If you’re looking to kickstart your trading career swiftly, choosing the top single-step challenge prop firm can make all the difference. This streamlined assessment process helps you shift directly to trading with real capital after fulfilling specific criteria, ideal if you’re eager to begin promptly.

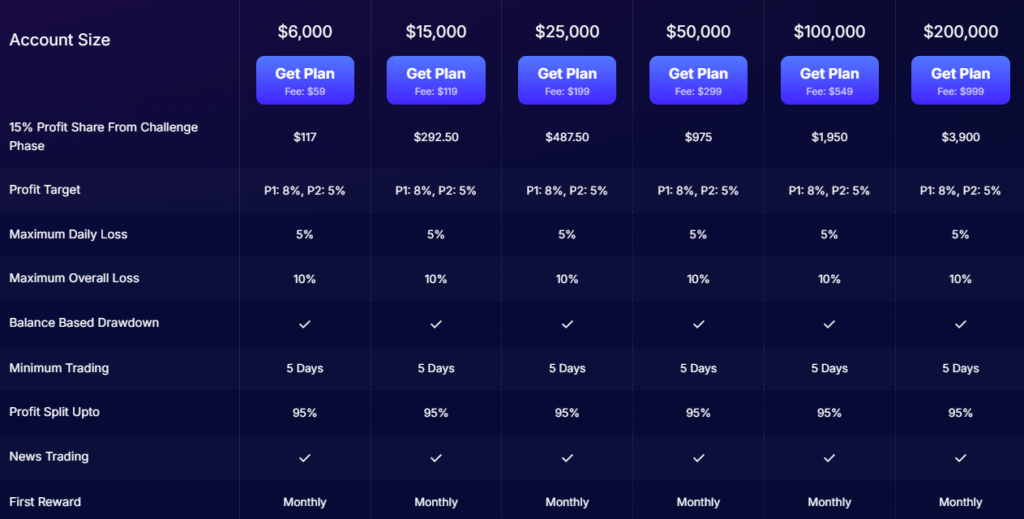

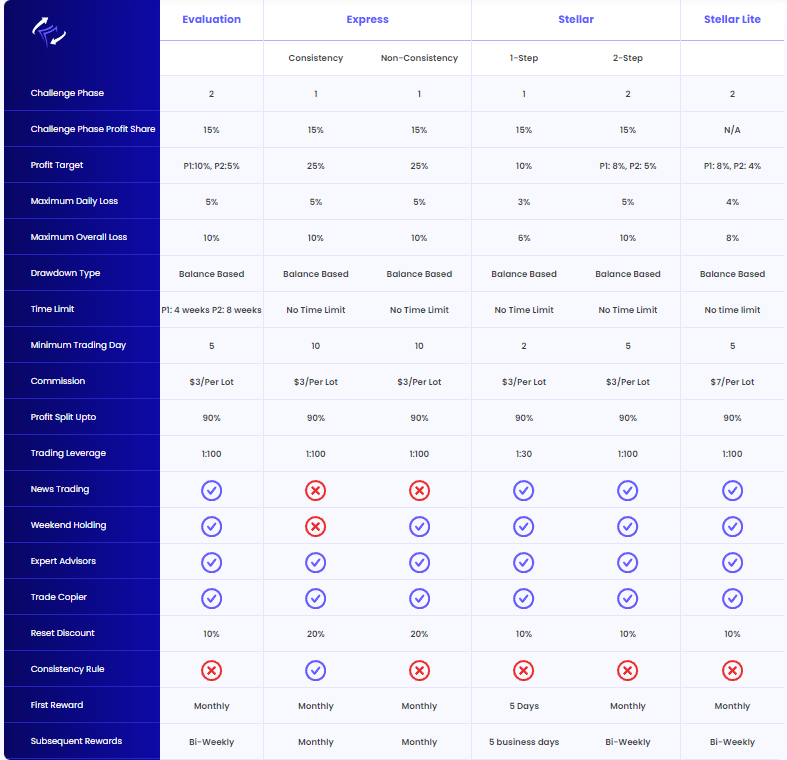

Most prop firms provide a range of funding opportunities, with account sizes varying from $10,000 to $200,000, and profit splits that increase as you handle larger accounts. You’ll notice that fee structures differ, but the top firms uphold transparency with no undisclosed costs. For example, FundedNext offers a compelling opportunity for traders through its Express Model and Stellar 1-Step Challenge, both designed to provide a streamlined path to accessing funded trading accounts.

