Understanding and mastering the Marubozu Candlestick is a vital step for Forex traders seeking to improve their technical analysis skills. This unique candlestick pattern provides valuable insights into market trends, making it an essential tool for analyzing price action. By recognizing and trading the Marubozu Candlestick correctly, you can develop a more refined approach to your trading strategy.

This discussion dives deep into what the Marubozu Candlestick is, how to identify it, and the best ways to use it in your Forex trading strategy. This guide will provide practical knowledge to take your candlestick trading strategies to the next level.

Table of Contents

ToggleWhat is a Marubozu Candlestick?

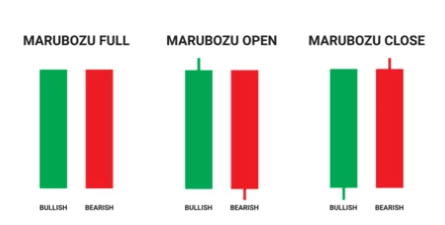

The Marubozu Candlestick is one of the simplest yet most effective patterns in Forex candlestick patterns. It lacks wicks at either end, which signifies strong price action in one direction. This pattern is fundamental in Forex technical analysis and can provide valuable clues about market momentum.

Components of a Marubozu Candlestick

A Marubozu Candlestick consists of a solid body without any upper or lower shadows. The absence of wicks means that the opening and closing prices are also the high and low prices, which signifies strong directional movement.

Importance of Marubozu Candlestick in Technical Analysis

The Marubozu Candlestick reveals the strength of buyer or seller control in Forex market trends. It indicates that the market is moving decisively, which makes it a reliable signal for trading opportunities.

Bullish vs Bearish Marubozu Candlesticks Explained

A bullish Marubozu candlestick in Forex trading shows that buyers are dominating, while a bearish Marubozu candlestick reveals intense selling activity. Recognizing these variations is key to understanding whether to buy or sell the currency pair.

How to Identify a Marubozu Candlestick in Forex Charts

Recognizing the Marubozu Candlestick pattern on Forex chart patterns takes practice. However, its distinguishing characteristics make it easier to spot compared to other candlestick patterns.

Steps to Locate Marubozu Candlesticks on Charts

Start by zooming into key timeframes where significant price action occurs. Look for Forex candlestick patterns that have no visible shadows—these are typically the Marubozu Candlesticks.

Tools for Identifying Marubozu Candlesticks in Forex Technical Analysis

Using Forex trading indicators can help identify these patterns effectively. Tools like moving averages or support and resistance levels can also complement your analysis.

The Bullish Marubozu Candlestick in Forex Trading

A bullish Marubozu Candlestick indicates strong buying momentum. Understanding this pattern’s implications can help you make better trading decisions, especially in trending markets.

What Does a Bullish Marubozu Candlestick Signal?

It signals that buyers are in complete control of market dynamics. This often forms part of reversal patterns, showing potential price direction changes in price action trading.

How to Trade a Bullish Marubozu Candlestick in Forex

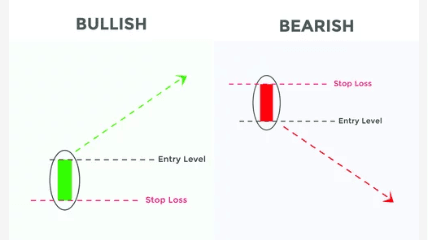

When you see a bullish Marubozu Candlestick during an uptrend, consider entering a buy position. It shows strong buying pressure, which could lead to further price increases.

The Bearish Marubozu Candlestick Explained

A bearish Marubozu Candlestick signifies strong selling momentum in the Forex market. This pattern can often signal bearish market trends.

Recognizing Bearish Marubozu Candlesticks on Forex Charts

On Forex charts, bearish Marubozu Candlesticks will have a solid downward body with no shadows. This type of pattern often appears near resistance levels or during corrective phases.

Trading Strategies for Bearish Marubozu Candlesticks

When you identify a bearish Marubozu Candlestick, consider initiating a sell trade. Be mindful to align it with other Forex trading indicators to confirm market direction.

How to Trade Marubozu Candlesticks in Forex Effectively

Understanding how to trade Marubozu Candlesticks in Forex requires a blend of technical analysis and price action understanding. Here’s how you can do it.

