Forex Brokers with the Lowest Spread: Navigating the Forex market is like finding your way through a dense, uncharted jungle. Identifying brokers with the lowest spread can be your ultimate survival tool. While it seems daunting, you’ve got the power to conquer this quest. Various brokers are vying for the title ‘Lowest Spread,’ including heavyweights such as MultiBank Group, M4 Markets, TMGM, OneRoyal, FxPro, IronFx, VS Capital, ActivTrades, EightCap, Naga, Exante, RS Prime and Skilling So, how do you determine who’s truly leading the pack? Stay with us as we pull back the curtain on these forex giants, break down their offerings, and equip you with crucial insights to boost your trading success.

Table of Contents

ToggleBest Zero Spread Forex Brokers

So, who are the best zero-spread forex brokers to consider for your trading needs? The answer lies in understanding the zero spread advantages and how these brokers can enhance your trading strategy.

Firstly, zero-spread brokers provide an opportunity for immediate entry and exit points, a critical factor in volatile markets. This feature reduces the risk of slippage, promoting effective risk management in your trading activities.

Secondly, leverage considerations are crucial. High leverage might seem attractive, but remember, it also magnifies losses. Therefore, choosing brokers like ActivTrades or TMGM, known for their responsible leverage offers, can be wise.

Understanding Zero Spread Accounts

When exploring zero-spread accounts, it’s crucial to understand that these offer no difference between the bid and ask price, which can streamline your trading activities. This setup’s benefits include easier analysis of market conditions and straightforward execution. However, risks are involved, such as the possible widening of spreads, which can impact your trading strategies.

The advantages of zero-spread accounts include fast transactions and transparency in pricing. However, their disadvantages cannot be ignored. They may seem cost-effective, but when you factor in commission charges, you might find other account types more beneficial. Therefore, a detailed comparison is necessary before making a choice.

You should also consider the impact of zero-spread accounts on your trading strategies. While they offer a simplified trading environment, they might not align with certain trading strategies that rely on spread differentials.

In the end, the advantages and disadvantages of zero-spread accounts must be weighed against your trading needs and strategies. This involves careful consideration and analysis to ensure you choose the most beneficial route for your trading activities.

Earning Methods for Zero Spread Brokers

When trading with zero-spread brokers, it’s important to grasp how they generate revenue, as these earning methods can directly influence your trading experience and outcomes. Here’s a brief rundown:

- Commission Structure: Zero-spread brokers usually charge a fixed commission per trade, their primary revenue source. This structure might impact your strategies, especially if you’re a high-frequency trader.

- Risk Management: Brokers manage risk by hedging against large trades with liquidity providers, safeguarding their earnings.

- Trading Conditions: Brokers may adjust trading conditions, such as margin requirements or stop levels, which can indirectly affect their earnings.

- Liquidity Providers: Brokers earn rebates from liquidity providers for their trading volume. This doesn’t affect your trade but is part of their revenue model.

- Additional Services: Some brokers might offer value-added services like advanced trading tools or market analysis for a fee.

Understanding these earning methods can help you make more informed decisions and potentially improve your trading conditions. Remember, a broker’s commission structure and relationship with liquidity providers could significantly impact your strategies and risk management. Therefore, it’s crucial to consider these factors when choosing a zero-spread broker.

Trading With Zero Spread Brokers

Understanding how zero-spread brokers generate revenue is vital, but knowing how to navigate trading with these brokers is equally vital to maximizing your potential benefits. In volatile markets, high-frequency trading and scalping strategies can be particularly useful. With zero-spread brokers, your trades are often immediately passed to liquidity providers, eliminating the broker’s role in price-setting and reducing trade costs.

Scalping strategies thrive on small price changes, and zero spreads eliminate any hindrance to these rapid transactions. High-frequency trading, which relies heavily on speed, also benefits from the absence of spreads. However, remember that market volatility can be both an opportunity and a risk. While it can provide more opportunities for scalping and high-frequency trading, it also carries the potential for large losses.

Risk management is, therefore, crucial when trading with zero-spread brokers. Developing a comprehensive risk management strategy is essential to protecting your investment.

This includes setting stop losses to limit potential losses and taking profits at predetermined levels to secure gains. Remember, while trading with zero-spread brokers can offer advantages, it’s important to approach it with a strategic and informed mindset.

