A prop firm challenge is a competition where you trade with simulated capital under specific guidelines. You’ll need to demonstrate your trading skills, risk management, and ability to make profits under pressure. The main goal is to meet or exceed the challenge’s targets to potentially earn the opportunity to trade with the firm’s real money. It’s a great chance to showcase your expertise and earn access to greater capital, within a set framework that includes drawdown limits and other risk mitigation rules. You’ll also need to manage time effectively, as most challenges come with a time limit. Exploring further could reveal deeper insights into successful strategies.

Table of Contents

ToggleProp Trading Fundamentals

Prop trading allows you to leverage a firm’s capital, magnifying your potential profits and enabling effective portfolio diversification. When you’re evaluated for prop trading, firms meticulously assess your ability to manage risks and gauge your profit potential. They’re looking for traders who not only aim for high returns but also demonstrate consistency and discipline within defined trading parameters.

During the trader selection process, your performance is scrutinized under various market conditions to make sure you can maintain composure and profitability. This evaluation isn’t just about spotting wining trades; it’s about how well you adhere to risk management principles. The firm sets specific trading parameters that could include maximum drawdown limits and target profits, aligning with broader strategic objectives. You’re expected to operate within these guidelines to prove you’re a valuable asset to the firm.

Understanding these elements is important because they dictate the sustainability of your trading career with the firm. You’ll need to continuously balance between pushing for profits and managing potential losses. Excelling in a prop trading setup means mastering the art of strategic trading—where every decision you make is measured against the backdrop of risk and reward.

Impact of Time on Performance

While mastering strategic trading is important, you’ll also find that the constraints of time can greatly influence your performance in prop trading. Time constraints often force you to make decisions more quickly than you might in less pressured circumstances. This impact of time on your trading strategies can be significant, pushing you to alter your approach, sometimes at the expense of importance.

The pressure effects from looming deadlines can skew trading outcomes. It’s not just about making decisions quickly, but also about how these time limits can lead to stress, potentially clouding your judgment. You’ll notice that under time constraints, your performance analysis might rush, leading to overlooked details that are important for successful trades.

Effective time management becomes critical in these situations. It allows for better risk assessment, ensuring that you’re not just reacting to market conditions, but actively managing potential downsides. Remember, your performance evaluation isn’t just about profits, but also about how well you adhere to risk management practices within the set time limits. Managing these aspects well under pressure is what can set you apart in the competitive world of prop trading.

Challenges of Prop Firm Time Limits

Time limits in prop firm challenges often impose significant stress on traders, forcing quick decisions that may compromise risk management. You’re pushed into making snap judgments under severe time pressure, which isn’t just about beating the clock but also about outperforming others who are equally desperate to succeed. It’s a high-stakes game where stress management becomes as vital as your trading strategy.

Under these constraints, your decision-making under pressure can lead to rushed trades where risk neglect becomes a real issue. You might find yourself ignoring some of the basic rules of risk management simply because the ticking clock doesn’t allow the luxury of thorough analysis. This urgency can trigger emotional reactions that cloud your thinking, leading you to make choices that you might not consider under normal conditions.

Prop Firm Challenges With No Time Limit

Challenges offered by some proprietary trading firms come without a time limit, allowing you to demonstrate profitability at your own pace. This setup places a stronger emphasis on effective time management, as you’re not pressured by a ticking clock. You can dive deeper into the market’s dynamics without the stress of imminent deadlines, honing your ability to spot trends and make decisions that are more informed.

With no time constraints, you’ve got unlimited potential to scale your profits. You’re free to wait for the most opportune moments to trade, which is essential for profit maximization. This approach allows you to grow your capital steadily, focusing on long-term gains rather than quick wins.

Moreover, this type of challenge enhances your ability to practice risk mitigation. Without the pressure to meet short-term targets, you can develop a more robust trading strategy that stands the test of time. Strategic planning becomes a cornerstone of your trading process, enabling you to design and follow a plan that maximizes returns while controlling potential losses.

Strategies and Considerations in Prop Trading

Building on the freedom afforded by no time limits, it’s essential you select a prop trading firm that aligns with your strategy and goals. You’ve got to dive deep into understanding what each firm offers and how it matches your trading style. Remember, your success in prop trading hinges on making informed decisions based on thorough research and consistent strategy application.

Here are some key strategies and considerations:

- Risk assessment: Always evaluate the risks associated with your trades. Understand the firm’s risk tolerance and make sure your trading plan respects these limits.

- Profit potential: Set realistic profit targets. Analyze past performance but stay adaptable to market changes to maximize your earnings.

