Forex order blocks are pivotal elements in trading that represent areas where financial institutions have placed significant buy or sell orders. These blocks are crucial for identifying potential market reversals and trends, providing traders with insights into the actions of large market players.

Understanding order blocks can empower traders to make informed decisions, aligning their strategies with institutional movements rather than against them. As traders seek to enhance their market analysis skills, delving into the dynamics of order blocks becomes essential for predicting price movements accurately. Discovering how these blocks influence currency pairs can be a game-changer in developing a successful trading strategy.

Table of Contents

ToggleOrder Blocks in Forex: How to Spot Them

Forex order blocks are key market zones where big players place large buy or sell orders, helping traders spot potential reversals and align their strategies with institutional trends.

The power of understanding and utilizing Order Blocks can be the difference between being a profitable trader and one who continually struggles.

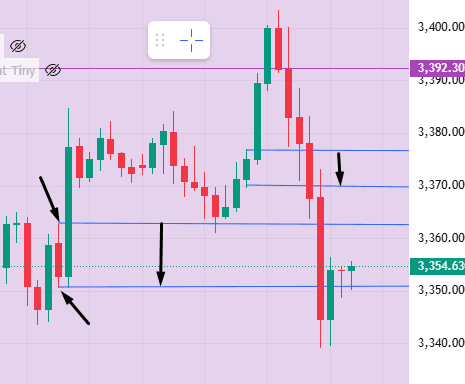

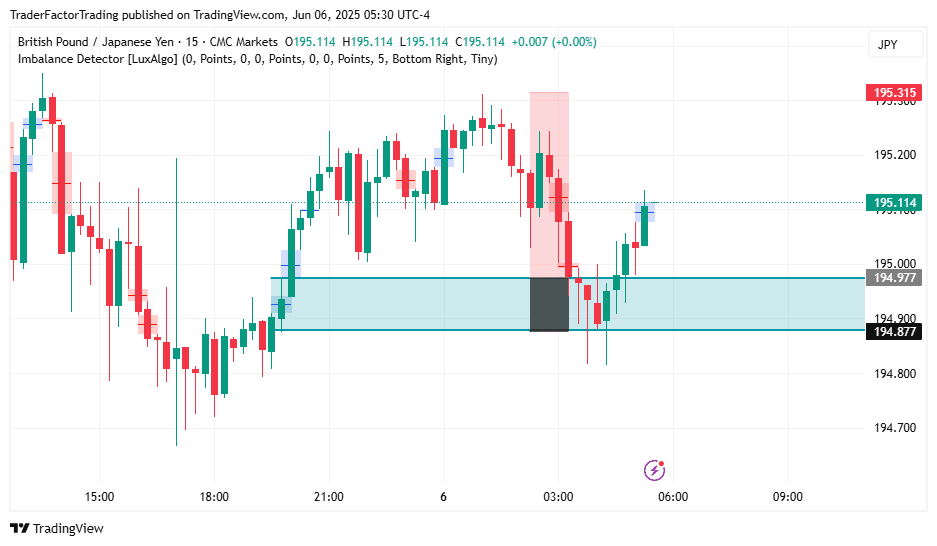

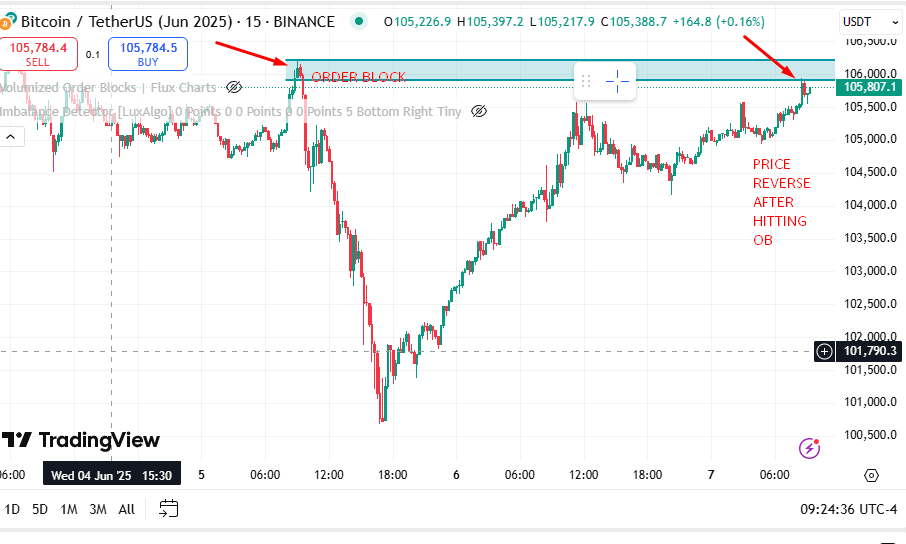

Imagine this scenario: It’s a typical trading day, and you notice a significant price rise in the GBPJPY currency pair. Instead of panicking and buying, you remember the concept of Order Blocks.

You identify a daily bullish Order Block from a previous large uptrend, indicating that ‘smart money’ might be interested in buying at this level. Instead of selling your position in fear, you decide to hold on, anticipating a potential price reversal.

As you can see, proce has reversed after hiting the Order Block.

This introduction to Order Blocks will explain what they are, how they work, and how you can use them to enhance your Forex trading strategy. With the right knowledge and application, you could be on your way to more consistent profits.

Significance of Forex Order Blocks

Order blocks are essentially the backbone of any financial market, including Forex. They represent a significant amount of orders placed at a certain price level. Large players like banks and hedge funds often use order blocks to enter or exit their positions. Understanding these trading order blocks can give traders a glimpse into the market’s mechanics and help them make more informed decisions.

Price Turning Points

Price turning points are critical moments in the forex market where the price changes direction. Identifying these points can give traders valuable insights about potential future price movements.