While exploring your choices, you’ll discover unique advantages that could enhance your trading strategy further.

Table of Contents

ToggleFundedNext 1-Step Challenge Processes

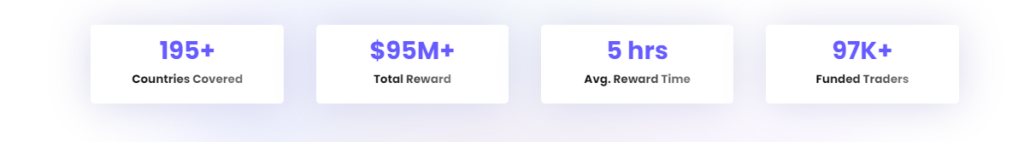

With a strong reputation and a commitment to trader success, FundedNext is a top choice for those looking for a streamlined and efficient one-phase funding process. The one-step challenges make it an attractive choice for traders seeking a straightforward path to trading with real funds.

Express Model

The Express Model is a one-step challenge aimed at consistent traders who can reach a 25% profit target without any time constraints. Key features include:

| Feature | Description |

|---|---|

| Profit Target | Achieve a 25% profit target to qualify for a funded account. |

| Profit Split | Start with a 60% profit split, which can increase up to 90% based on performance. |

| No Time Limit | Traders can take as long as needed to reach the profit target. |

| Instant Funding | Access to a funded account can be achieved in as little as 10 trading days. |

| Account Sizes | Options range from $6,000 to $200,000, with corresponding plan fees. |

| Drawdown Limits | A maximum daily loss of 5% and an overall loss of 10% are allowed. |

Stellar 1-Step Challenge

The Stellar 1-Step Challenge by FundedNext is a straightforward model designed for traders who prefer a single-phase evaluation process. Here’s a breakdown of its key features:

| Feature | Description |

|---|---|

| Profit Target | Traders need to achieve a 10% profit target to qualify for a funded account. |

| Risk Management | Emphasizes effective risk management and account management skills. |

| Profit Sharing | Offers competitive profit splits, starting at 60% and potentially increasing based on performance. |

| Flexibility | Designed to accommodate different trading styles and risk tolerances, making it suitable for a wide range of traders. |