- Market analysis: Stay updated with global economic indicators and market trends. Your ability to interpret market conditions accurately can define your trading success.

- Trading strategies: Develop and refine trading strategies that capitalize on your strengths and the unique offerings of the prop firm.

- Performance evaluation: Regularly review your trading results. Identify what’s working and what isn’t, and adjust your strategies accordingly to improve your performance.

Aligning these elements with a prop firm’s structure and your personal trading goals can greatly increase your chances of success.

Prop Firm Challenges Overview

Proprietary trading firms use challenges to assess your ability to manage risk and generate consistent profits within predefined parameters. These challenges are fundamentally about performance assessment, where you’re tested on how well you can adhere to the firm’s strict trading rules and targets. It’s not just about how much money you can make—profit potential is significant, but so is your ability to limit losses and manage risk effectively.

The evaluation criteria can be stringent. You’ll need to demonstrate market analysis skills, showing that you understand the dynamics that drive price movements. Risk evaluation is equally critical; you need to prove that you can protect capital under various market conditions. This involves setting stop-losses correctly, adjusting positions, and maybe most importantly, knowing when to stay out of the market.

Specific Prop Firm Challenge Programs

Several proprietary trading firms offer unique challenge programs tailored to assess and enhance your trading skills. These programs are designed to put you through a specific evaluation process where your ability to generate profits under controlled conditions is tested. Here’s a closer look at what you’ll typically encounter:

- Specific Evaluation: Each firm has a unique set of criteria and performance metrics that you must meet to progress.

- Profit Split: Once you’re successful, the profit split arrangement kicks in, allowing you to earn a significant portion of the profits generated.

- Funded Accounts: Passing the challenge grants you access to a funded account, where you can trade with the firm’s capital.

- Community Support: Most firms boast active communities and forums where traders share strategies and support each other.

- Fee Structures: Entry fees for these challenges vary, often depending on the level of funding and resources provided.

Conditions in Prop Firm Challenges

After exploring the specific programs offered by proprietary trading firms, let’s now look at the conditions that govern these prop firm challenges. You’ll find that these conditions are primarily designed with risk mitigation, trading psychology, performance evaluation, market analysis, and trader support in mind.

First, risk mitigation is critical. You’re expected to follow strict drawdown limits and adhere to daily loss rules. This approach helps manage potential financial exposure, both for you and the firm. Market analysis is another pillar; you must demonstrate your ability to dissect market conditions and make informed decisions based on real-time data. This skill is continuously assessed to make sure you’re adapting to market volatility and opportunities.

Performance evaluation in these challenges isn’t just about your profit margins; it’s also how you align your trading strategy with the firm’s expectations and manage risks. Regular feedback sessions provide insights into your trading habits and help refine your strategies.

Furthermore, trading psychology plays a significant role. The support provided by the firm aims to foster a mindset conducive to disciplined and strategic trading. Access to experienced traders and psychological coaching can assist you in navigating the emotional rollercoaster of trading.

Choosing the Right Prop Firm Challenge

Selecting the correct prop firm challenge involves evaluating your trading style and goals against what each firm offers. It’s not just about jumping into any challenge that comes your way; it’s about finding the right fit that can greatly enhance your trading career. Here’s how you can make a well-informed decision:

- Researching challenges: Start by gathering as much information as possible about different prop firm challenges. Look at what past participants say and how these challenges have evolved.

- Evaluation process: Understand how each firm evaluates its candidates. What metrics are they looking at? This will help you align your trading strategy with their criteria.

- Fee structures: Be clear about upfront costs and any other associated fees. Some challenges may seem cheaper but have hidden costs.

- Trading types: Make sure the challenge allows the trading style you are comfortable with, whether it’s scalping, swing trading, or something else.

- Compatibility with firms: Finally, assess how well your trading philosophy matches the firm’s culture and goals. You’ll perform better in an environment that resonates with your own trading beliefs.

Support in Prop Firm Challenges

Participating in prop firm challenges offers you significant benefits and support, enhancing both your trading skills and financial opportunities. You’ll gain access to increased capital, allowing you to take on larger positions than you could with your funds alone. This boosts your potential for profitability, but it also introduces new challenges.

Support from the prop firm is essential here. You’re not just given funds; you’re provided with a framework to succeed. This includes thorough mentorship and learning resources. Experienced traders guide you, offering insights that refine your risk management strategies and trading techniques, vital for long-term success.

Moreover, these challenges immerse you in a community of like-minded individuals. Here, learning is a collective journey. Discussions and shared experiences with other participants can help you understand diverse trading approaches and market perspectives. This community support system fosters a rich environment where continuous learning is encouraged.