For instance, if you’re watching the USD/JPY currency pair and notice an area where the price has previously made a significant turn, it could be an order block. Large traders may have decided to enter or exit their positions at this point, causing the price to shift. Recognizing these areas can help you anticipate similar turning points in the future.

Support and Resistance Levels

Support and resistance levels are key concepts in technical analysis. They represent price levels that the market has historically struggled to move beyond. An order block can act as a support or resistance level, indicating areas where the price might struggle to break through or find support. For example, if you’re analyzing the EUR/USD chart and spot a range where the price seems to bounce back repeatedly, it could be an order block acting as a support or resistance level.

Liquidity Zones

Liquidity zones are regions of high trading volume. High liquidity often results in tighter spreads and less slippage, making it easier for traders to execute their trades efficiently. An order block can represent a liquidity zone, indicating a region where many trades have previously taken place. When observing the GBP/USD pair, for instance, an order block where many trades have occurred is a liquidity zone.

Confirmation of Price Patterns

Price patterns, such as head and shoulders or double tops, are commonly used in technical analysis to predict future price movements. An order block can help confirm these patterns, providing more confidence in your analysis. For instance, if you’re studying the AUD/USD chart and see a head and shoulders pattern forming, an order block at the neckline can confirm this pattern.

Trend Identification

Trends are fundamental to any market analysis. Recognizing a prevailing trend allows traders to trade in the direction of that trend, increasing their chances of success. An order block that has been respected several times during an uptrend or downtrend can help identify the prevailing trend. For example, if you’re looking at the USD/CAD pair and notice an order block that has been respected multiple times during an uptrend, this can indicate that the uptrend is likely to continue.

Risk Management

Risk management is crucial in forex trading. Setting stop losses at appropriate levels can limit potential losses if the market moves against a trader’s position. An order block can be used to set stop loss levels. For example, if you’re planning a trade on the EUR/JPY pair, setting your stop loss just beyond an order block can limit your risk if the price goes against you.

High-Probability Trades

High-probability trades are those with a high chance of success. Combining different technical analysis tools can often lead to high-probability trading opportunities. For instance, if you’re considering a trade on the USD/CHF pair, spotting an order block near a key Fibonacci retracement level might indicate a high probability trade.

