ActivTrades Review 2024: If you’ve been searching high and low through every nook and cranny of the internet for a comprehensive, unbiased, and user-friendly review of ActivTrades, your search ends here. As we march into 2024, it’s time we took a closer look at this UK-based broker, laying bare its trading fees, account options, trading features, and deposit and withdrawal methods. We’ll also shine a light on their investment options and the quality of their customer service. Is ActivTrades the key to unlocking your trading potential or another face in the crowd? Stick around as we pull back the curtain on one of the industry’s most talked-about platforms.

Table of Contents

ToggleOverview of ActivTrades

Let’s delve into ActivTrades, a UK-based forex and CFD broker renowned for its low trading fees and comprehensive suite of services. As a customer, you can access various ActivTrades services designed to enhance your trading experience. They offer cutting-edge trading tools, enabling you to navigate the financial markets with precision and confidence.

ActivTrades’ market analysis is top-notch, helping you stay ahead of the curve with real-time updates and expert insights. You’re not left in the dark, either. Their educational resources are abundant, equipping you with the knowledge you need, whether you’re a seasoned trader or just starting your journey.

But it’s not just about trading. ActivTrades takes your security seriously. They’ve put robust security measures in place to safeguard your personal and financial information. From advanced encryption technology to stringent data privacy policies, ActivTrades ensures you can trade with peace of mind.

In summary, ActivTrades provides a seamless, secure trading environment paired with excellent resources and services. It’s a top choice for traders looking for a reliable, customer-focused broker.

ActivTrades Trading Features Highlights

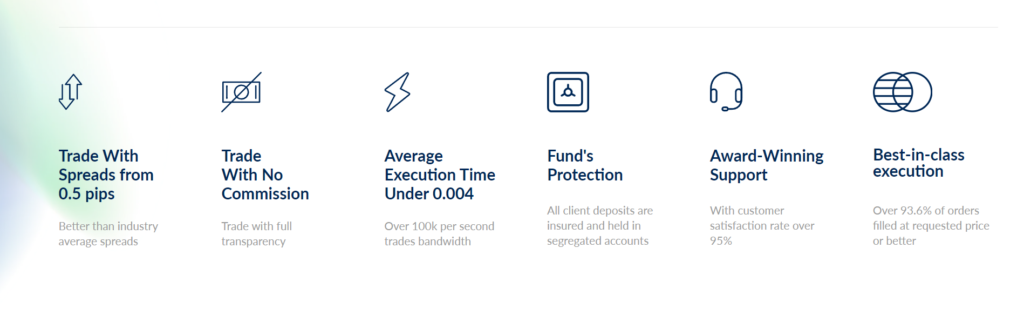

Delving into ActivTrades’ trading features, you’ll discover powerful tools designed to enhance your trading experience and boost your performance. ActivTrades is famed for its ultra-fast execution, averaging under 0.005 seconds, which is key to maximizing your trading efficiency.

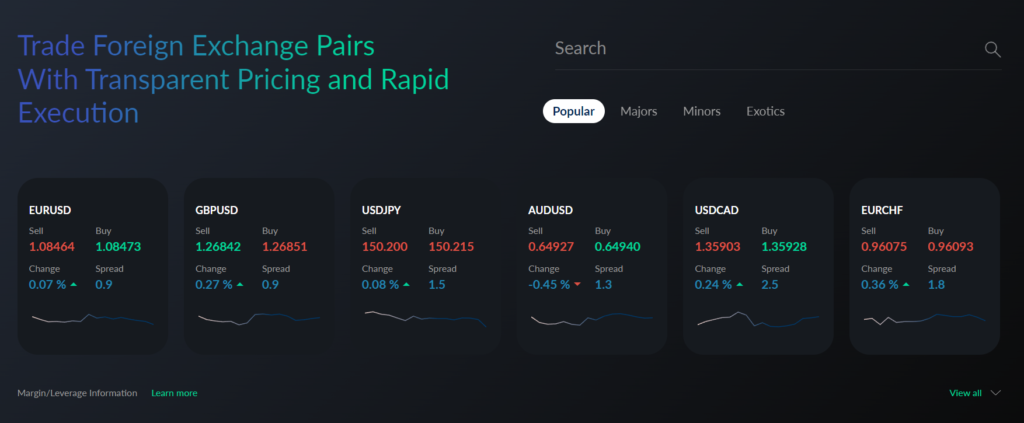

The platform offers a wide range of instruments, including forex, CFDs, and cryptocurrencies, allowing you to easily explore various markets. This diversity broadens your trading horizons and offers opportunities to hedge and diversify your portfolio.

ActivTrades also prioritizes secure trading. Industry-leading security features protect your funds and transactions, ensuring peace of mind as you trade. The platform also offers a customizable interface, catering to your trading preferences and personalizing your trading journey.