Benefits of Participating in a Challenge

You’ll find that engaging in a prop firm challenge greatly enhances your trading skills through real-world market exposure and strategic development. These challenges aren’t just about testing your ability to hit profit targets; they’re about deeply understanding the market, refining your strategies, and learning to manage risks effectively under real conditions.

Here are some key benefits you’ll experience:

- Improving skills: Sharpen your trading techniques and decision-making processes in a controlled yet competitive environment.

- Risk analysis: Develop a keen sense for risk management, learning to analyze and mitigate potential losses effectively.

- Profit potential: While the main goal is educational, you also have the chance to realize significant profits through smart trading decisions.

- Mentor guidance: Receive invaluable insights and feedback from experienced traders who can guide you through complex market scenarios.

- Real world experience: Simulate actual trading conditions which prepare you better for live market challenges, enhancing both your confidence and competence.

Access to Greater Funds

Accessing greater funds through a prop firm challenge empowers you to take larger market positions, potentially leading to higher profits. With more substantial fund allocation, you’re not just trading with your own limited capital anymore. Instead, you’re leveraging a prop firm’s resources, which amplifies your profit potential significantly. This opportunity to manage more considerable amounts allows you to practice and refine your trade evaluation skills actively. You’ll learn to analyze market conditions more effectively and make decisions that align with both your and the firm’s objectives.

Moreover, access to greater funds aids in robust risk mitigation strategies. You’re able to spread risks across a varied range of instruments, helping you protect your capital. This is where the importance of portfolio diversification comes into play. Diversifying your trades across different markets and assets can reduce the risk of significant losses and enhance the stability of your returns.

Opportunities for Increased Earnings

As you delve into a prop firm’s resources for greater funds, your potential to earn substantially more also increases. With access to significant capital, you can take positions that were previously out of reach, opening up a range of new trading opportunities. This enhanced capability isn’t just about bigger trades; it’s about smarter, more strategic market engagement.

Here’s how you can capitalize on these opportunities:

- Performance metrics: Track and analyze your trading performance rigorously. Improved metrics can lead to higher capital allocation.

- Market analysis: Explore thoroughly market trends and data. Superior analysis aids in making informed, profitable decisions.

- Risk mitigation: Implement strategies to minimize losses, preserving your capital and earnings potential.

- Diversified strategies: Use the additional funds to diversify your trading strategies, spreading risk and increasing potential gain.

- Profit-sharing models: Understand the firm’s profit-sharing structure. Higher earnings come from not only increased capital but also from favorable profit splits.

Gaining Insights From Expert Traders

Engaging with expert traders offers invaluable insights that can greatly enhance your trading skills and strategic approach. Through mentorship support, you’ll gain practical trading insights that aren’t just theoretical but tried and tested in live markets. These experts provide guidance that’s rooted in years of experience, helping you navigate complex market dynamics more confidently.

Expert guidance isn’t just about giving you tips; it’s about transforming your approach to trading. By observing and interacting with seasoned traders, you’ll learn not only strategies but also the discipline and psychological resilience required for trading. This form of community learning is essential because it immerses you in a culture of continuous skill development and shared knowledge.

Moreover, as you receive mentorship, you’ll find that your learning curve accelerates. Instead of struggling through trial and error, you’re guided through structured learning paths that enhance your skills systematically. This support helps you avoid common pitfalls and leverages collective wisdom to boost your trading performance.

Practical Exposure and Tips for Success

Building on the foundation of expert guidance, practical exposure is key to translating theoretical knowledge into real-world trading success. You’ll find that hands-on experience in a live market environment not only sharpens your skills but also builds your confidence as a trader. It’s in these real conditions that you really learn to apply strategic planning and market analysis while developing resilience against the stresses of trading.

Here are some practical tips to help you succeed in a prop firm challenge:

- Start small: Gain confidence with smaller trades before scaling up.

- Embrace market analysis: Spend time each day analyzing market trends and potential impacts on your trades.

- Develop a trading mindset: Focus on cultivating patience and discipline to stick to your trading plans.

- Practice risk mitigation: Always consider the worst-case scenario and have exit strategies in place.

- Learn from each trade: Whether a win or a loss, take insights from every trade to refine your strategy.

Risk Management Strategies

Effective risk management strategies are essential for maintaining your trading account’s health and ensuring long-term success in prop firm challenges. You’ve got to start with a solid risk evaluation. This means understanding your risk liability, which can make or break your trading career. Evaluating each trade’s potential risks and rewards helps you maintain an edge and avoid unexpected downturns.