Early Warning Signs

Breaking through an order block can be an early warning sign of a potential trend reversal. If the price breaks through an order block, it could indicate that the balance between buyers and sellers is shifting. For example, if you’re monitoring the NZD/USD pair and notice that the price has just broken through an order block, this might be an early signal that the trend is about to reverse.

Informed Decision-Making

Understanding order blocks can help traders make more informed decisions. By knowing where large traders are likely to enter or exit their positions, you can better anticipate potential price movements and adjust your forex order block strategy accordingly.

Technical and Fundamental Alignment

When a fundamental event aligns with an order block, it can provide a powerful trading signal. For example, if you’re following news about the EUR/GBP pair and a major economic announcement coincides with an order block, this could provide a strong signal for a potential trade.

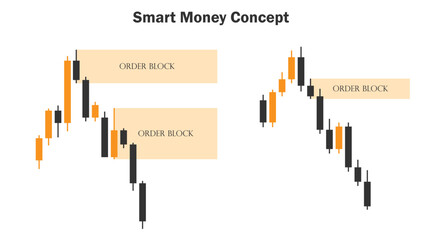

Types of Order Blocks Forex in Forex Trading

Order block in forex trading example

Understanding the types of order blocks in Forex can give you a unique edge in your trading strategy. Each type provides different insights into market behaviour, helping you make more informed trading decisions.

Supply Order Blocks (SOB)

Supply order blocks are regions with significant selling pressure, leading to a downward movement in price. When you see a sharp drop in price, a supply order block has likely been created. This is where sellers have overwhelmed buyers, creating an excess supply in the market. For instance, if you’re observing the EUR/USD pair and notice a rapid decrease in price, a supply order block may have been formed at the start of the decline.

Demand Order Blocks (DOB)

Demand order blocks represent areas where buying pressure has exceeded selling pressure, resulting in an upward movement in price. When you see a sudden rise in price, a demand order block has likely been established. This is where buyers have outmatched sellers, creating an excess demand in the market. For example, if you’re watching the USD/JPY pair and spot a quick increase in price, a demand order block may have been established at the beginning of the ascent.

Breakout Order Blocks

Breakout order blocks occur when a price breaks out of a specific range or pattern. These out-order blocks form and can provide valuable insights into potential trend continuations or reversals. If you’re monitoring the GBP/USD pair and notice a breakout from a consolidation range, an order block may have been formed at the breakout point.

Retest Order Blocks

Retest order blocks are formed when the price retests a previous level. They indicate that the market is confirming the validity of the new price level. For instance, if you’re analyzing the AUD/USD pair and see the price retest a previous resistance level, now acting as support, an order block may have been formed at this retest point.

Climactic Order Blocks

Climactic order blocks are created at the end of a strong trend, where the price makes a final, climactic move before reversing. If you observe the USD/CAD pair and notice a sudden, sharp move at the end of a long uptrend, a climactic order block may have been established at the peak.

Acceleration Order Blocks

Acceleration order blocks occur when the price accelerates in a particular direction, indicating strong buying or selling pressure. For example, if you’re watching the EUR/JPY pair and see a sudden upward acceleration in price, an acceleration order block may have been formed at the start of this acceleration.

Market Maker Order Blocks (How Smart Money Trades)

Market maker order blocks are regions where market makers (large institutions and institutional traders) are likely to enter or exit their positions. Recognizing these blocks can give you insight into ‘smart money’ movements. If you’re studying the USD/CHF pair and spot an area where there’s a significant change in price, a market maker order block may have been formed.

Volume-Based Order Blocks

A sudden increase in trading volume identifies volume-based order blocks. They indicate areas where large amounts of currency have been bought or sold. If you’re monitoring the NZD/USD pair and notice a spike in trading volume, a volume-based order block may have been established.

Pullback Order Blocks

Pullback order blocks occur when the price returns to a previous level after a significant move. These bearish order blocks can provide potential entry points during a trending market. For instance, if you’re analyzing the EUR/GBP pair and see a pullback during an uptrend, an order block may have been formed at the pullback point.