Moreover, ActivTrades offers a wealth of educational resources. Whether you’re a newbie learning the ropes or a seasoned trader looking to refine your strategies, these resources can be a great asset. From webinars to tutorials, they provide you with insights and knowledge to enhance your trading skills. In summary, ActivTrades equips you with the tools, security, and learning opportunities necessary for effective trading.

Understanding ActivTrades Fees Structure

Understanding ActivTrades’ fee structure is crucial to making the most cost-effective trading decisions. A detailed fee structure analysis will reveal the various costs involved, providing a comprehensive cost comparison opportunity.

ActivTrades prides itself on fee transparency, ensuring you have a clear view of all transaction-related costs. Here’s a brief pricing breakdown: – Spread costs: The primary fee you’ll encounter is the spread cost, which is competitive compared to other brokers. – Overnight charges: These are applied for positions held overnight, varying based on the instrument. – Inactivity fee: A charge of $10 per month is applied after 12 months of inactivity. – Currency conversion charge: A fee of 0.5% is applied if trading in a currency different from your account-based currency.

ActivTrades offers various payment options, including credit/debit cards, wire transfers, and e-wallets like Skrill and Neteller. It’s crucial to note that while ActivTrades doesn’t charge for deposits and withdrawals, your payment provider might. Understanding these nuances will ensure you make informed, cost-effective trading decisions.

Investment Options With ActivTrades

With ActivTrades, you have many investment options to diversify your trading portfolio. The platform offers a broad spectrum of financial instruments, enabling effective portfolio diversification. You can trade forex, indices, commodities, shares, ETFs, and even cryptocurrencies, spreading your risk and enhancing your investment strategies easier.

ActivTrades also provides tools for comprehensive market analysis, helping you make informed decisions and manage your risk more effectively. Their charting tools, real-time news feeds, and market sentiment indicators offer critical insights into market trends, enabling you to adjust your investment strategies accordingly.

Moreover, ActivTrades understands the importance of trading psychology. They offer educational resources that teach you the basics of trading and guide you on managing your emotions and maintaining discipline in your trading activities.

Furthermore, ActivTrades provides risk management tools such as stop loss and take profit orders to protect your investments from significant losses. These tools and their responsive customer support ensure you have the necessary assistance to navigate the often volatile trading markets. So, with ActivTrades, you get a comprehensive trading experience tailored to your investment needs and risk tolerance.

ActivTrades Deposit and Withdrawal Process

After exploring the diverse investment options, let’s examine the deposit and withdrawal process at ActivTrades. As a trader, you’ll find the deposit process straightforward and convenient, with various funding methods available, including bank transfers, credit/debit cards, and e-wallets.

ActivTrades prioritizes transaction security, ensuring your funds and information are safe through secure encryption technologies. This is further reinforced by their strict account verification process, which requires proof of identification and residence.

The withdrawal options at ActivTrades are just as flexible as the deposit methods. You can withdraw funds via bank transfer, credit/debit cards, and e-wallets, which generally take 1-3 business days to process.

In summary, here’s what you need to know about the deposit and withdrawal process at ActivTrades:

- The deposit process is simple and quick, with multiple funding methods available.

- ActivTrades uses robust encryption technologies for transaction security.

- Account verification involves providing proof of identification and residence.

- Withdrawal options mirror deposit methods, typically processed within 1-3 business days.

With ActivTrades, you can rest assured that your transactions are secure, swift, and seamless.