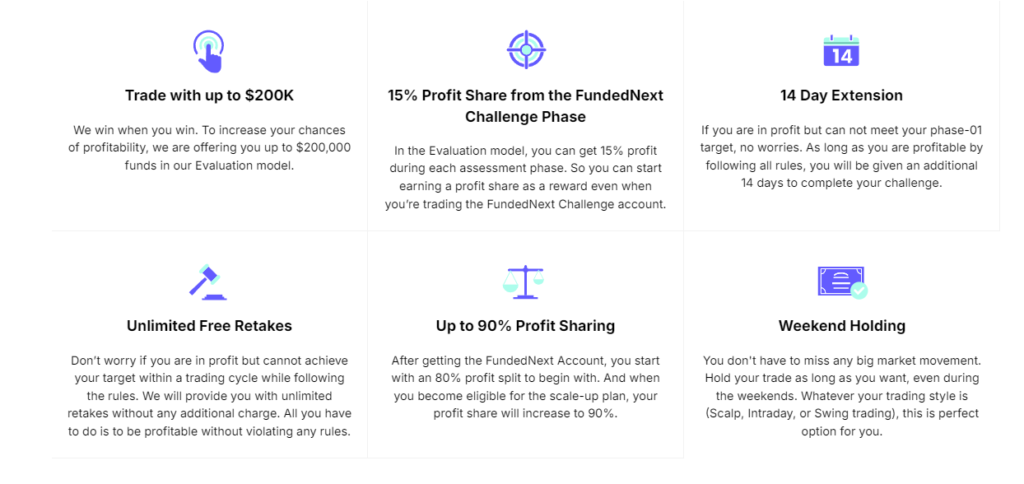

Both models are designed to minimize pressure on traders by removing unrealistic profit targets and time constraints, allowing them to trade at their own pace. FundedNext also offers additional benefits such as a 15% profit share during the challenge phase, trader-friendly leverage, and the potential to grow account balances significantly over time.

Evaluation Process Comparison

While traditional two-step assessments require traders to first demonstrate their skills in a practice account, one-step assessments streamline the process to a large degree. You’re thrown right into the action, where your trading strategies and risk management are tested in real market conditions. This approach not only enhances assessment efficiency but also speeds up funding significantly. Instead of waiting to shift from a practice to a live account, you meet the criteria once and move directly to trading with actual capital.

In prop trading, the discussion between conventional vs contemporary methods is ongoing. However, the one-step process appeals if you’re confident in your strategy and excited to start without delay. It allows you to showcase your expertise in a single, all-encompassing test. This method prioritizes direct evaluation and swift results, addressing the eagerness many traders feel to take advantage of their skills.

Furthermore, the one-step approach simplifies the entry into professional trading. You don’t juggle multiple stages but concentrate on hitting one clear goal. While this could heighten risk, effective management and a solid strategy mitigate potential downsides, aligning with the modern trader’s need for both promptness and efficiency.

Cost and Fees

Understanding the cost and fees associated with one-step evaluations is important as you consider this route for prop trading. Before you immerse yourself, you’ll want to thoroughly examine the fee structure. Most firms charge a single evaluation fee upfront, which covers your access to the trading platform and the evaluation itself. This fee varies widely among firms, so you’ll need to shop around.

It’s essential to look into the payment options available. Can you pay with credit card, PayPal, or perhaps cryptocurrencies? Flexibility in payments can ease your initial financial burden.

Also, make sure there’s fee transparency. The best prop firms will have no hidden charges; everything from the cost breakdown to any potential additional costs should be clearly outlined on their websites.

Funding Opportunities

What options are available after passing the one-step evaluation? You’re in a great spot to leverage the funding opportunities provided by top prop firms, aiming to maximize your profit potential and enhance your trading career. These firms offer various account sizes, allowing a customized approach to risk management and trading assessment.

Here’s a quick glance at what you could expect regarding account sizes, profit splits, and risk management:

| Account Sizes | Profit Split | Risk Management Rules |

|---|---|---|

| $10,000 | 50% | Maximum loss 5% |

| $50,000 | 70% | Maximum loss 4% |

| $100,000 | 80% | Maximum loss 3% |

| $200,000 | 85% | Maximum loss 2% |

With these options, you can choose an account that suits your comfort level and aspirations. The larger the account size, the more advantageous the profit split becomes, motivating you to manage risks effectively.

Each firm has its unique set of rules for trading assessment and risk management, ensuring you’re always at the top of your game. Don’t just settle for any funding opportunity; aim for one that aligns with your trading strategy and growth goals.

Benefits and Models

The benefits of one-step evaluations streamline your path to becoming a funded trader, providing you with faster access to trading capital.

This streamlined process cuts through the usual complexities, offering a direct route to showcase your trading skills and meet profit targets. You’re not bogged down by multi-tiered evaluations; instead, you dive straight into trading with real stakes and real-time experience.