Account Types and Trading Strategies

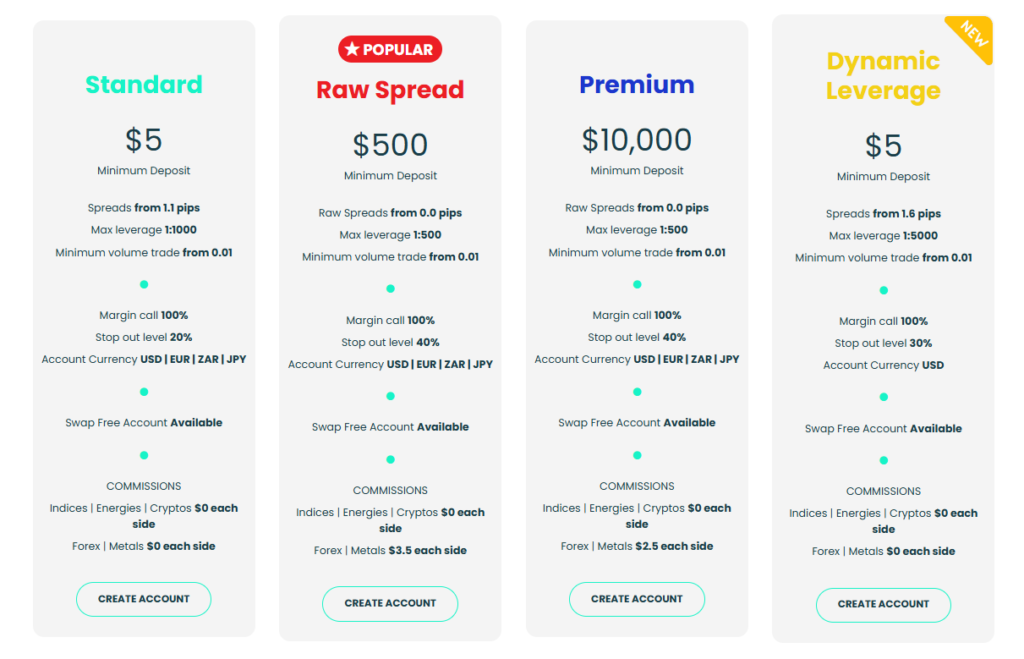

To maximize your trading success, it’s crucial to understand the different account types and align them with your specific trading strategies.