ActivTrades Trading Platforms Review

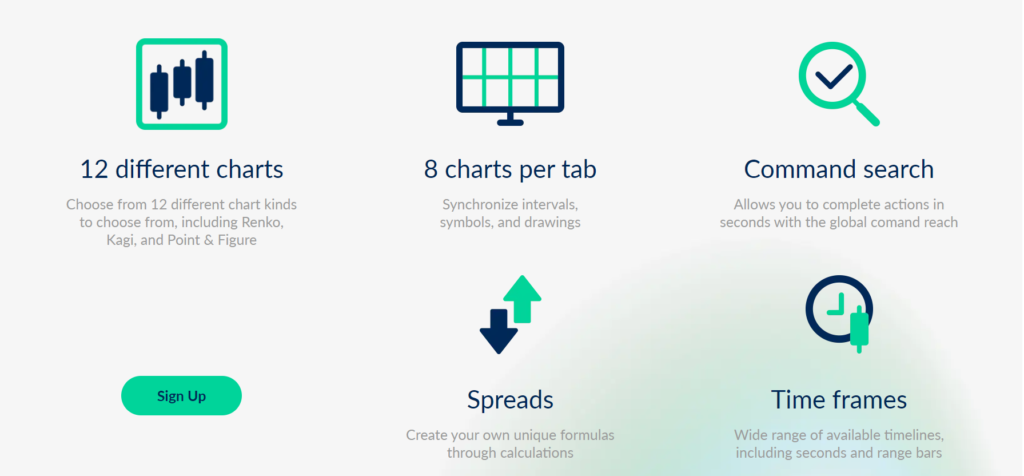

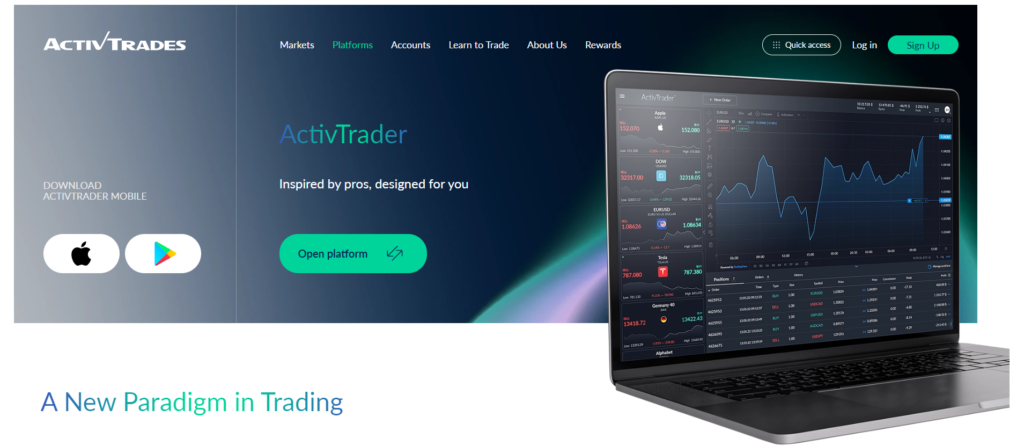

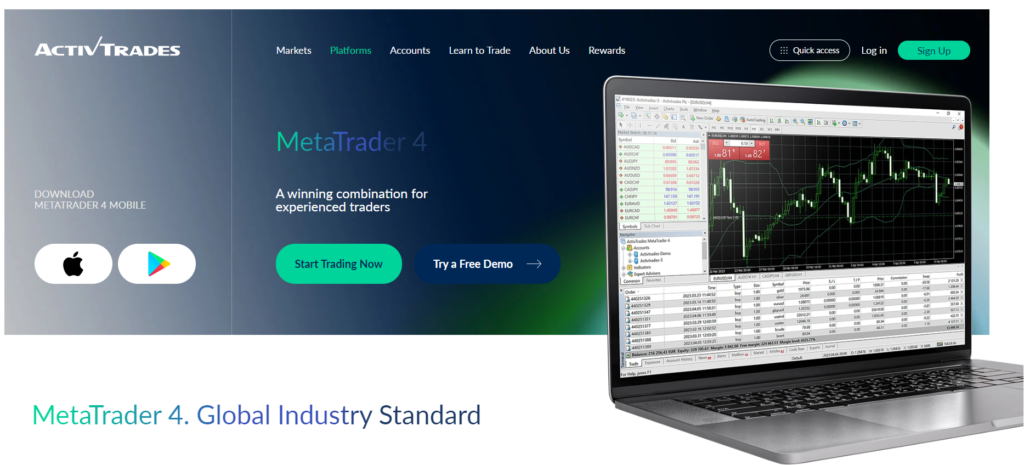

Let’s delve into the variety of trading platforms that ActivTrades offers to enhance your trading experience. The ActivTrades platform comparison reveals that they provide four major platforms: MetaTrader 4, MetaTrader 5, ActivTrader, and TradingView. Each platform is engineered to cater to different trading needs and styles.

One standout feature is ActivTrades mobile trading. This lets you trade on the go, ensuring you never miss a market opportunity. The mobile platform offers all the essential charting tools and order types, making it as functional as the desktop version.

ActivTrades charting tools are robust, boasting over 50 technical indicators and advanced drawing tools. These tools can help you conduct detailed ActivTrades market analysis and make informed trading decisions.

With ActivTrades, you get a variety of order types, including Market, Limit, Stop, and Trailing Stop orders. Such versatility allows for flexible and strategic trading.

| Platform | Key Feature |

| MetaTrader 4 | Advanced charting tools |

| MetaTrader 5 | Multiple order types |

| ActivTrader | User-friendly interface |

| TradingView | Real-time market analysis |

Customer Support and Account Services

When it comes to customer support and account services, ActivTrades doesn’t disappoint. They offer around-the-clock assistance and a range of account options to suit every trader’s needs. You can count on their dedicated support team to promptly address your concerns and queries.