Nested Order Blocks

Nested order blocks are smaller order blocks within a larger one. They provide more detailed insights into the order flow within the larger order block range. If you observe the USD/ZAR pair and spot a smaller order block within a larger one, you’ve identified a nested order block.

Harmonic Pattern Order Blocks

Harmonic pattern order blocks are formed at the completion point of harmonic patterns such as Gartley, Butterfly, or Bat patterns. These trade order blocks can provide high-probability trading opportunities. For example, if you’re studying the EUR/AUD pair and see a Gartley pattern complete, an order block may have been formed at the pattern’s completion point.

Confluence Order Blocks

Confluence order blocks occur where multiple technical analysis tools align with an order block, such as Fibonacci retracement levels, support/resistance levels, or trend lines. These often combined order blocks can provide powerful trading signals. If you’re watching the GBP/JPY pair and notice an order block aligning with a key Fibonacci level, you’ve identified a confluence order block.

Each type of order block provides unique insights into market behavior, helping you refine your trading strategy and make more informed decisions. By understanding these types, you can better identify market participants, anticipate potential price movements, and improve your trading performance.

How to Use Order Block in Forex Trading

Order blocks are critical points in the whole market structure where large players have placed their orders. Identifying these areas can provide important insights into potential price movements. Here are some techniques you can use:

Price Consolidation

Price consolidation occurs when the price moves within a narrow range for an extended period. Large players often accumulate or distribute their positions during these periods, creating order blocks. For instance, if you observe the EUR/USD pair and notice a prolonged period of sideways price movement, this consolidation area could be an order block.

Support and Resistance Levels

Support and resistance are price levels at which the price tends to stop and reverse. These levels often coincide with order blocks as large players place their orders at these strategic points. For example, it might be an order block if you’re analyzing the USD/JPY pair and spot a level where the price has repeatedly bounced back.

Volume Analysis

Volume analysis involves examining the number of contracts or lots traded during a specific time period. High volumes often indicate order blocks, which suggest significant trading activity. If you’re watching the GBP/USD pair and see a spike in volume, an order block may have been formed at that price level.

Candlestick Patterns

Candlestick patterns, such as doji or hammer, can indicate potential order blocks. These patterns represent indecision or reversal in the market, often coinciding with forming order blocks. For instance, if you’re studying the AUD/USD pair and see a hammer candlestick at a key support level, an order block may exist.

Supply and Demand Zones

Supply and demand zones are areas where the laws of supply and demand have shifted the price significantly. These zones often overlap with order blocks. For example, if you’re observing the USD/CAD pair and notice a sharp rise in price after a period of consolidation, a demand order block may have been formed.

Market Profile Analysis

Market profile analysis involves studying the price distribution during a specific time period. Areas where the trading price action has spent considerable time often indicate order blocks. If you’re analyzing the EUR/JPY pair and see a price level that has been frequently visited, it could be an order block.

Fibonacci Retracement Levels

Fibonacci retracement levels are used to identify potential reversal points in the market. These levels often coincide with order blocks as large players place their orders at these strategic points. For instance, an order block might exist if you’re watching the USD/CHF pair and see the price bouncing off the 61.8% Fibonacci level.

Time-Based Analysis

Time-based analysis involves examining how the price behaves at different times of the day, week, or month. Certain times can coincide with the formation of order blocks. For example, if you’re observing the NZD/USD pair and notice a recurring price pattern during the London opening, an order block may exist at that time.

Volume Profile

The volume profile shows the volume traded at different price levels. High-volume areas in price charts often indicate order blocks. An order block may have been formed at that price level if you analyse the EUR/GBP pair and see a high-volume node.

Moving Averages

Moving averages smooth out price data to identify trends. Price interactions with moving averages can indicate potential order blocks. For instance, if you’re studying the USD/ZAR pair and see the price bouncing off a key moving average, an order block may exist at that level.

Order Flow Analysis

Order flow analysis involves studying the flow of buy and sell orders in the market. Large buy or sell orders can indicate the formation of order blocks. If you’re watching the EUR/AUD pair and notice a surge in buy orders at a specific price level, an order block may have been formed.