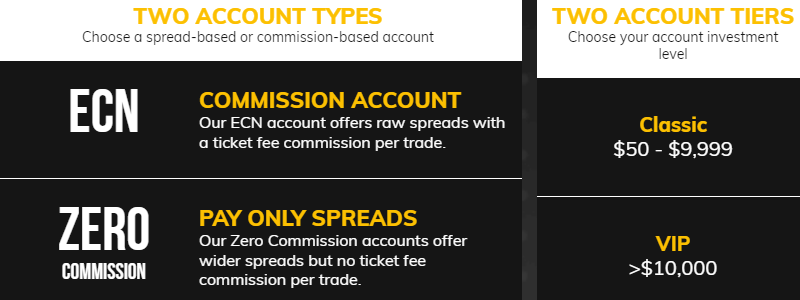

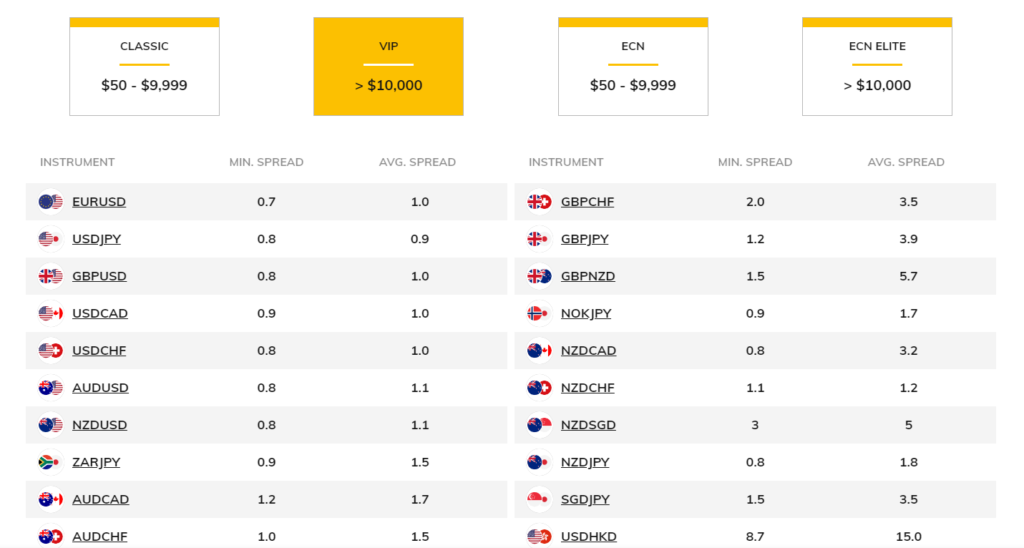

Standard accounts typically bundle the commission within the spread, while ECN accounts offer raw, interbank spreads. Consider which is more cost-effective for your trading volume and frequency.

Your trading strategies, such as scalping or hedging, may influence your account choice. Some brokers may not allow these techniques in standard accounts due to the risk management factors involved.

Position sizing is another vital aspect to consider. Determining the right position size can help manage risks effectively.

Technical analysis methods are essential for predicting market trends. Whether you use chart patterns, indicators, or other tools, ensure your broker’s platform supports them.

Remember: – Standard vs ECN accounts: Understand the cost structure – Scalping strategies: Ensure your broker allows them – Hedging techniques: Check the broker’s policy – Position sizing: Manage risks effectively – Technical analysis methods: Ensure the platform supports your preferred tools.

With a clear understanding of these factors, you can select a forex broker that aligns with your trading strategies and goals.

