In the latest financial market developments, the Eurozone and the United States have presented intriguing inflation data that could influence trading activities, particularly within the currency markets.

Table of Contents

ToggleEurozone Inflation Data Bolsters the Euro Amidst Trading Volatility

The Eurozone has reported a core Harmonised Index of Consumer Prices (HICP) increase of 3.1% on a yearly basis for February, surpassing market expectations which were set at 2.9%. This stronger-than-anticipated inflation reading has provided support to the Euro, despite the EUR/USD pair facing downward pressure during Thursday’s American trading hours, marking its third consecutive day in negative territory. Although managing to maintain stability above the 1.0800 mark on Friday, the EUR/USD’s recovery prospects remain uncertain without further supportive Eurozone inflation data.

US Inflation Data and Federal Reserve’s Hawkish Stance Influence Currency Movements

Across the Atlantic, the US Bureau of Economic Analysis has reported a decline in the Personal Consumption Expenditures (PCE) Price Index to 2.4% on a yearly basis for January. The Core PCE Price Index, excluding food and energy prices, aligned with expectations, rising by 2.8% year-on-year. Following this inflation report, hawkish comments from Federal Reserve policymakers have enhanced the US Dollar’s performance against its counterparts, pushing the EUR/USD pair lower. Meanwhile, the GBP/USD pair has seen modest gains above 1.2600 in European trading hours on Friday, benefiting from a risk-on mood ahead of significant US economic data releases.

Manufacturing Data and Market Sentiment to Guide Short-Term Trends

Market participants are keenly awaiting the ISM Manufacturing PMI data from the US, expected to marginally improve to 49.5 from 49.1. A reading above 50 could bolster USD demand, while the inflation component, the Prices Paid Index, will also be closely monitored for indications of input cost trends. Positive stock market futures in Europe suggest a potentially bullish start on Wall Street, which may further influence currency dynamics, especially for risk-sensitive pairs like GBP/USD and AUD/USD.

EUR/USD Sees Consolidation; Analysts Recommend Selling

The EUR/USD pair is currently experiencing a phase of consolidation, with a slight downtrend observed in the early hours of trading. The Relative Strength Index (RSI), a key indicator of momentum, shows a lack of upward movement, suggesting potential for further decline. Based on current market analysis, there is a sell recommendation with an entry price (pivot) at 1.0825, targeting take profit levels at 1.0795 and 1.0780. Traders are advised to manage risk effectively, allocating no more than 2% per trade.

Australian Dollar Dynamics: Retail Sales and Manufacturing Insights

The Australian Dollar has shown resilience, supported by positive retail sales and private capital expenditure data, alongside a slight improvement in the Judo Bank Manufacturing PMI for February. Despite some retracement against a stronger US Dollar on Thursday, the AUD/USD pair remains buoyant, aided by record highs in the S&P/ASX 200 Index and an optimistic global stock market outlook.

AUD/USD: Bullish Momentum Continues

On the brighter side, the AUD/USD pair is witnessing an uptrend, buoyed by positive momentum. The RSI for this asset indicates a strong upside potential, making it an attractive buy option for intraday traders. The recommended entry point stands at 0.6490, with take profit targets set at 0.6525 and 0.6540. As with all trades, a risk management strategy limiting exposure to 2% per trade is advisable.

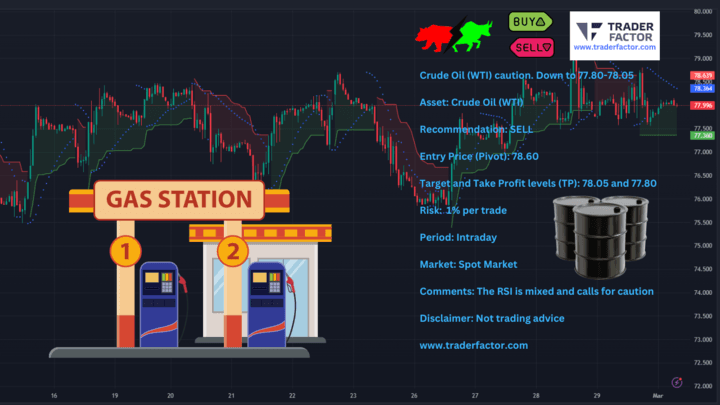

Crude Oil (WTI): A Cautious Approach Advised

The crude oil market is currently marked by caution, as mixed signals from the RSI indicate uncertainty. For intraday traders looking at WTI crude, a sell position is suggested with an entry price at 78.60, aiming for take profit levels at 78.05 and 77.80. The risk associated with this trade is recommended to be capped at 1%.

Disclaimer:

All information has been prepared by TraderFactor or partners. The information does not contain a record of TraderFactor or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.