Price Rejections

Price rejections occur when the price tries to move beyond a certain level but fails. These rejections often coincide with order blocks. For instance, if you’re observing the GBP/JPY pair and see a sharp reversal after the price tried to break a key level, it could be an order block.

Chart Patterns

Chart patterns, such as head and shoulders or double tops, can indicate potential order blocks. The completion of these patterns often coincides with the formation of order blocks. For example, if you’re studying the EUR/AUD pair and see a completed double top pattern, an order block may exist at the neckline.

Multiple Time Frame Analysis

Multiple time frame analysis involves examining the same currency pair across different time frames. This can help identify order blocks that are not visible in a single time frame. If you’re watching the USD/ZAR pair and spot a potential ICT order block on the daily chart that’s not visible on the 1-hour chart, this could signal a significant order block.

Backtesting

Backtesting involves testing your order block identification strategy on historical data. This can help refine your technique and increase its accuracy. For example, if you’re backtesting your strategy on the EUR/GBP pair, you might identify potential order blocks and then check if the price reacted as you predicted.

Common Mistakes to Avoid When Using Order Block Trading Strategy

Order blocks can be a powerful tool in your trading arsenal. However, it’s essential to avoid common mistakes that could undermine your strategy’s effectiveness. Here are some pitfalls to watch out for:

Overlooking Context

Remember that order blocks don’t exist in isolation. They form part of the larger market context. When identifying an order block, ignoring the broader market trend or key technical levels can lead to misinterpretations. For example, if you’re trading the EUR/USD pair and identify an order block without considering the overall downtrend, you may wrongly anticipate a bullish move.

Ignoring Confluence

Confluence occurs when multiple technical analysis tools align, reinforcing each other. Ignoring confluence can result in weaker trade setups. For instance, if you identify an order block on the GBP/USD pair but disregard its alignment with a key Fibonacci retracement level, you might miss a high-probability trade opportunity.

Overfitting

Overfitting refers to adjusting your strategy excessively to fit historical data, which can reduce its effectiveness on future data. If you constantly modify your order block identification method to match past price movements on the USD/JPY pair, your strategy may perform poorly in real-time trading.

Misinterpreting Reactions

Not every price reaction at an order block represents a trading opportunity. Misinterpreting minor reactions as significant can lead to poor trade entries. For example, if you see a small price bounce at an order block on the AUD/USD pair and hastily enter a trade, you might get stopped if the same price action continues against your position.

Neglecting Risk Management

Even the best order block strategy can lead to losses if not paired with robust risk management. A single loss could significantly impact your account balance if you risk too much of your account on a single trade based on an order block on the USD/CAD pair.

Chasing Trade Setups

Chasing trade setups means entering a trade after the optimal entry point has passed. If you spot an order block on the EUR/JPY pair but enter the trade late, you may face a worse risk-reward ratio and increased likelihood of a stop-out.

Lack of Patience

Trading requires patience. Jumping into trades without waiting for confirmation from an order block can result in premature entries. For instance, if you rush into a trade on the USD/CHF pair before the price reaches the order block, the trade might turn against you.

Overemphasizing Specific Block Orders

Giving undue importance to specific order blocks while neglecting others can distort your market view. You might miss critical bearish signals if you only focus on demand order blocks while trading the NZD/USD pair and ignore supply order blocks.

Ignoring Fundamental Analysis

While order blocks are a technical concept, ignoring fundamental analysis can be detrimental. If you disregard significant economic news and market sentiment while analyzing an order block on the EUR/GBP pair, unexpected market reactions to the news may surprise you.

Trading Against the Trend

The old saying “the trend is your friend” holds. Trading against the dominant trend based on an order block can be risky. You might face a strong adverse move if you spot an order block on the USD/ZAR pair and take a counter-trend trade.

Lack of Flexibility

Markets are dynamic, and so should be your approach. Being rigid in your order block strategy can limit your adaptability to changing market conditions. If you stick to one method of identifying order blocks on the EUR/AUD pair despite it repeatedly failing, you may incur unnecessary losses.

