintain discipline in your trading approach are key to your success.

- Risk Management: Effective risk management practices are crucial. You must be adept at setting stop-loss orders and managing the size of your trades to minimize losses.

- Growth Opportunities: Prop firms often provide growth opportunities through mentorship programs and advanced trading tools, helping you to refine your strategies and expand your trading capabilities.

Joining a prop firm means committing to a career where continuous learning, skill enhancement, and strict compliance with risk management protocols are part of your daily routine. Embrace the challenge, and you could see significant professional growth and financial rewards.

Daily Life of a Prop Firm Trader

As a prop firm trader, your day begins early with market analysis and strategy planning. You’re at your desk reviewing global financial news, charts, and data to update your trading strategies. This isn’t just about catching trends. It’s about understanding how new information might affect your positions and the profit potential of new opportunities.

Your trading strategies are dynamic. Throughout the day, you adjust them based on market analysis, balancing the pursuit of profit with the imperatives of risk management. You’re not just working with algorithms; you’re immersed in a constant flow of decision-making that tests your trading psychology. The stress can be high, but so can the rewards.

Risk management is your constant companion. You set stop-loss orders, monitor trading volumes, and adjust leverage to make sure you’re not exposed to unnecessary risks. It’s a fine line to walk, balancing the aggressive pursuit of profits with the need to protect your capital.

Trading psychology plays an important role in your daily life. You’ve got to maintain discipline, control your emotions, and stay focused under pressure. Each decision reflects a blend of analysis, intuition, and experience. As markets close, you review your day’s trades, ready to refine your approach for tomorrow.

Frequently Asked Questions

How Do Prop Firms Handle Trader Mental Health and Stress?

Prop firms offer mental resilience training, stress management workshops, and psychological support services. You’ll benefit from mindfulness meditation and learn emotional regulation techniques to handle trading stress effectively.

What Happens if a Prop Firm Goes Bankrupt?

If a prop firm goes bankrupt, you’ll face unemployment and legal repercussions. The asset liquidation process prioritizes creditors’ claims, potentially affecting client assets protection. Always understand the implications of such an event.

Are There Specific Tax Implications for Traders at Prop Firms?

Yes, as a trader at a prop firm, you’ll face distinctive tax implications including income reporting, withholding requirements, deduction eligibility, and potential audit risks. It’s essential to strategize effectively to navigate these challenges.

Can Prop Firm Traders Participate in Other Investment Opportunities?

You can participate in other investments, but check your prop firm’s diversification limits, compliance regulations, and portfolio restrictions to avoid conflicts of interest with personal investments.

How Do Global Economic Events Impact Prop Firm Strategies?

Global economic events can cause market volatility, prompting you to adjust strategies, reassess risks, and analyze liquidity. Effective economic forecasting is essential to navigate these changes and optimize your trading approach.

Disclaimer:

All information has been prepared by TraderFactor or partners. The information does not contain a record of TraderFactor or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.