Top Lowest Spread Forex Brokers

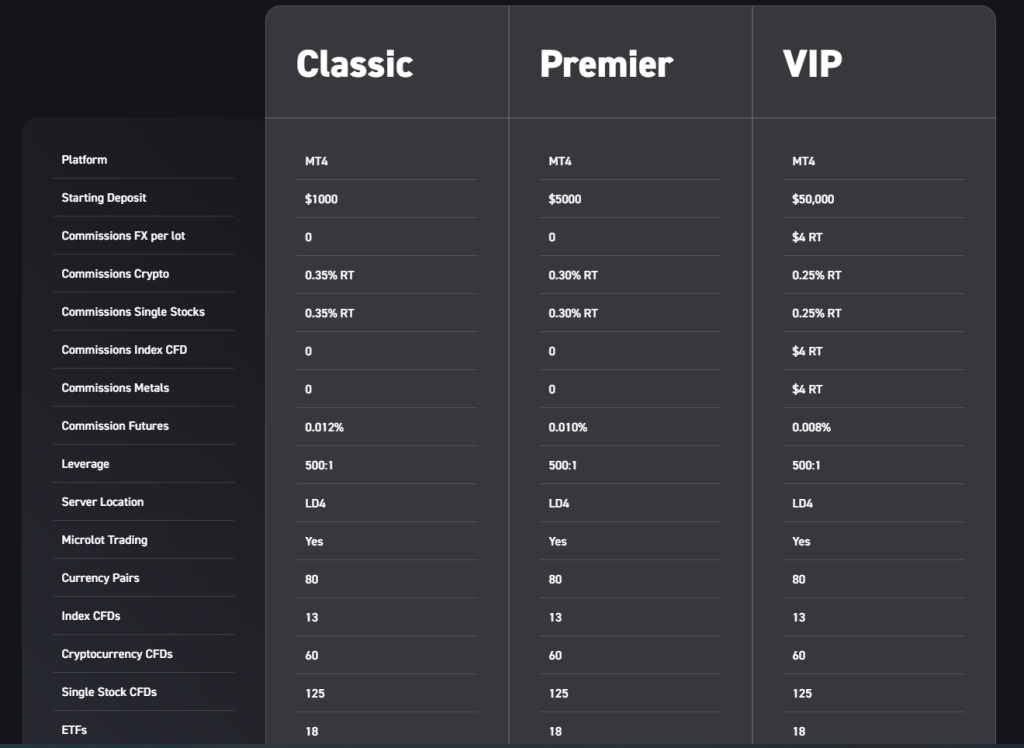

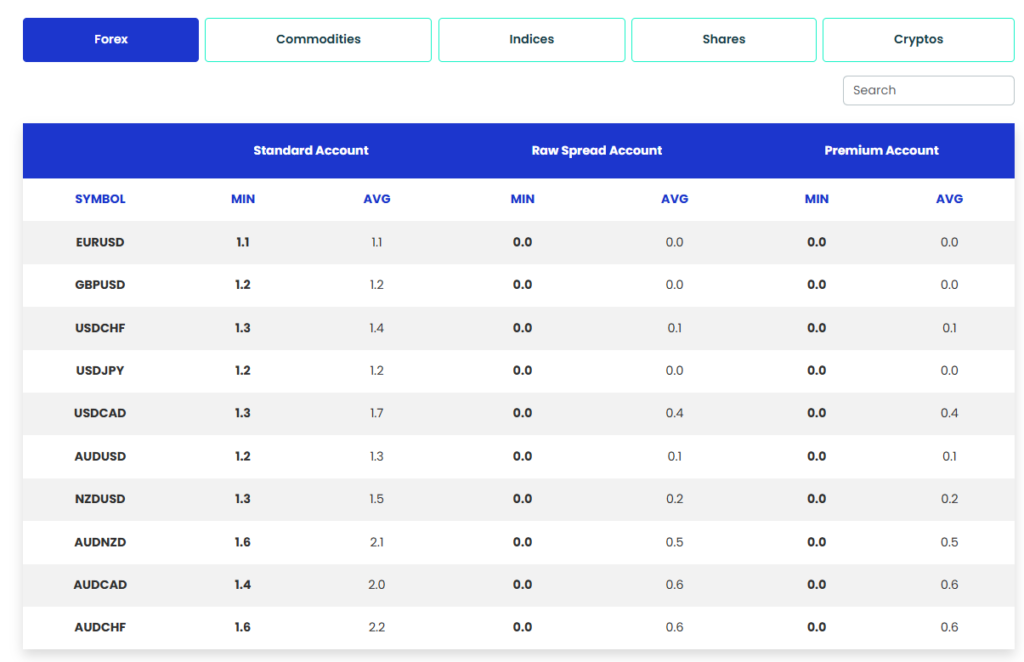

Let’s analyze the top five forex brokers with the lowest spreads for 2024, which you should consider for your trading needs.