Your position sizing is critical. It isn’t just about the profit potential; it’s about how much you’re willing to risk on each trade. You’ve got to tailor your position sizes based on the volatility of the market and your current account balance, ensuring you’re never overexposed.

Here’s a straightforward guide to help you manage your risks effectively:

| Strategy | Description |

|---|---|

| Risk Evaluation | Evaluate the potential risks and rewards of each trade. |

| Profit Potential | Target trades that offer a higher potential return relative to the risk. |

| Position Sizing | Adjust your position size based on your account balance and market conditions. |

| Risk Liability | Determine how much of your total capital you’re willing to risk. |

| Profit Targets | Set clear profit targets to secure gains and prevent greed. |

Stick to these strategies to keep your trading in check and aim for consistent growth.

Practical Trading Plan

A practical trading plan sets the stage for disciplined trading by clearly defining your risk management rules and trading strategies. When you’re participating in a prop firm challenge, it’s essential to have a plan that not only outlines how you’ll approach the markets but also how you’ll handle the psychological pressures of trading. Here’s how you can align your trading plan with your profit potential while considering market analysis and risk assessment:

- Developing Strategies: You’ll need to create adaptive strategies that respond to changing market conditions. This guarantees you’re always positioned to capitalize on opportunities.

- Risk Assessment: Clearly define how much you’re willing to risk per trade. It’s all about safeguarding your downside while setting yourself up for sustainable success.

- Trading Psychology: Maintain discipline by adhering to your trading plan. Don’t let emotions drive your trading decisions; stick to your pre-defined strategies and risk parameters.

- Market Analysis: Regularly analyze market trends and economic indicators. Use this analysis to refine your strategies and align them with current market conditions.

- Profit Potential: Set realistic profit targets within your trading plan. This helps you stay focused on achieving measurable goals without taking unnecessary risks.

Setting Limits

After establishing a practical trading plan, it’s important to set personal trading limits to manage risks efficiently. Setting boundaries is critical in prop trading, not just for safeguarding capital but also for nurturing trade discipline. You’ll want to start by conducting a thorough risk assessment to understand how much you’re comfortable losing per trade. It isn’t just about numbers; it’s about ensuring these limits resonate with your trading style and long-term goals.

Next, define your profit targets. These should be realistic and aligned with the market’s volatility and your risk tolerance. Remember, greed can cloud judgment, leading to risky decisions. By setting clear profit targets, you’re more likely to stick to your plan and avoid emotional trading.

Emotional control is another crucial aspect of setting limits. The market can be unpredictable, stirring a range of emotions from excitement to fear. By establishing firm trading limits, you’re essentially putting a safety net around your emotional wellbeing. This discipline ensures you don’t make impulsive decisions based on fleeting emotions or market noise.

In essence, setting limits isn’t just a safety protocol; it’s a strategic approach to consistent and disciplined trading. Stick to your defined boundaries and adjust them as necessary based on market conditions and your trading performance.

Drawdown Management

Managing your drawdown is vital as it helps you keep losses within acceptable limits and protects your trading capital. As you commence on your journey with a prop firm challenge, understanding and implementing effective drawdown management techniques becomes essential. This not only preserves your capital but also enhances your ability to make calculated decisions under pressure, maximizing your profit potential.

Here are some strategies to effectively manage your drawdown:

- Risk assessment: Regularly analyze the risk associated with each trade. Adjust your strategies based on market conditions and your trading performance.

- Portfolio diversification: Don’t put all your eggs in one basket. Spread your investments across different assets to mitigate risks and stabilize your returns.

- Profit potential: Focus on trades that offer a higher probability of substantial gains. This helps in balancing out any potential losses incurred.

- Decision making skills: Improve your decision-making by staying informed and planning your trades meticulously. This minimizes rash decisions driven by market noise or emotional responses.

- Emotional responses: Keep your emotions in check. Don’t let fear or greed dictate your trading actions. Staying objective and composed is key to managing drawdowns effectively.

Loss Management Techniques

Building on effective drawdown management, let’s explore how you can further protect your capital by mastering loss management techniques. Loss mitigation is pivotal, and one of the key elements is implementing robust risk control measures. By focusing on trade management and capital preservation, you’ll guarantee your trading strategy remains sustainable.

Firstly, always set stop loss strategies for each trade. This not only limits potential losses but also helps in maintaining a healthy balance between risk and reward. You’ve got to be proactive about cutting losses to prevent them from spiraling.