With the simplified criteria, you’re able to focus solely on hitting that vital profit mark. The one-step model boosts your profit potential since you can start earning from a funded account quicker than in traditional multi-step setups. Plus, personalized support from the prop firm assures you’re not alone in this journey. They’re there to guide you, adjusting risk parameters to match your trading style and needs.

This model isn’t just about quick access; it’s also about fitting into your unique trading strategy, allowing you to operate within predefined risk parameters that protect both you and the firm. It’s a real test of your ability to manage trades effectively, giving you the invaluable experience needed to thrive in the competitive world of trading.

Prop Trading Firm Information

Several prop trading firms offer one-step evaluations, each with unique benefits and support systems designed to suit various trading styles and needs. When you’re choosing a firm, firm selection becomes important. You’ll want to take into account not just the reputation and reliability of the firm, but also how their specific rules and opportunities align with your trading strategy.

Account sizes vary greatly among firms, allowing you flexibility depending on your confidence and experience levels. Smaller accounts might be less risky if you’re just starting, but larger accounts can offer greater profit potential once you’ve proven your strategies are effective. Speaking of profits, setting realistic profit targets is crucial. These targets not only guide your trading efforts but are also important benchmarks you must meet to succeed in the one-step challenge.

Effective risk management is perhaps the most vital aspect of prop trading. You need to understand and adhere to the firm’s risk parameters to protect your account from significant losses. Finally, account growth opportunities within a firm can influence your long-term potential. Look for firms that offer scaling plans, as these can increase your trading capital based on consistent performance, thereby enhancing your profit-making potential.

Funding Options and Criteria

In evaluating your options for prop trading, examining the variety of funding options and criteria different firms offer is essential. You’ll find that account sizes can vary significantly, which affects how much leverage you’re able to work with. Larger accounts often come with stricter risk management rules but potentially higher profit splits. It’s important to understand the evaluation criteria each firm uses to measure your trading success before granting you more substantial funding.

Here’s a quick breakdown of typical offerings:

| Criteria | Details |

|---|---|

| Account Sizes | Ranges from $10,000 to $500,000 |

| Profit Split | Typically 50% to 80% |

| Risk Management | Strict guidelines to limit losses |

Different firms also offer diverse funding options, from initial smaller accounts to multi-million dollar portfolios for highly skilled traders. When you’re starting, it’s crucial to look for a firm that provides a balance between a good profit split and reasonable risk management protocols.

This balance helps ensure that you can grow your trading career sustainably, without facing undue risk that could wipe out your capital. Remember, the right firm should align with your trading style and financial goals.

Challenge Requirements and Guidelines

Understanding the variety of funding options lays the groundwork for the next vital step: acquainting yourself with the challenge requirements and guidelines each prop trading firm enforces. Every firm has its set of rules, but let’s delve into the common ones you’ll likely encounter.

Firstly, you’re expected to meet specific profit targets to complete the challenge successfully. These targets are carefully calculated to evaluate your trading skill and discipline effectively. You’ll also need to stay within the daily drawdown limit, typically capped at about 4%. This rule helps manage risk and prevents significant losses.

Furthermore, the maximum loss per trade is usually set at 2%. It’s a safety measure that keeps your trading under control and minimizes financial damage. Now, assuming you pass these obstacles, there’s the scaling plan to ponder. This plan isn’t just about increasing your trading capital. It’s about strategically boosting your potential earnings while maintaining risk management.

The criteria for scaling include reaching profit milestones without breaching drawdown limits. It’s essential because it shows you’re not just profitable but consistently so, under varied market conditions. Remember, understanding and adhering to these guidelines is your roadmap to success in the trading challenge.

Support and Resources

Why is strong support necessary for your success in prop trading? As you navigate the fast-paced world of proprietary trading, access to robust training support and market insights isn’t just helpful; it’s essential. These resources empower you to maximize your profit potential while effectively managing risks.