Marubozu Candlestick Strategy for Forex Traders

One effective strategy involves entering trades in the direction of the candlestick, using stop-loss orders to manage risks effectively. Always complement it with other Forex trading for beginners tools.

Common Mistakes When Trading Marubozu Candlesticks

Avoid using the Marubozu Candlestick pattern in isolation. Lack of proper confirmation may result in inaccurate Forex market trends analysis.

Comparing Marubozu Candlestick vs Other Patterns

The Marubozu Candlestick stands out due to its strong directional bias. However, comparing it to other patterns can help clarify trading strategies.

Key Differences Between Marubozu and Other Forex Candlestick Patterns

Compared to patterns with wicks, the Marubozu Candlestick offers more decisive signals. It’s especially useful for capturing Forex price movement momentum.

Why is the Marubozu Candlestick Unique?

The Marubozu Candlestick is unique for its simplicity and reliability, making it a staple in candlestick trading strategies.

Best Timeframes for Marubozu Candlestick in Forex

Choosing the right timeframes is central to leveraging the Marubozu Candlestick pattern effectively. Both short and long timeframes can work depending on your strategy.

Ideal Timeframes for Day Traders and Swing Traders

Day traders often use shorter timeframes, such as 5-minute or 15-minute charts. Swing traders may prefer 4-hour or daily charts for Marubozu Candlestick pattern backtesting results.

How to Adapt Timeframes Based on Market Conditions

Understanding Forex candlestick reversal patterns and adapting your timeframes accordingly ensures better trade entries and exits.

Marubozu Candlestick Pattern Trading Tips

When trading Marubozu Candlesticks, having a clear set of rules is essential. Here are some tips for success.

Placing Stop-Loss and Take-Profit Levels

Setting stop-loss orders beneath bullish or above bearish Marubozu Candlesticks helps minimize risks. Also, use support and resistance levels for more accurate take-profits.

Combining Price Action Trading with Indicators

Pairing the Marubozu Candlestick pattern with indicators such as RSI or MACD strengthens your trading analysis.

Common Considerations for Marubozu Candlesticks in Forex

There are certain considerations to account for when trading the Marubozu Candlestick pattern in Forex. This ensures better accuracy in your trades.

Avoid Trading During High Market Volatility

Extreme volatility can distort Marubozu Candlestick patterns. Monitor market conditions carefully before acting.

The Importance of Forex Trading Psychology

Maintaining discipline while trading the Marubozu Candlestick is crucial. Awareness of Forex trading psychology helps avoid impulsive decisions.

Real-World Examples of Marubozu Candlesticks in Forex

Examples provide a practical understanding of using Marubozu Candlesticks. Reviewing historical patterns is an effective way to learn.

Backtesting Marubozu Candlestick Patterns

Analyze historical charts to understand Marubozu Candlestick pattern success rates. This process provides deeper insights into their reliability.

Applications in Current Market Trends

Identify current Forex market trends where Marubozu Candlestick patterns appear. Use these as benchmarks to develop and refine your strategies.

Marubozu Candlestick Patterns for Beginners

If you’re new, focusing on basic patterns like Marubozu Candlesticks is a good start. They offer clarity and simplicity.

Beginner-Friendly Tips for Marubozu Candlesticks

Stick with the basics of Forex candlestick patterns and avoid overcomplicating your trading strategy.

Building Confidence with Simple Strategies

Using the Marubozu Candlestick pattern for day trading helps create disciplined routines. Gradually expand your strategies for greater mastery.

Conclusion

The Marubozu Candlestick serves as a powerful tool for traders in the Forex market. Its simple structure and clear signals make it accessible for beginners yet valuable for professionals. By combining the Marubozu Candlestick with indicators and other price action trading strategies, you can find and execute more accurate trades. Whether you’re a day trader or a swing trader, the Marubozu Candlestick can elevate your technical analysis and improve your Forex trading outcomes. Always focus on practice and backtesting to unlock the full potential of the Marubozu Candlestick in your trading approach.

Disclaimer:

All information has been prepared by TraderFactor or partners. The information does not contain a record of TraderFactor or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.