Focusing on Short Time Frames Only

While bullish order blocks can be identified on all time frames, focusing only on short time frames can lead to increased noise and false signals. If you only identify order blocks on the 5-minute chart of the GBP/JPY pair, you might miss significant order blocks visible on higher time frames.

Overcomplicating Analysis

Adding too many indicators or tools to your order block analysis can lead to confusion and paralysis by analysis. If you use multiple indicators while identifying an order block on the EUR/AUD pair, conflicting signals may confuse you.

Neglecting Backtesting

Backtesting allows you to validate your order block strategy on historical data. Neglecting to backtest your strategy can result in unproven trade setups. If you develop a new method of identifying order blocks on the EUR/GBP pair but don’t backtest it, you won’t know how well it might perform in live trading.

Emotional Trading

Allowing emotions to dictate your trading decisions can lead to impulsive and irrational trades. If you let fear or greed influence your decision-making after identifying an order block on the GBP/JPY pair, you may deviate from your trading plan and make poor decisions.

By avoiding these common mistakes, you can effectively utilize order blocks in your trading strategy, improving your decision-making process and boosting your trading performance.

Order Blocks and Risk Management

Risk management is a critical aspect of any successful trading strategy. When used correctly, order blocks can significantly enhance your risk management techniques. Here’s how:

Precise Entry and Exit Points

Order blocks can help identify precise entry and exit points for your trades, reducing the risk of entering too early or exiting too late. For instance, if you identify a supply order block on the EUR/USD pair, you might use this as an entry point for a short trade and the next demand order block as your exit point.

Defining Risk-Reward Ratios

Order blocks can help you define your risk-reward ratios. If you’re trading the GBP/USD pair and identify a demand order block, you could set your stop loss below this block and take profit at the next supply block, ensuring a favourable risk-reward ratio.

Confirmation of Support and Resistance

Order blocks often coincide with key support and resistance levels. By confirming these levels, you reduce the risk of false breakouts or breakdowns. For example, if you see an order block on the USD/JPY pair aligning with a major resistance level, it further confirms that level’s significance.

Avoid Overtrading

Order blocks can help you avoid overtrading by focusing on quality over quantity. Rather than jumping into every minor price move on the AUD/USD pair, you could wait for a significant order block to form before entering a trade, reducing the risk of overtrading.

Trade Size Determination

Order blocks can aid in determining your trade size. If you identify a large order block on the USD/CAD pair, you might trade a smaller size due to the increased potential for volatility, helping to manage your risk.

Early Exit Signals

Order blocks can provide early exit signals, reducing the risk of holding onto losing trades for too long. If you’re in a long trade on the EUR/JPY pair and a supply order block forms, it could signal a potential reversal, prompting an early exit.

Diversification

Order blocks can be identified across different currency pairs, aiding in diversification. Instead of putting all your risk into one trade on the USD/CHF pair, you could spread your risk across multiple trades based on order blocks on various pairs.

Trailing Stop Techniques

Order blocks can be used to trail your stop loss, locking in profits as the price moves in your favour. If you’re in a profitable trade on the NZD/USD pair, you could move your stop loss up to each new demand order block, protecting your profits.

Risk Mitigation in Breakouts

Order blocks can help mitigate risk in breakout scenarios. If you’re trading a breakout on the EUR/GBP pair, you could wait for an order block to form after the breakout before entering, reducing the risk of a false breakout.

Managing Volatile Markets

Order blocks can provide stability during volatile markets by identifying key areas of supply and demand. If the USD/ZAR pair is experiencing high volatility, you could use order blocks to identify potential reversal points, helping you manage your risk.

Time-Based Risk Management

Order blocks can aid in time-based risk management by identifying key times when large players are likely to enter or exit the market. If you notice that order blocks on the EUR/AUD pair frequently form around the London open, you could adjust your trading schedule accordingly to manage your risk.

Long-Term Strategy Alignment

Order blocks can help align your short-term trades with your long-term strategy. If your long-term view on the GBP/JPY pair is bullish, you could use demand order blocks to enter long positions, ensuring your trades align with your overall strategy.