Top prop firms understand this. They don’t just hand you an account and wish you luck. Instead, they provide extensive training that enhances your ability to make informed decisions. Think of it as equipping yourself with a sharp, well-oiled toolkit. Every piece of knowledge and every tool you gain, from real-time market insights to advanced risk management strategies, serves to fortify your trading approach.

Moreover, ongoing support is crucial. Whether it’s a complex market movement or a strategy adjustment, having expert guidance at your fingertips can make a significant difference. This isn’t just about immediate issues; it’s about ensuring sustainable account growth and long-term success. So, when you’re choosing a prop firm, consider how their support structure can not only guide you through initial challenges but also foster your growth as a trader.

Profit Sharing and Incentives

How do profit-sharing models impact your potential earnings as a funded trader? Understanding the dynamics of profit sharing is essential to maximizing your profit potential. In the one-step challenge prop firms, the profit-sharing arrangement dictates a significant portion of your financial outcome.

These firms often employ incentive structures that are designed to reward you for high performance. For instance, higher profit splits are available as you demonstrate consistent success, encouraging a focus on developing effective trading strategies. Let’s break down some typical offerings:

| Firm Type | Profit Distribution | Additional Incentives |

|---|---|---|

| Standard | 50% | Performance bonuses |

| Advanced | 70% | Scaling opportunities |

| Premium | 80% | Up to 100% on targets |

Performance rewards and incentive programs aren’t just numbers; they’re a reflection of the firm’s confidence in its traders. By aligning their success with yours, these firms create a mutually beneficial environment. You’re not just trading; you’re aiming for those higher tiers of profit sharing that come with proven success. This model guarantees that both you and the firm are invested in your trading proficiency and financial achievements.

Benefits, Risks, and Process

Engaging with a one-step challenge prop firm offers you direct access to funding without needing your own capital, providing a real-time experience in the markets that could lead to substantial profits. You’ll face specific evaluation criteria that determine whether you’re ready to manage a sizable account. Success not only hinges on hitting profit targets but also on how effectively you apply your trading strategy and adhere to risk management rules.

The allure of high profit potential can be compelling, but it’s important to recognize the risks involved. If you fail to meet the evaluation criteria, you could lose your trading capital. There’s also a psychological pressure to perform, which isn’t suitable for everyone. Plus, you’ll need to maintain consistent performance to secure account growth and take advantage of scaling opportunities.

The process starts with the evaluation phase, where your trading strategy, risk management, and ability to hit profit targets are tested. If you succeed, you move to the live trading phase with real capital at stake. Here, profit withdrawal options and further account growth targets become available, guiding you towards a potentially lucrative trading career.

Frequently Asked Questions

Step Challenge Prop Firm

What Happens if I Fail the One-Step Challenge?

If you fail the one-step challenge, it’s a chance to enhance learning opportunities, build emotional resilience, and refine success strategies. Embrace a growth mindset to overcome setbacks and prepare for future attempts.

Can I Retake the One-Step Challenge After Failing?

Yes, you can retake the one-step challenge after failing. It’s a chance to develop skills, gain mentor support, build confidence, and explore learning opportunities, enhancing your trading strategy for future attempts.

Are There Any Age Restrictions for Joining a Prop Firm?

You’ll find most prop firms don’t impose age restrictions, focusing instead on your trading strategies and ability to meet evaluation criteria. Age limits aren’t typically part of joining criteria or evaluation impact.

How Do One-Step Evaluations Impact Long-Term Trading Careers?

One-step evaluations in prop trading can accelerate your career by focusing on performance evaluation and quick progress tracking, enhancing your psychological resilience, and improving risk management and strategy adaptation skills.

What Types of Trading Strategies Are Best for One-Step Challenges?

For one-step challenges, you’ll find scalping techniques, trend following, and strong risk management essential. Employ technical analysis and understand market psychology to enhance your trading strategy and boost your chances of success.

Disclaimer:

All information has been prepared by TraderFactor or partners. The information does not contain a record of TraderFactor or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.