ActivTrades also prioritizes account security. They employ high-level data protection measures, ensuring your personal and financial information remains secure. Plus, with readily available educational resources, you’re equipped to make informed trading decisions and stay updated on market trends.

With ActivTrades, client satisfaction is a top priority. Their tailored account services cater to various trading styles, allowing for a personalized trading experience.

Here’s what you can expect from ActivTrades:

- Robust account security measures and data protection policies

- Comprehensive educational resources to keep you informed about market trends

- A dedicated customer support team is available 24/5

- A variety of account options to suit diverse trading needs

ActivTrades Account Types and Fees

Now that we’ve covered the security and support services offered by ActivTrades let’s examine the different account types and their associated fees. ActivTrades offers a range of account types to cater to specific trading needs. These include individual accounts, corporate options, and even swap-free accounts for those adhering to Islamic finance principles.

| Account Type | Professional Fees | Minimum Deposits |

| Individual | Competitive | Low |

| Professional | Lower | Higher |

| Corporate | Varies | Varies |

| Swap Free | Standard | Moderate |

Individual accounts are designed for private traders, with competitive professional fees and low minimum deposits. Professional accounts are for experienced traders and offer lower fees but require higher minimum deposits.

Corporate options cater to institutional clients, with fees and deposits varying based on the trading volume and nature of the institution. Swap-free accounts, or Islamic accounts, abide by Sharia law and offer standard fees and moderate minimum deposits.

Frequently Asked Questions

Does Activtrades Offer Any Additional Features or Services to High-Volume Traders?

As a high-volume trader, you’ll appreciate ActivTrades’ leverage options, competitive spreads comparison, and variety of trading platforms. They also offer reliable customer support and comprehensive trading education to enhance your trading experience.

Are there any promotional offers or bonuses available to new traders at Activtrades?

ActivTrades doesn’t currently offer sign-up bonuses or reward programs. However, it does provide training offers, occasional account upgrades, and referral incentives to attract and retain new and existing traders.

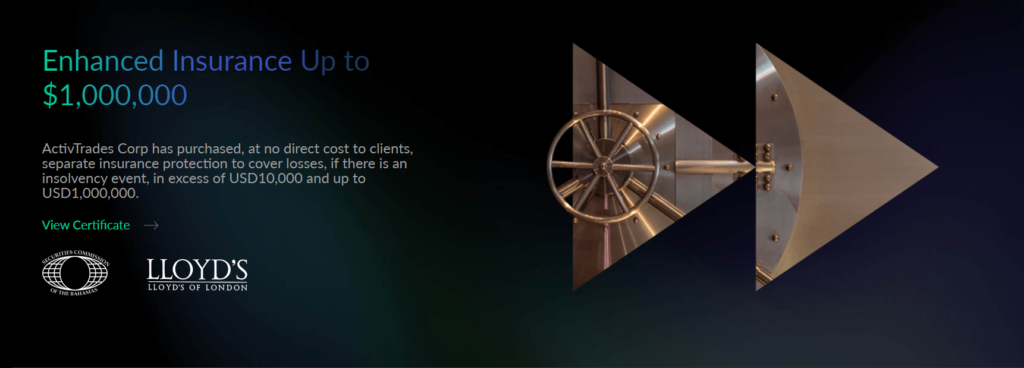

How Does Activtrades Protect Client Funds in the Event of the Company’s Insolvency?

ActivTrades safeguard your funds through strict client protection measures. They practice fund segregation, keeping your money separate from company funds. In case of insolvency, established procedures ensure financial security. Effective risk management further enhances protection.

Does Activtrades Offer Any Tools or Resources for Automated Trading?

Yes, ActivTrades offers automated trading tools. You’ll find automated strategies, algorithmic trading, and backtesting functionality. Their platforms are compatible with such tools, aiding risk management and enhancing trading efficiency.

Can I Open a Joint Account or Manage Multiple Accounts at ActivTrades?

Yes, you can manage multiple accounts at ActivTrades. However, they don’t offer joint accounts. Their customer service can guide you through the account setup process and discuss the benefits of each account type.

Conclusion

ActivTrades Review 2024

In conclusion, ActivTrades offers a robust platform for novices and seasoned traders. With its competitive fee structure, diverse investment options, and top-notch customer support, it’s worth considering for your online trading journey. However, always assess your trading goals and financial situation before diving in. This ActivTrades review’s insights will better equip you to make an informed decision. Happy trading!

Disclaimer:

TraderFactor and our partners have compiled all the provided information. This information does not include a record of TraderFactor or our partners’ pricing, nor does it constitute an offer or invitation to proceed with any financial instrument transactions. We do not guarantee the accuracy or completeness of this information. The material is not tailored to any reader’s specific investment goals or financial conditions. Past performance does not indicate future results.