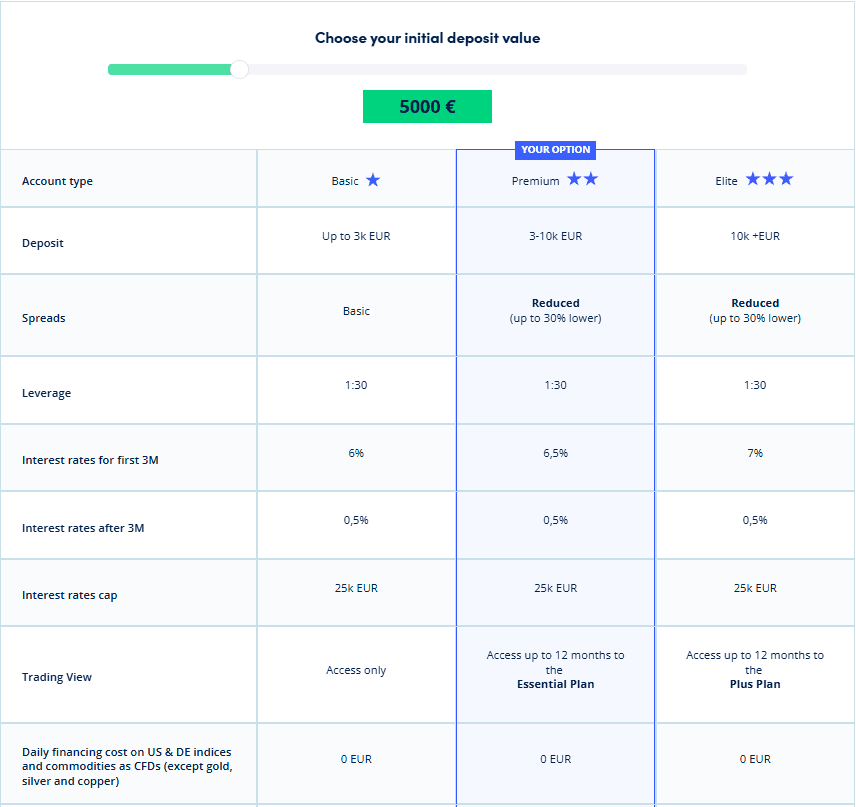

Start with ActivTrades, known for zero spreads and multiple trading platforms offering a key advantage. Next is OneRoyal, which tops the list for instrument variety with its raw spread ECN accounts. Admirals follows with its low spreads and high leverage on its MT4 platform. IronFx, with zero spreads and AI-driven analysis, is ideal for trading major markets. Lastly, EighCap excels in the markets with competitive pricing, leverage, and margin options.

When choosing your broker, a spread comparison is essential. Lower spreads mean lower trading costs. Review the trading platforms available, ensuring they align with your trading style. Also, consider the leverage options and instrument variety offered.

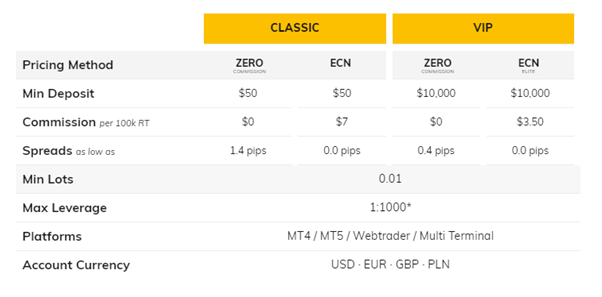

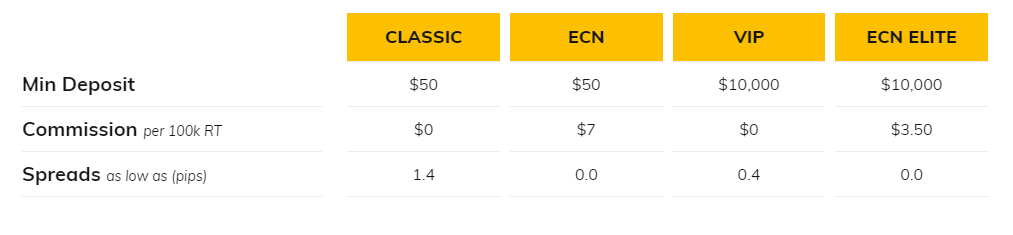

Lastly, account customization is crucial. Brokers like IC OneRoyal and IronFx offer different account types, such as STP, ECN, and DMA, each with varying spread offerings. This flexibility allows you to select an account that best suits your trading strategy.

Key Considerations for Choosing Low-Spread Brokers

When hunting for a low-spread forex broker, it’s crucial to understand the key factors that should guide your decision-making process. Consider the following:

- Spread competitiveness analysis helps you identify brokers with the most competitive spreads, maximizing your trading profits.

- Fee comparison strategies: Be sure to compare all associated fees, as hidden costs can affect your profits.

- Account balance impact: Some brokers offer lower spreads to accounts with larger balances. Consider if this fits your trading strategy.

- Platform customization options: A customizable trading platform can enhance your trading experience significantly.

- Regulatory compliance assessment: Ensure a reputable body regulates your broker. This offers you certain protections and safeguards.

Regulatory Compliance and Fund Protection

Why are regulatory compliance and fund protection crucial when choosing a forex broker? Essentially, it comes down to ensuring your investment is safe and that the broker operates within legal guidelines. Regulatory oversight offers this assurance. Regulated brokers comply with strict standards set by trusted financial authorities to ensure fund security and client protection.

Tiered regulation further propels the importance of regulatory compliance. Tier-1 regulators, like the UK’s FCA or the US’s CFTC, are renowned for their stringent standards. They require brokers to maintain high capital reserves and employ protective measures such as segregated accounts. This means your funds are kept separate from the broker’s operating funds, providing additional protection.

Avoiding unregulated brokers is a wise move. They operate without oversight, increasing the risk of fraud or unfair practices. Despite potentially attractive offers, the absence of fund security and client protection makes them highly risky.

In your hunt for the lowest spread forex broker, consider the cost, the broker’s regulatory compliance, and measures for fund protection. Remember, the safety of your investment should always come first.