By integrating order blocks into your risk management practices, you can enhance your trading strategy, reduce your exposure to risk, and potentially improve your overall trading performance.

Essential Insights

| Main Ideas | Insights and Significant Details |

|---|---|

| Definition | Order blocks in Forex are zones of significance where large buy or sell orders are put into place by institutional traders. |

| Functioning | The primary function of order blocks is to break down hefty orders from institutional traders, thus averting drastic price swings in the Forex market. |

| Detection | To identify an order block, traders must look for an Engulfing pattern and examine the price’s behaviour within this range. |

| Key Attributes | Profit-generating order blocks often signal trend reversals, characterized by well-defined support and resistance levels in Forex trading. |

| Reason Behind Formation | Order blocks are created to enable institutional traders to execute large-scale orders without causing a significant disturbance in price. |

| Illustrative Examples | One common strategy involves spotting downtrends, identifying bullish candlesticks, and closely observing subsequent price movements. |

| Primary Indicators | Key indicators that signal the presence of order blocks in Forex include support and resistance levels, coupled with engulfing patterns. |

| Benefits and Drawbacks | Although order blocks can provide valuable insights into institutional trading patterns, mastering their interpretation demands practice. |

Frequently Asked Questions

Is order block the same as support and resistance?

Order blocks and support/resistance levels are not the same; order blocks indicate zones where large institutional orders exist, while support and resistance are horizontal price levels from historical price action. Order blocks can sometimes coincide with support or resistance levels but have a different origin and function.

How do I confirm an order block?

An order block is confirmed when there is a significant price reaction upon returning to that area, often marked by a sharp reversal or continuation pattern. Analyzing volume and candlestick patterns at the order block can also provide confirmation.

How to identify order block in forex PDF?

To identify order blocks in a forex PDF, look for sections that explain key market zones where institutional buy or sell orders are clustered. Diagrams showing price reactions and reversals at certain price points are also helpful indicators.

What are forex order blocks?

Forex order blocks are key market zones where big players place large buy or sell orders, helping traders spot potential reversals and align their strategies with institutional trends. They serve as crucial indicators for anticipating market movements based on large-scale trading activity.

How do you know which order block is right?

The right order block is usually the one that aligns with current market trends and has been recently validated by price action. Assessing the strength of the order block through historical price reactions and volume can help determine its reliability.

How to draw order blocks correctly?

To draw order blocks correctly, identify areas on the chart where there has been significant buying or selling pressure, usually followed by a strong price movement. Mark the range from the highest to the lowest price within the cluster of candlesticks that led to the move.

What time frame is best for order blocks?

Higher time frames like daily or weekly charts are generally preferred for identifying order blocks, as they offer a clearer picture of significant institutional activity. However, order blocks can also be relevant on lower time frames for short-term trading strategies.

How does order block finder work?

An order block finder tool analyzes historical price data to pinpoint areas where large institutional orders have likely influenced price movements. It highlights these zones on the chart, allowing traders to incorporate them into their analysis and decision-making process.

Who Are the Best Forex Brokers?

Here are some trusted multiregulated forex brokers suitable for all styles of trading :

OneRoyal: Known for its social trading platform, OneRoyal offers many educational resources and a convenient demo account for practice.

IronFx: This broker provides a simple platform and a risk management tool, helping you better control your trading risks.

Admirals: Admirals stands out with exceptional customer support and a wide range of educational resources.

ActivTrades: Offers a user-friendly platform, extensive educational resources, and versatile demo accounts.

EightCap: EightCap wraps it up with an intuitive platform, top-notch educational materials, and an effective customer support team.

Read These Next

Creating an Effective Forex Trading Plan

The Winning Mindset for Weekend Forex Trading

Essential Education for Taxes on Forex Trading

What is a Margin Level in Forex?

Forex Breakout Strategy: A Guide for Profitable Trading

Forex Consolidation Breakout Strategies for Traders

Master Forex Flag Pattern Strategy for Profit

Disclaimer:

All information has been prepared by TraderFactor or partners. The information does not contain a record of TraderFactor or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.