Here’s a handy table outlining some essential techniques and their impact:

| Technique | Impact |

|---|---|

| Stop Loss Orders | Caps losses, preserves capital |

| Risk-to-Reward Ratios | Ensures potential gains outweigh risks |

| Daily Loss Limits | Prevents excessive daily losses |

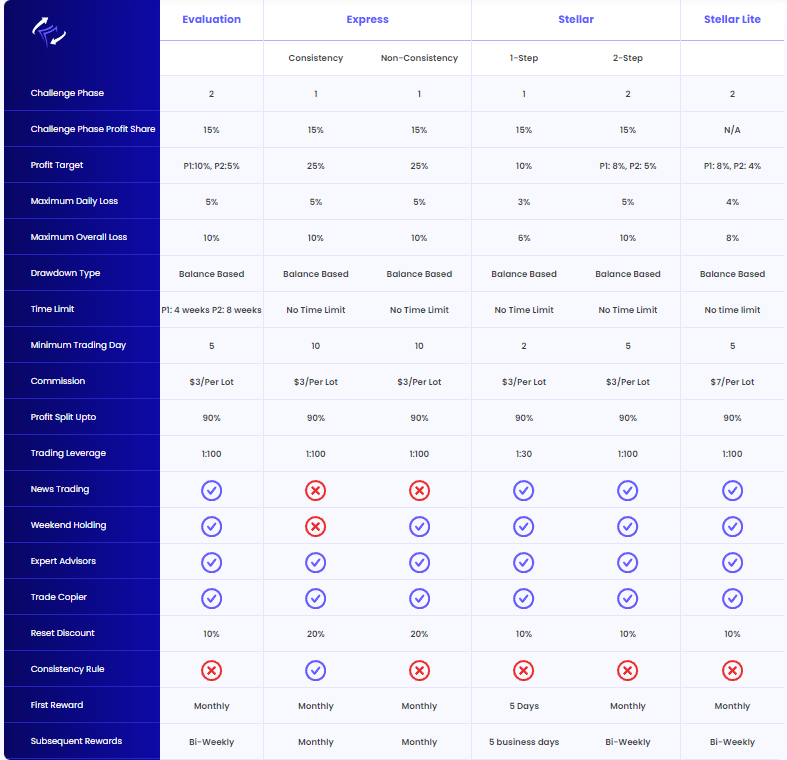

🔥 FundedNext’s Unique Challenge Models for Traders

Challenge Type-1: Evaluation Challenge Insights

🔴 The Evaluation Challenge is a 30-day skill assessment designed to identify talented traders. Those who succeed gain access to funded accounts and profit-sharing opportunities.

👉 Two-Phase Evaluation: Demonstrate consistency and profitability through a structured process.

👉 Flexible Targets: Reach achievable profit goals tailored to your trading style.

Challenge Type-2: Express Challenge Breakdown

🔴 The Express Challenge caters to seasoned traders looking for a fast-track route with a shorter evaluation period, enabling quicker access to funded trading accounts.

👉 Single Phase Evaluation: Undergo a swift assessment of your trading prowess.

👉 Quick Funding: Secure funding at a much faster pace.

Challenge Type-3: Stellar Challenge Options

🔴 The Stellar Challenge targets elite traders by offering higher funding levels and exclusive profit-sharing models.

👉 Higher Profit Targets: Set your sights on substantial gains.

👉 Increased Leverage: Amplify your trading power with greater leverage options.

Frequently Asked Questions

Can Traders Use Automated Systems in Prop Firm Challenges?

You can use automated systems in prop firm challenges if they align with the firm’s rules on algorithm compatibility, strategy testing, system monitoring, risk management, and execution speed. Always check their specific guidelines.

Are There Any Age Restrictions to Participate in Prop Challenges?

You’ll need to meet specific eligibility criteria for prop challenges, including age verification. Often, a minimum age limit applies, and if you’re underage, parental consent might bypass some legal restrictions.

How Frequently Can a Trader Retry a Challenge After Failing?

You can retry a challenge often, but watch for challenge retry limits and failure penalties. Adjust your strategy and consider the psychological impacts of frequent attempts to improve your success rates.

Are Profits From the Challenge Phase Withdrawable?

In trading challenges, you can’t withdraw profits during the initial phase. Your earnings are tied to meeting specific profit conditions and overcoming withdrawal limits, which affect your overall challenge profitability and initial fee implications.

Do Prop Firms Provide Any Hardware or Software Tools for Trading?

Prop firms often provide software licenses, trading platforms, and analytical tools. You’ll get technical setups and hardware support to enhance your trading efficiency. They guarantee you’ve got the necessary tools for success.

Disclaimer:

All information has been prepared by TraderFactor or partners. The information does not contain a record of TraderFactor or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.