Frequently Asked Questions

Who Are the Best Regulated Forex Brokers?

In the ever-evolving world of forex trading, selecting a broker that aligns with your investment goals and trading style is crucial. The landscape is dotted with numerous brokers, each offering a unique blend of tools, educational resources, and regulatory backing to ensure a secure and efficient trading environment. Today, we’ll delve into some trusted and multiregulated forex brokers suitable for various trading styles, highlighting their key features and regulatory credentials.

OneRoyal stands out not only for its comprehensive social trading platform but also for its dedication to trader education and various trading tools designed to enhance trading strategies. With leverage options up to 1:1000 and the opportunity to apply for a 100% deposit bonus, OneRoyal caters to a wide range of traders. Its regulatory oversight spans multiple jurisdictions, including AFSL-ASIC, CySEC, VFSC, and FSA, ensuring a robust regulatory framework for trader protection.

IronFx offers a streamlined trading experience complemented by risk management tools designed to help traders better manage their exposure to market volatility. Traders can leverage up to 1:1000 and benefit from a 100% deposit booster to amplify their trading capital. IronFx’s regulatory landscape includes oversight from FCA, CySEC, FSCA, and BMA, underscoring its commitment to maintaining high compliance and security standards.

MultiBank Group, renowned for its exceptional customer support and extensive educational offerings, provides traders with leverage up to 1:1000 and the opportunity to apply for VIP account conditions, including cashback on trades. The broker employs a suite of advanced trading tools to support informed decision-making. It is regulated by many reputable authorities, such as FCA, CySEC, AFSL-ASIC, JSC, CIPC,CMA and more reflecting its global reach and adherence to international regulatory standards.

ActivTrades prides itself on offering a user-friendly platform, rich educational content, and flexible demo accounts to cater to novice and experienced traders. With leverage options tailored to different trader profiles, including up to 1:400 for professional traders, ActivTrades aims to accommodate a broad spectrum of trading preferences. Its regulatory framework is supported by FCA, CSSF, CMVM, SCB, and BACEN, ensuring a secure trading environment.

EightCap rounds off the list with its intuitive trading platform, comprehensive educational materials, and responsive customer support team. Offering leverage up to 1:500 and a 10% deposit bonus, EightCap seeks to provide traders with the tools and incentives to explore global markets effectively. Regulated by AFSL-ASIC and SCB, EightCap adheres to stringent regulatory standards, reinforcing its commitment to trader safety and transparency.

Each broker offers something unique, from innovative trading tools to robust educational resources, all underpinned by a strong regulatory framework. Whether you’re a seasoned trader or just starting out, assessing each broker’s offerings against your trading objectives can help you navigate the complex forex market with confidence.

What Are Some Common Trading Strategies That Work Best With Zero Spread Brokers?

Scalping, intraday, positional, breakout, and trend-following strategies are effective with zero-spread brokers. They allow swift entry and exit, minimizing cost and maximizing potential profits.

How Does the Choice of Trading Platform Affect My Trading With a Zero Spread Broker?

Your platform selection greatly impacts your trading. The user interface and platform customization options affect your efficiency. Technical tools aid analysis, while mobile trading offers flexibility. Choose wisely for optimal results with zero spread brokers.

Are there any additional benefits to trading with Regulated Zero Spread Brokers beyond fund security and client protection?

Yes, there are additional benefits. Leveraging benefits and cost efficiency are key. Lower broker commissions and faster execution speed enhance profitability. Trading flexibility allows you to adapt to market changes, optimizing your trading strategies.

How Does a Broker’s Reputation Impact My Trading Experience With Zero Spread Forex Trading?

A broker’s credibility significantly impacts your trading experience. Client testimonials, reputation analysis, and broker’s longevity provide insights into their trustworthiness. These factors directly influence your confidence and decision-making in zero-spread forex trading.

Can I Switch Between Different Account Types With the Same Broker if I Want to Change My Trading Strategy?

You can switch account types with the same broker for strategy adaptation. Brokers’ flexibility allows for account migration, but consider the switching implications for your trading transition.

Conclusion – Forex Brokers with the Lowest Spread

In conclusion, choosing the right

Disclaimer:

All information has been prepared by TraderFactor or partners. The information does not contain a record of TraderFactor or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.